Question: ! Required information Problem 1 5 - 4 6 ( LO 1 5 - 3 ) ( Algo ) [ The following information applies to

Required information

Problem LO Algo

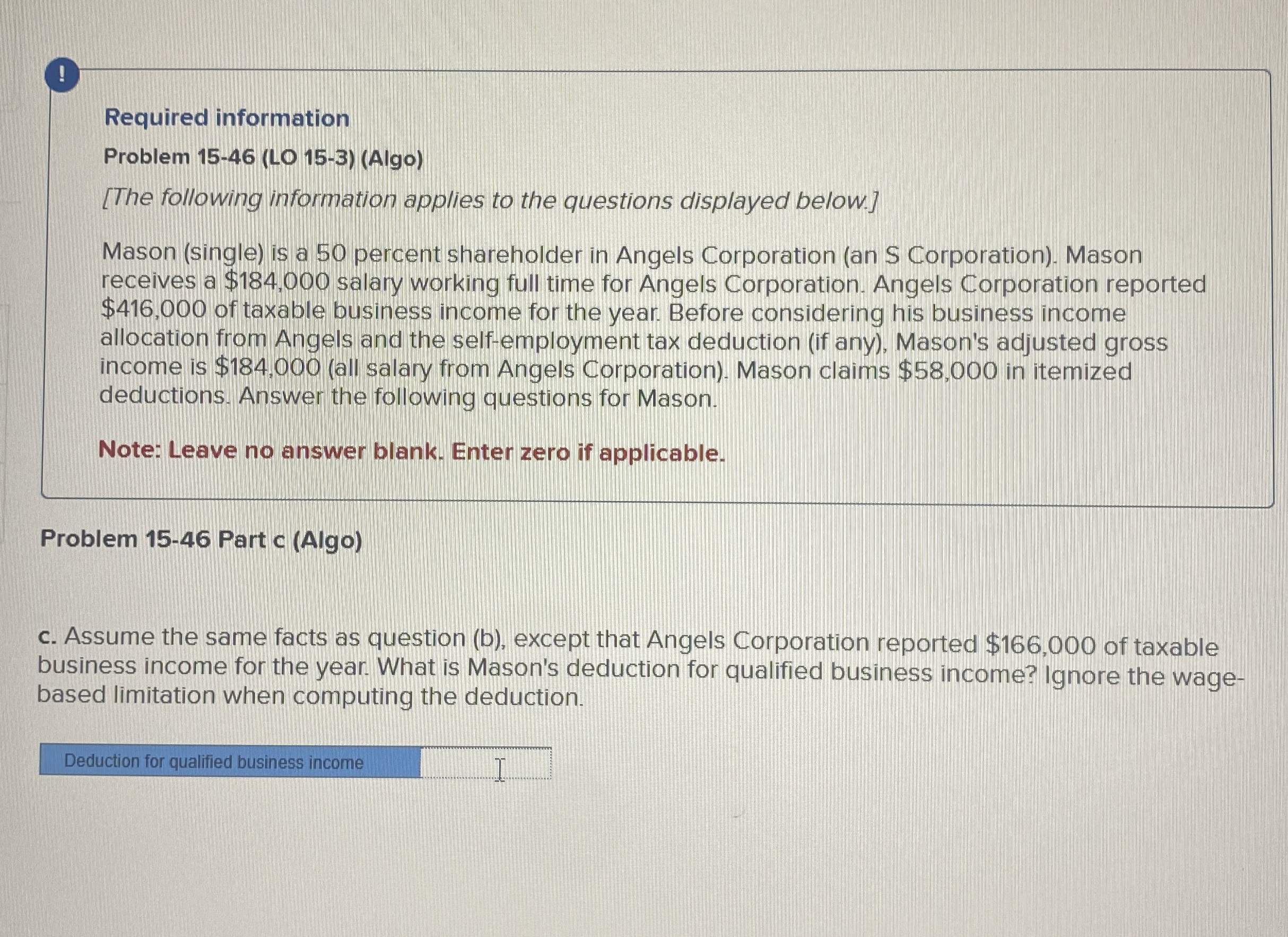

The following information applies to the questions displayed below.

Mason single is a percent shareholder in Angels Corporation an S Corporation Mason receives a $ salary working full time for Angels Corporation. Angels Corporation reported $ of taxable business income for the year. Before considering his business income allocation from Angels and the selfemployment tax deduction if any Mason's adjusted gross income is $all salary from Angels Corporation Mason claims $ in itemized deductions. Answer the following questions for Mason.

Note: Leave no answer blank. Enter zero if applicable.

Problem Part c Algo

c Assume the same facts as question b except that Angels Corporation reported $ of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wagebased limitation when computing the deduction.

Deduction for qualified business income.

Note: $ is not the answer. Help me figure out what im doing wrong please.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock