Question: 14. What are the primary differences between US GAAP and IFRS related to capitalizing borrowing costs related to self-constructing an asset? A. With convergence, there

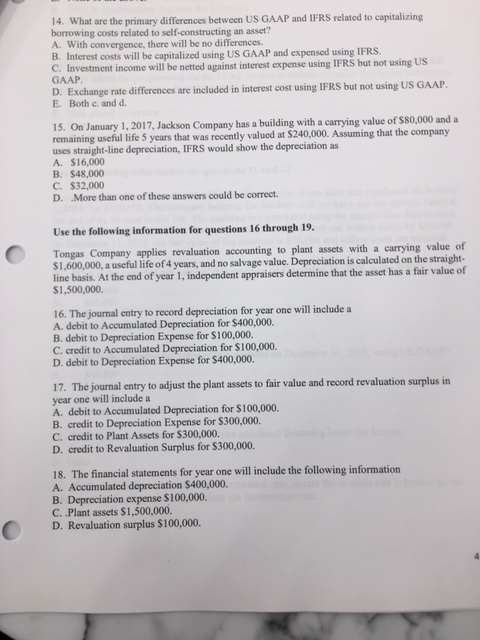

14. What are the primary differences between US GAAP and IFRS related to capitalizing borrowing costs related to self-constructing an asset? A. With convergence, there will be no differences. B. Interest costs will be capitalized using US GAAP and expensed using IFRS. C. Investment income will be netted against interest expense using IFRS but not using US GAAP. D. Exchange rate differences are included in interest cost using IFRS but not using US GAAP. E. Both c. and d. 15. On January 1, 2017, Jackson Company has a building with a carrying value of $80,000 and a remaining useful life 5 years that was recently valued at $240,000. Assuming that the company uses straight-line depreciation, IFRS would show the depreciation as A. $16,000 B. $48,000 C. $32,000 D. More than one of these answers could be correct. Use the following information for questions 16 through 19 Tongas Company applies revaluation accounting to plant assets with a carrying value of $1,600,000, a useful life of 4 years, and no salvage value. Depreciation is calculated on the straight- line basis. At the end of year 1, independent appraisers determine that the asset has a fair value of $1,500,000. 16. The journal entry to record depreciation for year one will include a A. debit to Accumulated Depreciation for $400,000. B. debit to Depreciation Expense for $100,000. C. credit to Accumulated Depreciation for $100,000. D. debit to Depreciation Expense for $400,000. 17. The journal entry to adjust the plant assets to fair value and record revaluation surplus in year one will include a A. debit to Accumulated Depreciation for $100,000. B. credit to Depreciation Expense for $300,000. C. credit to Plant Assets for $300,000. D. credit to Revaluation Surplus for $300,000. 18. The financial statements for year one will include the following information A. Accumulated depreciation $400,000. B. Depreciation expense $100,000. C. .Plant assets $1,500,000. D. Revaluation surplus $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts