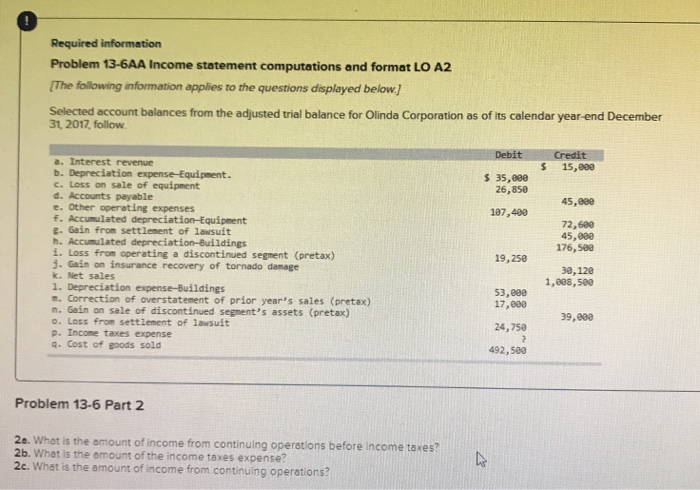

Question: Required information Problem 13-6AA Income statement computations and format LO A2 [The following information applies to the questions displayed below) Selected account balances from the

Required information Problem 13-6AA Income statement computations and format LO A2 [The following information applies to the questions displayed below) Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31, 2017, follow Debit Credit 15,000 $ $ 35,000 26,850 45,880 107,400 72,689 45,000 176,500 a. Interest revenue b. Depreciation expense-Equipment. c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation-Equipment E. Gain from settlement of Lawsuit h. Accumulated depreciation-Buildings 1. Loss from operating a discontinued segment (pretax) 3. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings . Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income taxes expense 9. Cost of goods sold 19,250 30,12e 1,688,5ee 53,000 17,000 39,000 24,750 492,500 Problem 13-6 Part 2 2. What is the amount of income from continuing operations before income taxes? 2b. What is the amount of the income taxes expense? 2c. What is the amount of income from continuing operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts