Question: ! Required information Problem 1 4 - 4 5 ( LO 1 4 - 3 ) ( Algo ) [ The following information applies to

Required information

Problem LO Algo

The following information applies to the questions displayed below.

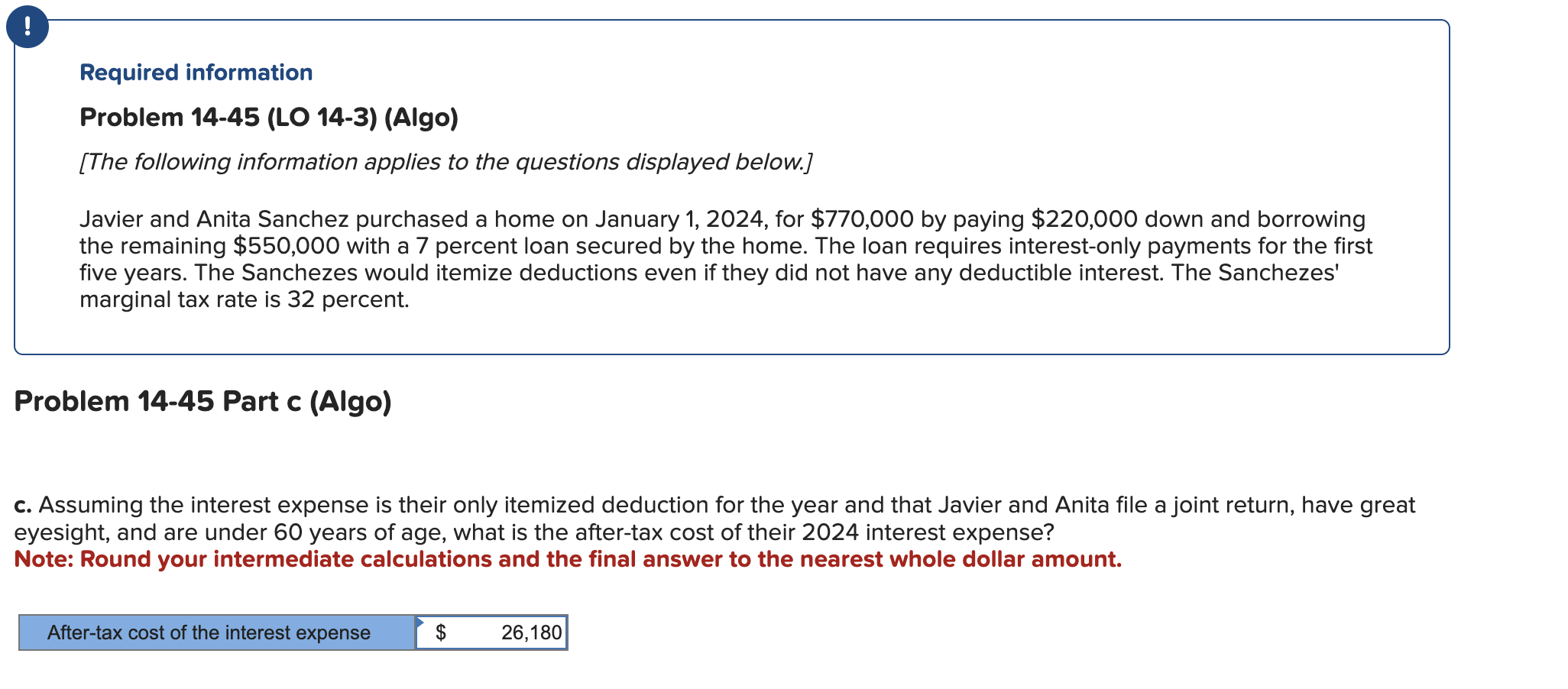

Javier and Anita Sanchez purchased a home on January for $ by paying $ down and borrowing the remaining $ with a percent loan secured by the home. The loan requires interestonly payments for the first five years. The Sanchezes would itemize deductions even if they did not have any deductible interest. The Sanchezes' marginal tax rate is percent.

Problem Part c Algo

c Assuming the interest expense is their only itemized deduction for the year and that Javier and Anita file a joint return, have great eyesight, and are under years of age, what is the aftertax cost of their interest expense?

Note: Round your intermediate calculations and the final answer to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock