Question: Required information Learning Objective 12-09 Discuss the primary differences between U.S. GAAP and IFRS with respect to investments. [The following information applies to the questions

![the questions displayed below.] U.S. GAAP and IFRS are similar in most](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e5edb4013b5_62766e5edb365ffd.jpg)

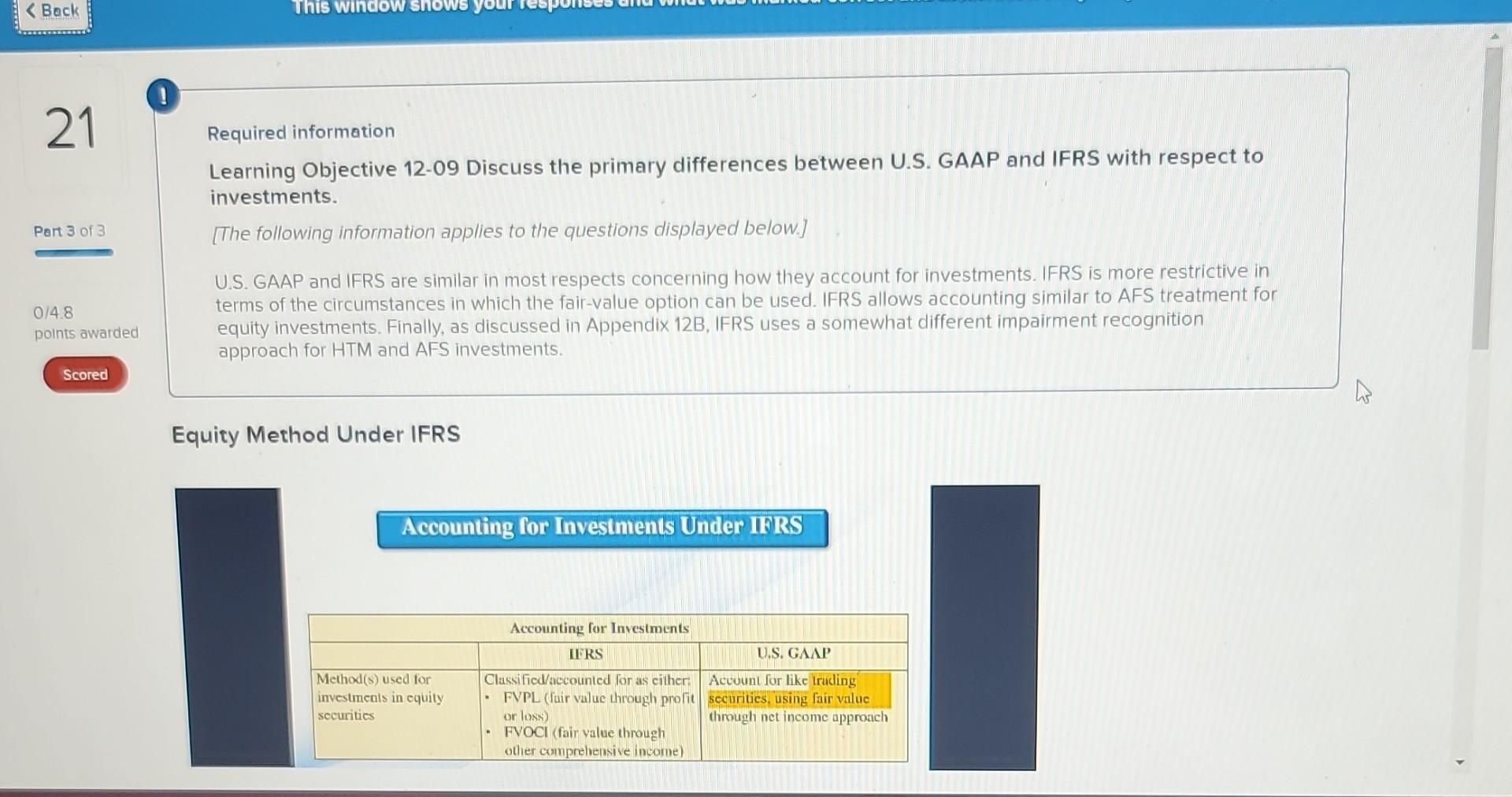

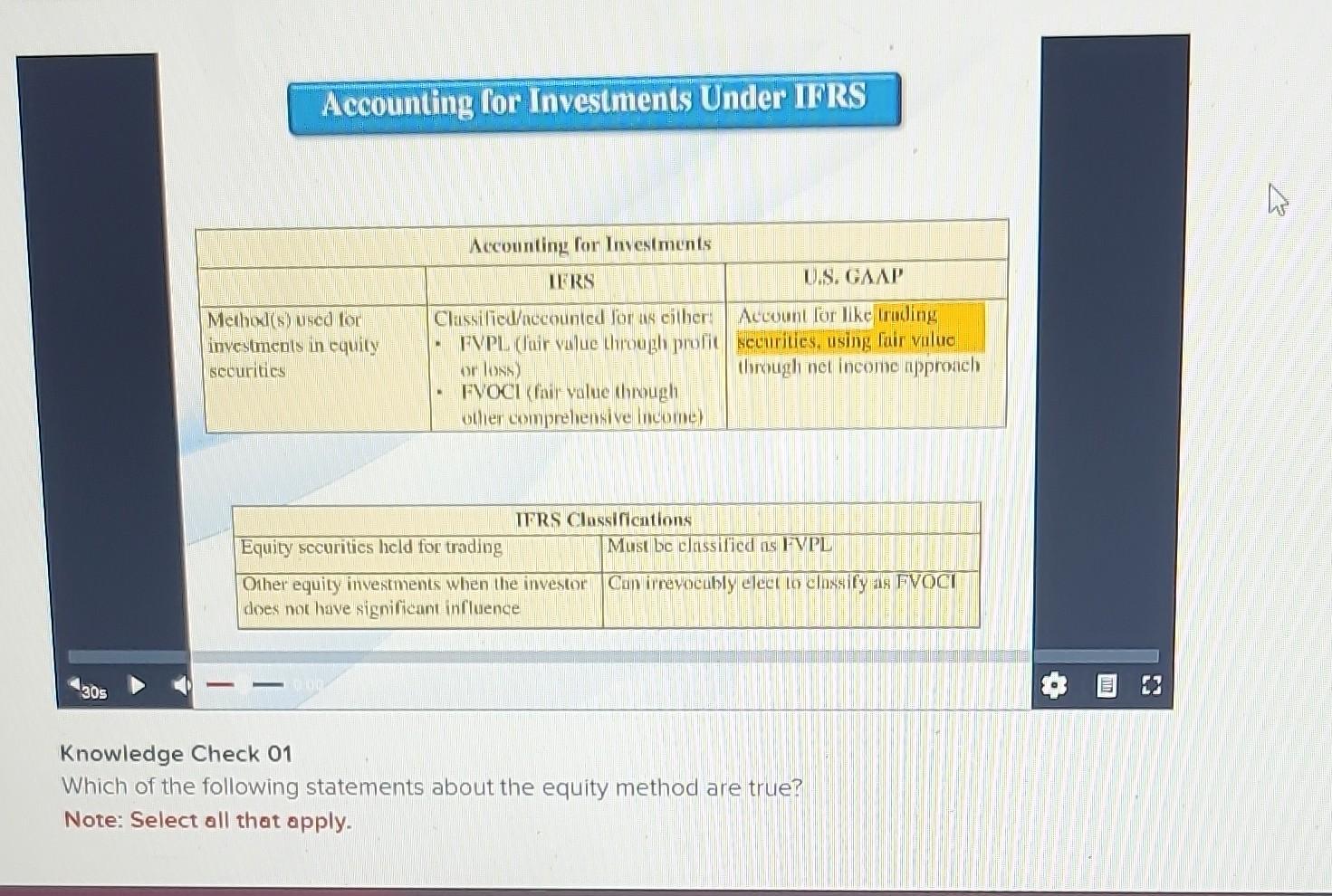

Required information Learning Objective 12-09 Discuss the primary differences between U.S. GAAP and IFRS with respect to investments. [The following information applies to the questions displayed below.] U.S. GAAP and IFRS are similar in most respects concerning how they account for investments. IFRS is more restrictive in terms of the circumstances in which the fair-value option can be used. IFRS allows accounting similar to AFS treatment for equity investments. Finally, as discussed in Appendix 12B, IFRS uses a somewhat different impairment recognition approach for HTM and AFS investments. Equity Method Under IFRS Knowledge Check 01 Which of the following statements about the equity method are true? Note: Select all that apply. Check All That Apply International accounting standards require the equity method for use with significant influence investees. U.S. GAAP require the equity method for use with significant influence investees. U.S. GAAP requires that the accounting policies of investees be adjusted to correspond to those of the investor when applying the equity method. Both IFRS and U.S. GAAP provide the fair value option for all investments that qualify for the equity method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts