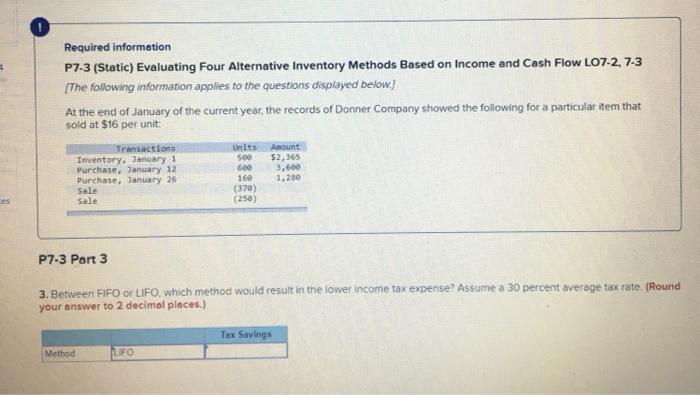

Question: Required information P7-3 (Static) Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow L07-2, 7-3 [The following information applies to the questions displayed

Required information P7-3 (Static) Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow L07-2, 7-3 [The following information applies to the questions displayed below.] At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $16 per unit Transactions Inventory, January 1 Purchase, Tanuary 12 Purchase, January 26 Sale Units 500 600 160 (370) Amount $2,365 3,600 1,280 Sale P7-3 Part 3 3. Between FIFO or LIFO, which method would result in the lower income tax expense? Assume a 30 percent average tax rate (Round your answer to 2 decimal places) Tax Savings Method LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts