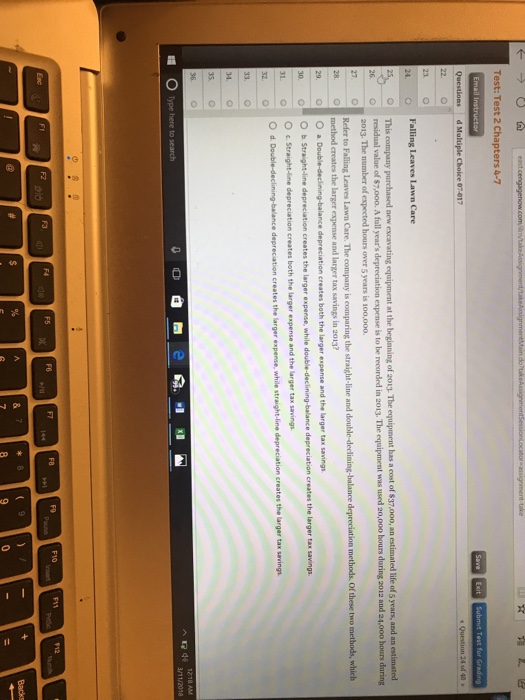

Question: Test: Test 2 Chapters 4-7 in 244f 40 22. O 24 Falling Leaves Lawn Care This company purchased aew excavating equipment at the beginning of

Test: Test 2 Chapters 4-7 in 244f 40 22. O 24 Falling Leaves Lawn Care This company purchased aew excavating equipment at the beginning of 2013 The equipment has a cost of $37,000, an estimated life of s years, and an estimated residual value of $7,000. A full year's depreciation expense is to be recorded in 2013. The equipment was used 20,00o hours during 2012 and 24,0oo hours during 2013. The number of expected hours over 5 years is 100,000. 26. O 27 C methods. Of these two 8 method creates the larger expense and larger tax savings in 2013 O c. Straight-ine depreciation creates both the larger expense and the larger tax sanng 31 C 32. O 33. O d. Double-dec 35. O 43/11/2010 ^ Type here to search F8 F12 F4 F5 F6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts