Question: Required information Problem 5 - 4 3 ( LO 5 - 1 ) ( Algo ) [ The following information applies to the questions displayed

Required information

Problem LO Algo

The following information applies to the questions displayed below.

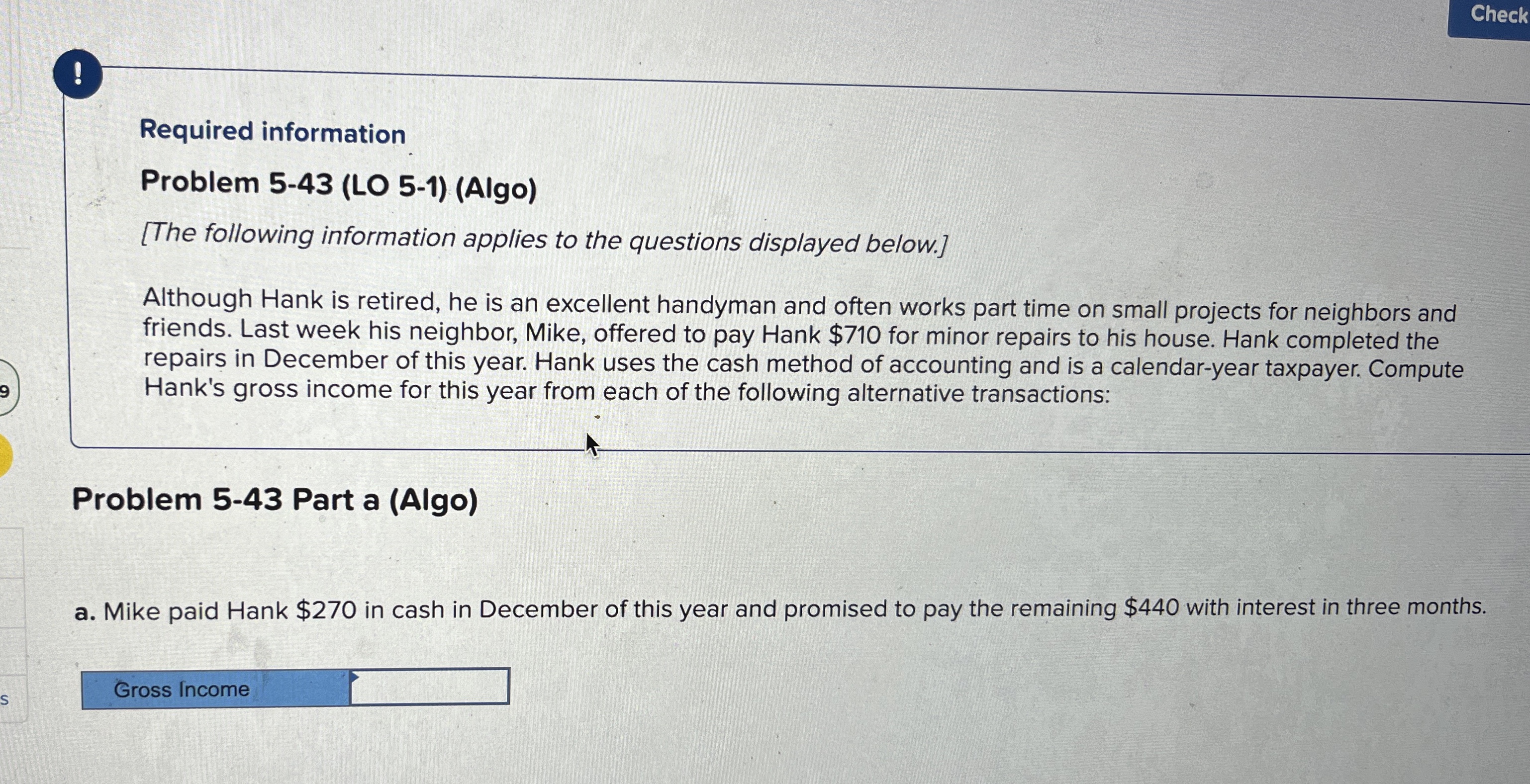

Although Hank is retired, he is an excellent handyman and often works part time on small projects for neighbors and

friends. Last week his neighbor, Mike, offered to pay Hank $ for minor repairs to his house. Hank completed the

repairs in December of this year. Hank uses the cash method of accounting and is a calendaryear taxpayer. Compute

Hank's gross income for this year from each of the following alternative transactions:

Problem Part a Algo

a Mike paid Hank $ in cash in December of this year and promised to pay the remaining $ with interest in three months.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock