Question: ! Required Information Problem 1 5 - 5 0 ( LO 1 5 - 3 ) ( Static ) [ The following information applies to

Required Information

Problem LO Static

The following information applies to the questions displayed below.

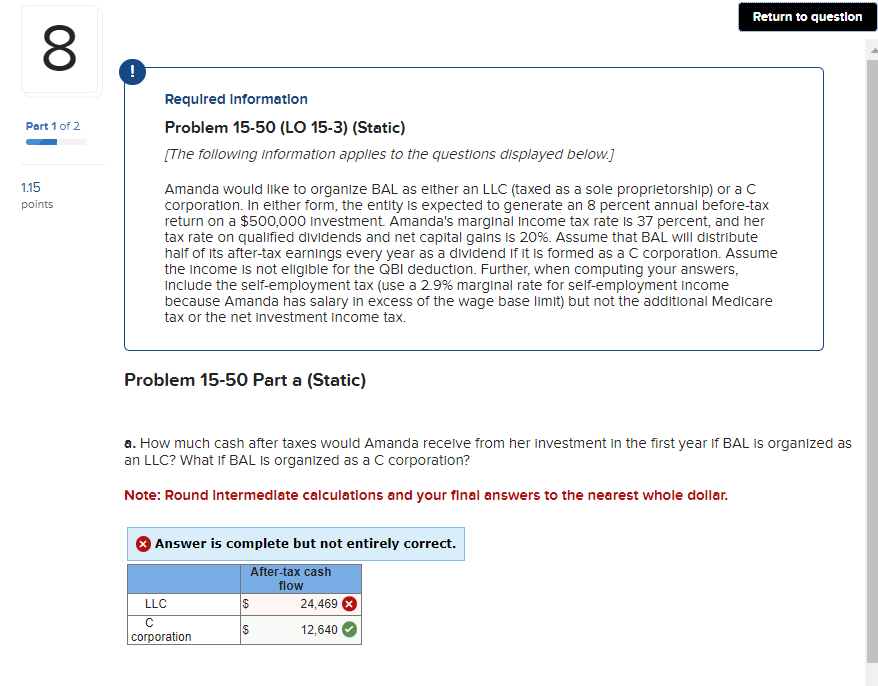

Amanda would like to organize BAL as elther an LLC taxed as a sole proprletorship or a C

corporation. In elther form, the entity is expected to generate an percent annual beforetax

return on a $ investment. Amanda's marginal income tax rate is percent, and her

tax rate on qualified dividends and net capital gains is Assume that BAL will distribute

half of its aftertax earnings every year as a dividend if it is formed as a C corporation. Assume

the income is not eligible for the QBI deduction. Further, when computing your answers,

include the selfemployment tax use a marginal rate for selfemployment income

because Amanda has salary in excess of the wage base limit but not the additional Medicare

tax or the net investment income tax.

Problem Part a Static

a How much cash after taxes would Amanda recelve from her investment in the first year if BAL is organized as

an LLC What if BAL is organized as a C corporation?

Note: Round Intermedlate calculations and your final answers to the nearest whole dollar.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock