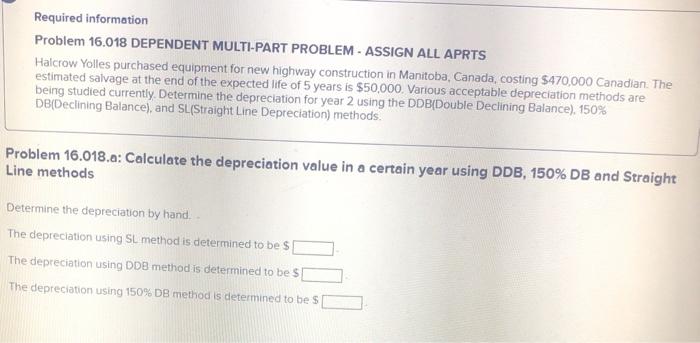

Question: Required information Problem 16.018 DEPENDENT MULTI-PART PROBLEM - ASSIGN ALL APRTS Halcrow Yolles purchased equipment for new highway construction in Manitoba, Canada, costing $470,000 Canadian.

Required information Problem 16.018 DEPENDENT MULTI-PART PROBLEM - ASSIGN ALL APRTS Halcrow Yolles purchased equipment for new highway construction in Manitoba, Canada, costing $470,000 Canadian. The estimated salvage at the end of the expected life of 5 years is $50,000 Various acceptable depreciation methods are being studied currently. Determine the depreciation for year 2 using the DDB(Double Declining Balance), 150% DB(Declining Balance), and SL(Straight Line Depreciation) methods Problem 16.018.0: Calculate the depreciation value in a certain year using DDB, 150% DB and Straight Line methods Determine the depreciation by hand. - The depreciation using SL method is determined to be $ The depreciation using DDB method is determined to be s The depreciation using 150% DB method is determined to be s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts