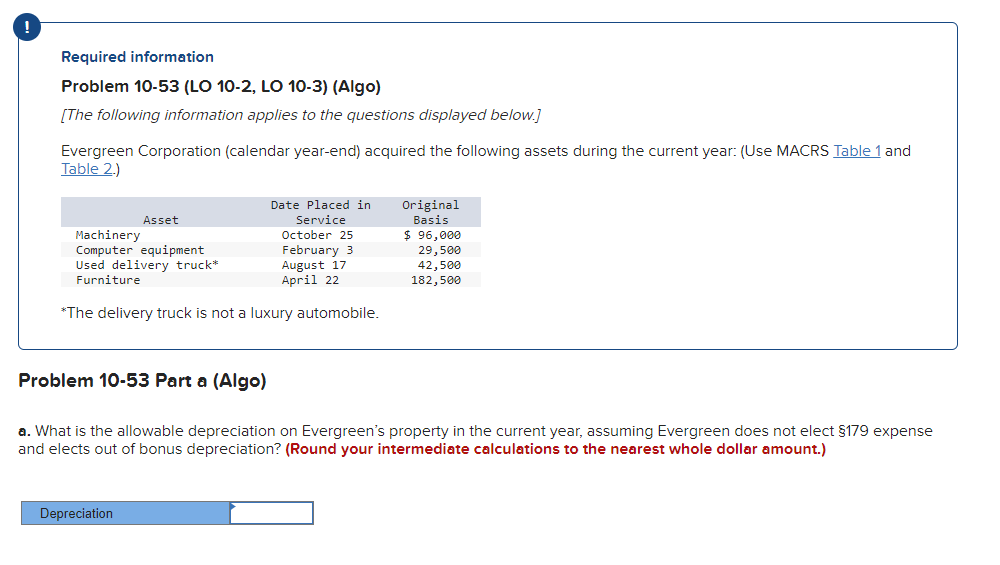

Question: Required information Problem 10-53 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] Evergreen Corporation (calendar year-end) acquired the following

![information applies to the questions displayed below.] Evergreen Corporation (calendar year-end) acquired](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66a490c4b3e5b_99666a490c462eb2.jpg)

Required information Problem 10-53 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) *The delivery truck is not a luxury automobile. Problem 10-53 Part a (Algo) What is the allowable depreciation on Evergreen's property in the current year, assuming Evergreen does not elect 179 expense and elects out of bonus depreciation? (Round your intermediate calculations to the nearest whole dollar amount.) b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts