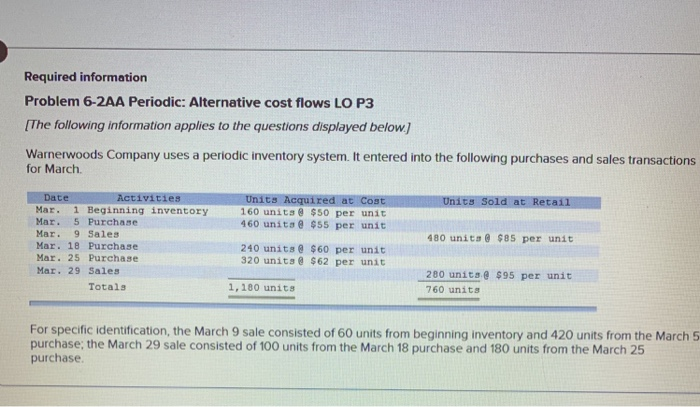

Question: Required information Problem 6-2AA Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below] Warnerwoods Company uses a periodic inventory

![following information applies to the questions displayed below] Warnerwoods Company uses a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb2e84a7e84_47566fb2e83f2c0a.jpg)

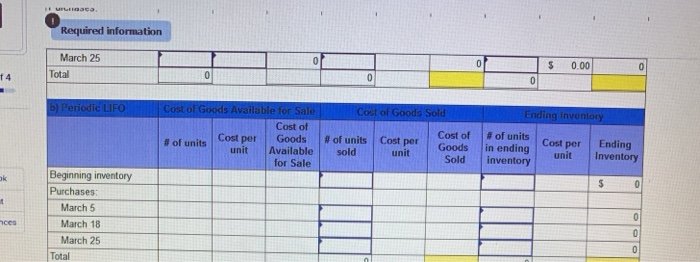

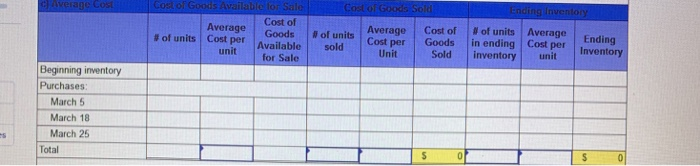

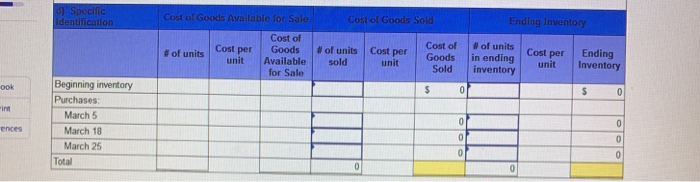

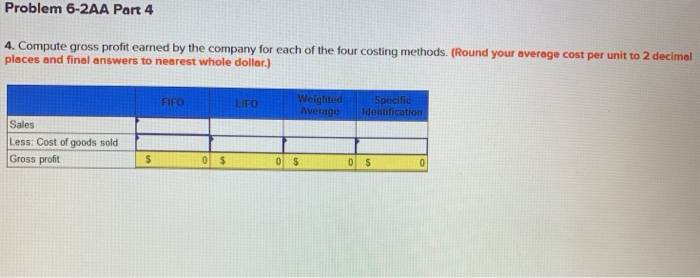

Required information Problem 6-2AA Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at CostUnits Sold at Retail Mar. 1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales 160 units $50 per unit 460 units e 55 per unit 480 unita $85 per unit 240 units $60 per unit 320 units $62 per unit 280 unitse s95 per unit 760 units Totals 1,180 units For specific identification, the March 9 sale consisted of 60 units from beginning inventory and 420 units from the March 5 purchase, the March 29 sale consisted of 100 units from the March 18 purchase and 180 units from the March 25 purchase Saved Help Se 0 Required information 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c)weighted average, and (d) specific identification. (Roun your average cost per unit to 2 decimal places.) a) Periodic FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Goods | Available | for Sale Cost of | # of units | Cost per | Ending Cost per unit | # of units l cost per | Goods | in ending | # of units l unit unit | Inventory sold Sold inventory 0.00 Beginning inventory Purchases 0.00 March 5 March 18 March 25 S 0.00 S 0.00 S 0.00 S 0.00 S 0.00 Total b) Periodic LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Cost of | # of units | Cost per | Ending Cost per | Goods | # of units Cost per unit # of units 1 unit Available sold ld inventory Resquired information 0.00 0 March 25 Total f 4 Cost of Cost of | # of units | Cost per | Ending Cost per | Goods | # of units | Cost per | Goods | in ending Sold inventory # of units | unit unit Inventory | Available | for Sale unit so Beginning inventory Purchases ok March 5 March 18 March 25 Total Cost of Average | Cost of | # of units | Average in ending Cost per Sold inventory unit | Ending # of units! Costpor!Available! Average | Goods | # of units | Cost per | Goods sold Inventory Unit unit for Sale Beginning inventory Purchases March 5 March 18 March 25 Total # of units | Cost per Goods | # of units | Cost per unit Available sold Cost of ! Goods |in ending | unit nnve Cost of | # of units | Cost per | Ending unit Sold inventory for Sale Beginning inventory Purchases ook int March 5 March 18 March 25 Total Problem 6-2AA Part 4 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places and final answers to nearest whole dollar.) Sales Less: Cost of goods sold Gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts