Question: Required information Problem 17-30 Joint Cost Allocation; Missing Data (LO 17-4) (The following information applies to the questions displayed below.) Berger Company manufactures products Delta,

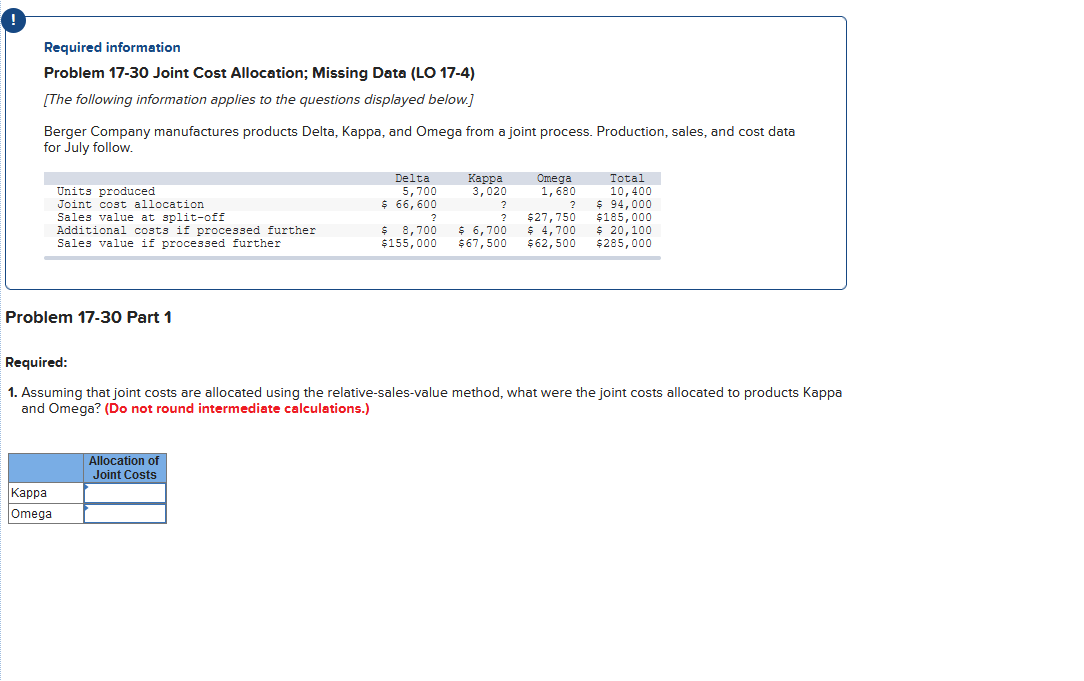

Required information Problem 17-30 Joint Cost Allocation; Missing Data (LO 17-4) (The following information applies to the questions displayed below.) Berger Company manufactures products Delta, Kappa, and Omega from a joint process. Production, sales, and cost data for July follow. Omega Delta 5,700 $ 66,600 Kappa 3,020 1,680 Units produced Joint cost allocation Sales value at split-off Additional costs if processed further Sales value if processed further Total 10,400 $ 94,000 $185,000 $ 20,100 $285,000 $ 8,700 $155,000 $27,750 $ 4,700 $62,500 $ 6,700 $67,500 Problem 17-30 Part 1 Required: 1. Assuming that joint costs are allocated using the relative-sales-value method, what were the joint costs allocated to products Kappa and Omega? (Do not round intermediate calculations.) Allocation of Joint Costs Kappa Omega

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts