Question: Required information PR 7-46 (Static) CVP Analysis of Changes in Sales Prices and Costs (LO 7-1, 7-4) [The following information applies to the questions displayed

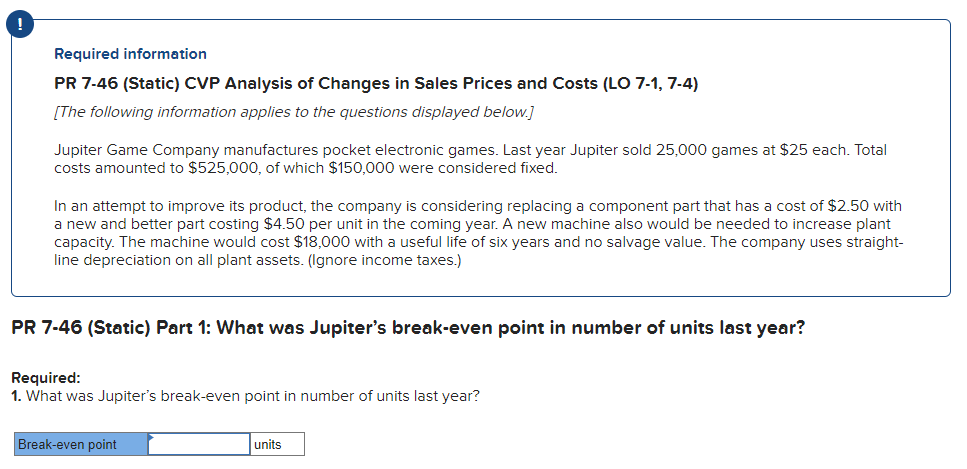

Required information PR 7-46 (Static) CVP Analysis of Changes in Sales Prices and Costs (LO 7-1, 7-4) [The following information applies to the questions displayed below.] Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would be needed to increase plant capacity. The machine would cost $18,000 with a useful life of six years and no salvage value. The company uses straightline depreciation on all plant assets. (Ignore income taxes.) PR 7-46 (Static) Part 1: What was Jupiter's break-even point in number of units last year? Required: 1. What was Jupiter's break-even point in number of units last year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts