Question: Required information Problem 5 - 7 7 ( Algo ) Methods of Cost Analysis: Account Analysis, High - Low Method, Simple and Multiple Regression, Data

Required information

Problem Algo Methods of Cost Analysis: Account Analysis, HighLow Method, Simple and Multiple

Regression, Data Analysis and Visualization LO

The following information applies to the questions displayed below.

Prest Metal Products manufactures and sells various products. The products are manufactured at one of a few plants

depending on the product and then shipped to a distribution center for eventual delivery to customers. The Auburn

Distribution Center ADC of Prest Metal Products handles a subset of Prest Products. The products handled by the ADC

are fairly similar in size and weight and differ primarily in features that do not affect handling or packaging.

When the sales staff at Prest receives an order, they send it to the appropriate distribution center to fill collect units and

package for shipping and ship the units to the customer. A single order may consist of one although unusual or more

units. Regardless of the number of units in the order, ADC has to follow certain steps to process the order, such as

verifying the customer's address and credit information, review the order for errors, and so on The ADC is also

responsible for following up on any complaints from the customer about problems with the order.

The ADC expects to distribute units of products next month. As a part of the normal planning process at ADC, the

center controller has classified next month's expected operating costs excluding costs of the distributed product as fixed

or variable with respect to units shipped as follows.

Required information

The following information applies to the questions displayed below.

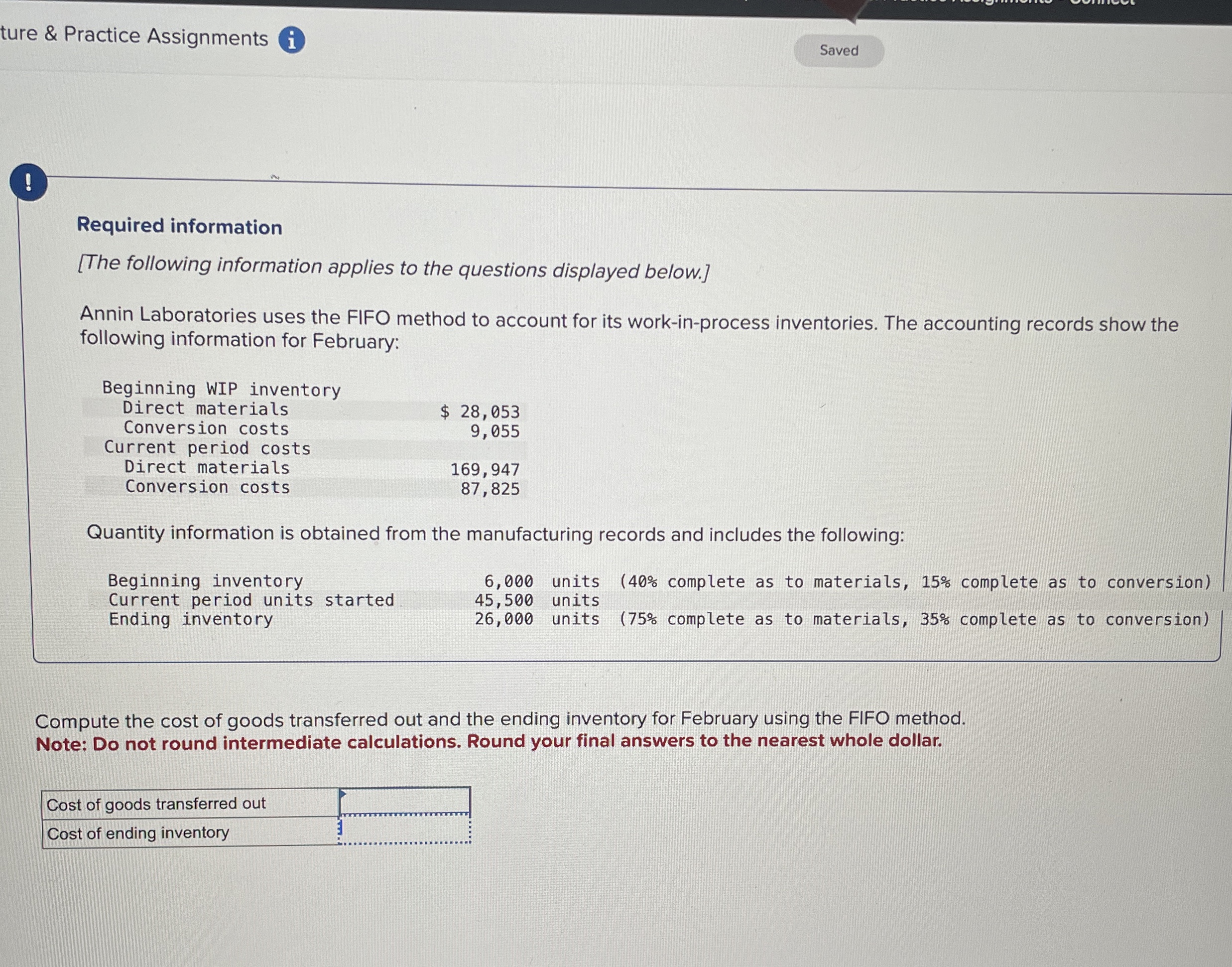

Annin Laboratories uses the FIFO method to account for its workinprocess inventories. The accounting records show the

following information for February:

Beginning WIP inventory

Direct materials $

Conversion costs

Current period costs

Direct materials

Conversion costs

Quantity information is obtained from the manufacturing records and includes the following:

Compute the cost of goods transferred out and the ending inventory for February using the FIFO method.

Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. The answer for equilavent units for materials is and equilavent for conversion cost is Direct materials is and conversion cost is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock