Question: Required Information EXHIBIT 2 5 - 2 The Exemption Equivalent / Applicable Exclusion Amount * The estate tax was optional for decedents dying in 2

Required Information EXHIBIT The Exemption Equivalent Applicable Exclusion Amount

The estate tax was optional for decedents dying in In lieu of the estate tax, executors could opt to have the adjusted tax basis of the assets in

the gross estate carry over to the heirs of the decedent. The applicable credit and exemption are zero for taxpayers who opt out of the estate tax in

The following information applles to the questions displayed below.

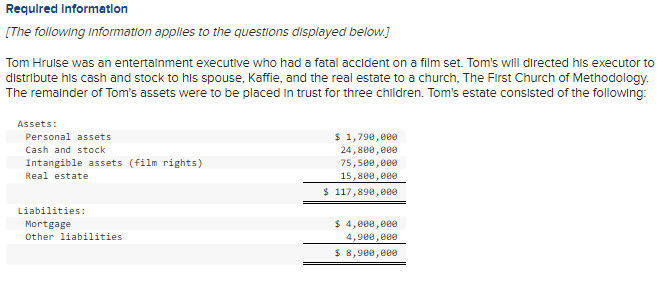

Tom Hrulse was an entertainment executive who had a fatal accident on a film set. Tom's will directed his executor to

distribute his cash and stock to his spouse, Kaffie, and the real estate to a church, The First Church of Methodology.

The remalnder of Tom's assets were to be placed in trust for three children. Tom's estate consisted of the following:

Assets:

Liabilities:

Mortgage

$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock