Question: Required information Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2018, Matthew participates in SV's money purchase pension

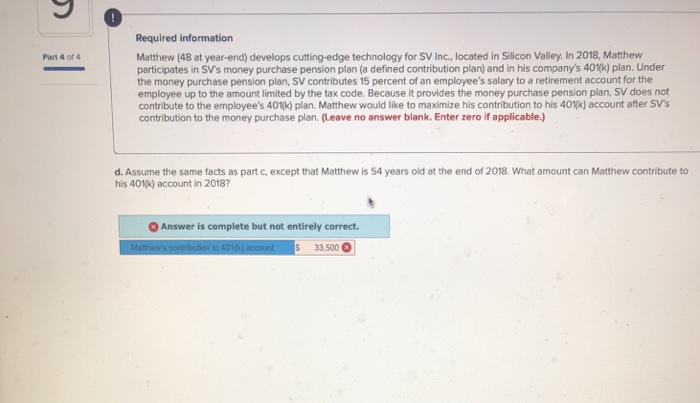

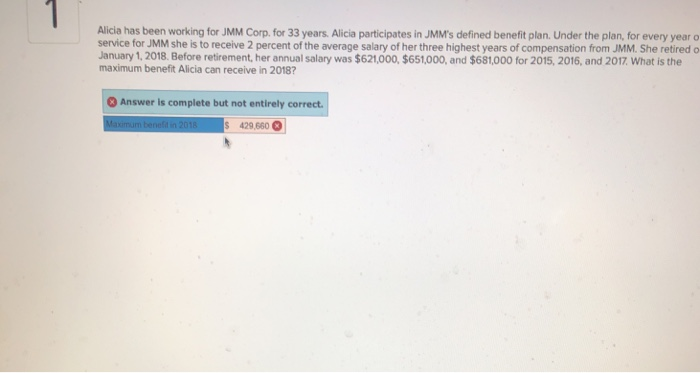

Required information Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2018, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 40 k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. (Leave no answer blank. Enter zero if applicable.) Part 4 of 4 d. Assume the same facts as part c, except that Matthew is 54 years old at the end of 2018. What amount can Matthew contribute to his 401(k) account in 2018? Answer is complete but not entirely correct. S 33,500 Alicia has been working for JMM Corp. for 33 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every year o service for JMM she is to receive 2 percent of the average salary of her three highest years of compensation from JMM. She retired o January 1, 2018. Before retirement, her annual salary was $621,000, $651,000, and $681,000 for 2015, 2016, and 2017 What is the maximum benefit Alicia can receive in 2018 0 Answer is complete but not entirely correct s 429,660

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts