Question: Required Information Problem 0-2A (Algo) Estimating and reporting bad debts LO P2, P3 (The following information applies to the questions displayed below.] At December 31,

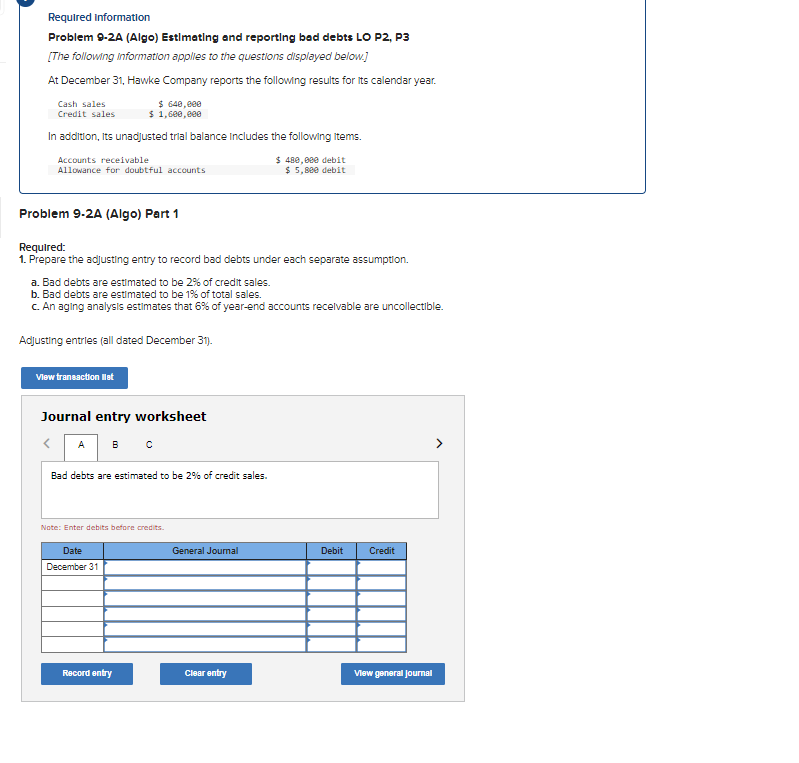

Required Information Problem 0-2A (Algo) Estimating and reporting bad debts LO P2, P3 (The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 648,eee $ 1,6eeeee In addition, its unadjusted trial balance includes the following items. Accounts receivable $ 480,8ee debit Allowance for doubtful accounts $ 5,8ee debit Credit sales $ Problem 9-2A (Algo) Part 1 Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 2% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). View transaction Mat Journal entry worksheet . B o Bad debts are estimated to be 2% of credit sales. Note: Enter debits before credits Date General Journal Debit Credit December 31 Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts