Question: Required information Problem 2-5A Computing net income from equity analysis, preparing a balance sheet, and computing the debt ratio LO C2, A1, A2, P3 [The

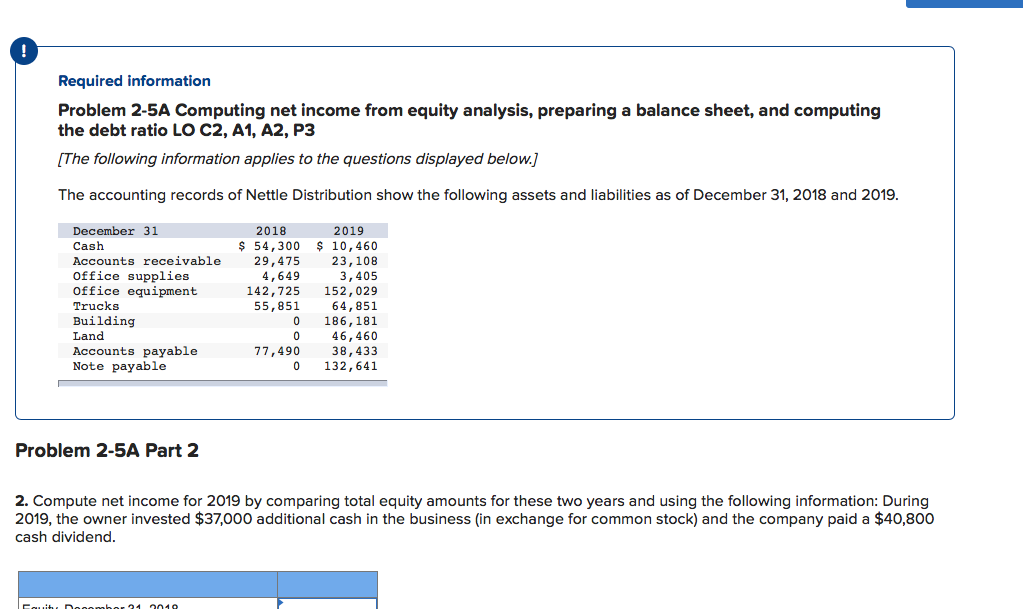

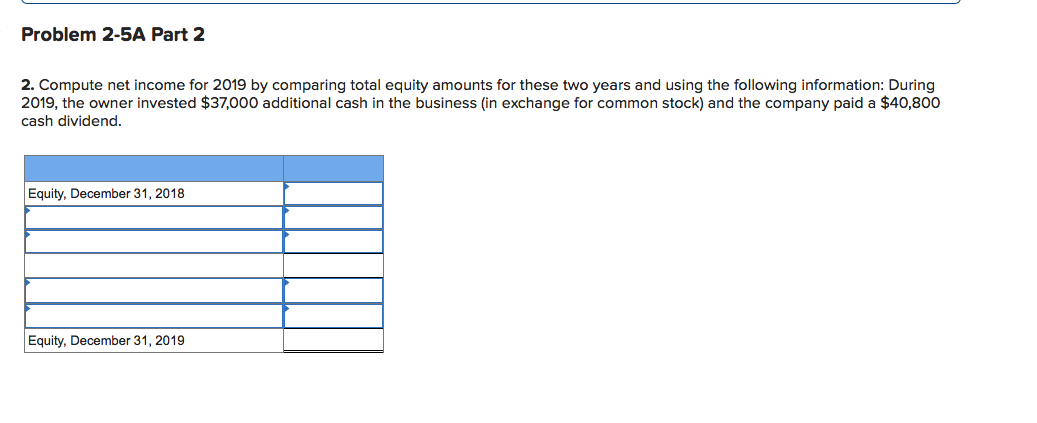

Required information Problem 2-5A Computing net income from equity analysis, preparing a balance sheet, and computing the debt ratio LO C2, A1, A2, P3 [The following information applies to the questions displayed below.] The accounting records of Nettle Distribution show the following assets and liabilities as of December 31, 2018 and 2019. 2019 $ 10,460 23,108 3,405 152,029 64,851 186,181 46,460 38,433 132,641 December 31 2018 $ 54,300 Cash Accounts receivable Office supplies Office equipment 29,475 4,649 142,725 Trucks 55,851 Building Land Accounts payable Note payable 77,490 Problem 2-5A Part 2 2. Compute net income for 2019 by comparing total equity amounts for these two years and using the following information: During 2019, the owner invested $37,000 additional cash in the business (in exchange for common stock) and the company paid a $40,800 cash dividend. Docember 21 2019 Problem 2-5A Part 2 2. Compute net income for 2019 by comparing total equity amounts for these two years and using the following information: During 2019, the owner invested $37,000 additional cash in the business (in exchange for common stock) and the company paid a $40,800 cash dividend. Equity, December 31, 2018 Equity, December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts