Question: Required information Problem 10-1A Plant asset costs; depreciation methods LO C1, P1 [The following information applies to the questions displayed below.] Timberly Construction makes a

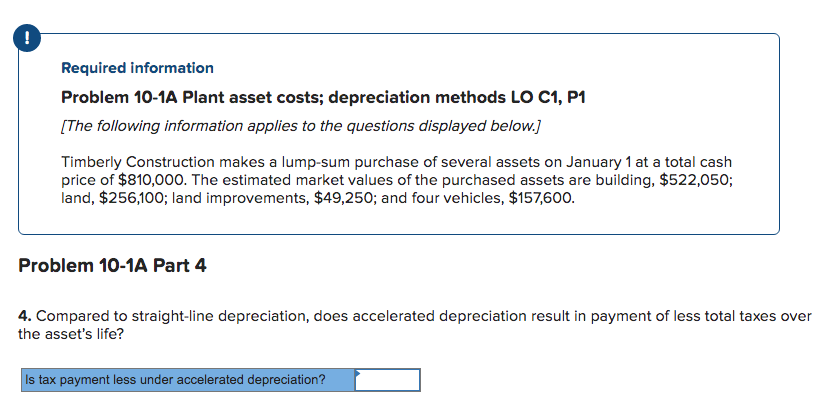

Required information Problem 10-1A Plant asset costs; depreciation methods LO C1, P1 [The following information applies to the questions displayed below.] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building, $522,050; land, $256,100; land improvements, $49,250; and four vehicles, $157,600. Problem 10-1A Part 4 4. Compared to straight-line depreciation, does accelerated depreciation result in payment of less total taxes over the asset's life? Is tax payment less under accelerated depreciation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock