Question: ! Required information Problem 11-42 (LO 11-3, LO 11-4) (Static) [The following information applies to the questions displayed below.] On August 1 of year 0,

![following information applies to the questions displayed below.] On August 1 of](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66945b767cf8c_77466945b761dc0d.jpg)

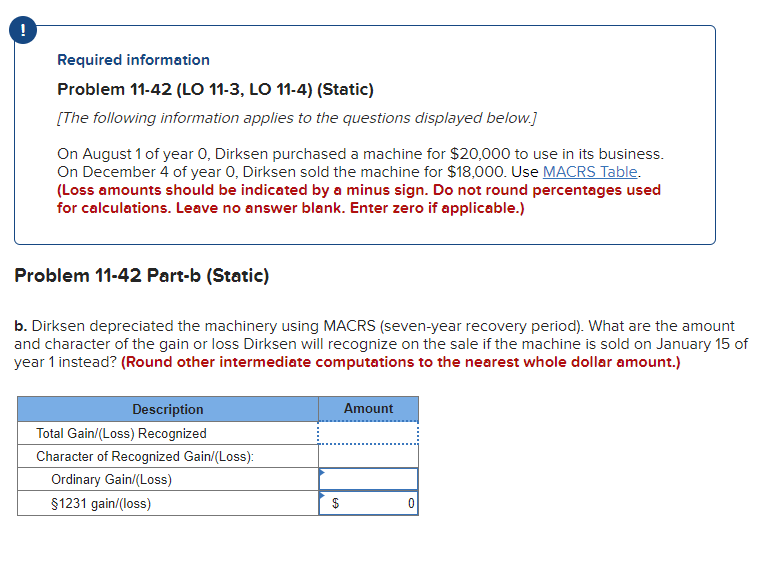

! Required information Problem 11-42 (LO 11-3, LO 11-4) (Static) [The following information applies to the questions displayed below.] On August 1 of year 0, Dirksen purchased a machine for $20,000 to use in its business. On December 4 of year 0, Dirksen sold the machine for $18,000. Use MACRS Table. (Loss amounts should be indicated by a minus sign. Do not round percentages used for calculations. Leave no answer blank. Enter zero if applicable.) Problem 11-42 Part-b (Static) b. Dirksen depreciated the machinery using MACRS (seven-year recovery period). What are the amount and character of the gain or loss Dirksen will recognize on the sale if the machine is sold on January 15 of year 1 instead? (Round other intermediate computations to the nearest whole dollar amount.) Amount Description Total Gain/(Loss) Recognized Character of Recognized Gain/(Loss): Ordinary Gain/(Loss) $1231 gain/(loss) 0 20-Year 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 Table 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period 3-Year 5-Year 7-Year 10-Year 15-Year Year 1 33.33% 20.00% 14.29% 10.00% 5.00% Year 2 44.45 32.00 24.49 18.00 9.50 Year 3 14.81 19.20 17.49 14.40 8.55 Year 4 7.41 11.52 12.49 11.52 7.70 Year 5 11.52 8.93 9.22 6.93 Year 6 5.76 8.92 7.37 6.23 Year 7 8.93 6.55 5.90 Year 8 4.46 6.55 5.90 Year 9 6.56 5.91 Year 10 6.55 5.90 Year 11 3.28 5.91 Year 12 5.90 Year 13 5.91 Year 14 5.90 Year 15 5.91 Year 16 2.95 Year 17 Year 18 Year 19 Year 20 Year 21 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts