Question: Required information PR 7-46 (Static) CVP Analysis of Changes in Sales Prices and Costs (LO 7-1, 7-4) [The following information applies to the questions displayed

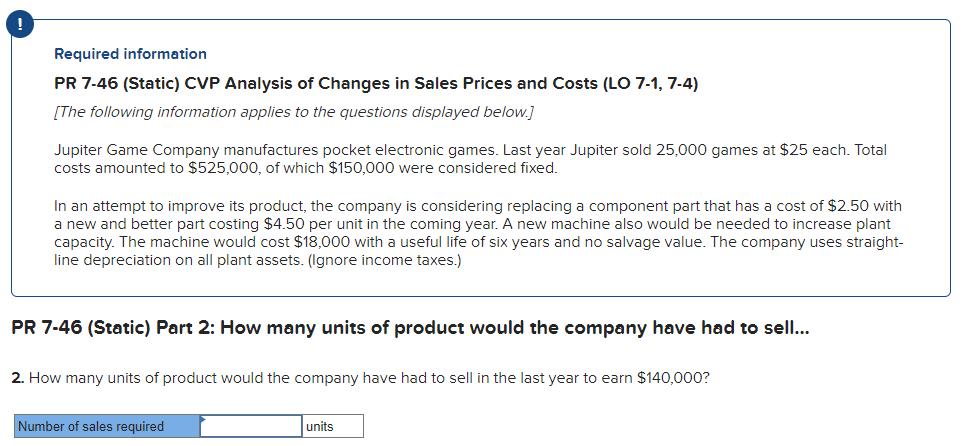

Required information PR 7-46 (Static) CVP Analysis of Changes in Sales Prices and Costs (LO 7-1, 7-4) [The following information applies to the questions displayed below.] Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at \$25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would be needed to increase plant capacity. The machine would cost $18,000 with a useful life of six years and no salvage value. The company uses straightline depreciation on all plant assets. (Ignore income taxes.) PR 7-46 (Static) Part 2: How many units of product would the company have had to sell... 2. How many units of product would the company have had to sell in the last year to earn $140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts