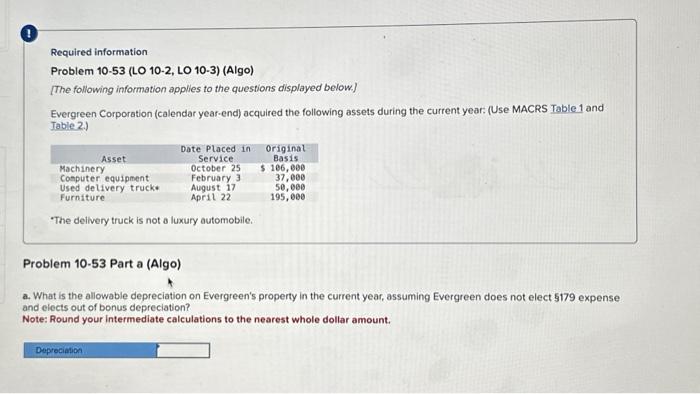

Question: Required information Problem 10-53 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below] Evergreen Corporation (calendar year-end) acquired the following

![information applies to the questions displayed below] Evergreen Corporation (calendar year-end) acquired](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e722bb575ae_73866e722bada41b.jpg)

Required information Problem 10-53 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below] Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) The delivery truck is not a luxury automobile. Problem 10-53 Part a (Algo) a. What is the allowable depreciation on Evergreen's property in the current year, assuming Evergreen does not elect 5179 expense and elects out of bonus depreciation? Note: Round your intermediate calculations to the nearest whole dollar amount. Required information Problem 10-53 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) The delivery truck is not a luxury automobile. roblem 10-53 Part b (Algo) What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation d elects out of 5179 expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts