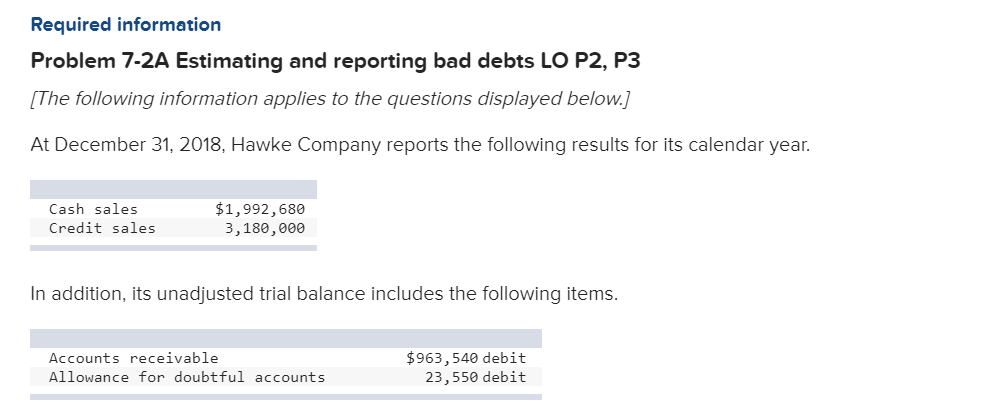

Question: Required information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31, 2018,

![P3 [The following information applies to the questions displayed below.] At December](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6b2e7ea453_11166e6b2e789b65.jpg)

Required information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31, 2018, Hawke Company reports the following results for its calendar year. $1,992,680 3,180,000 Cash sales Credit sales In addition, its unadjusted trial balance includes the following items. $963,540 debit 23,550 debit Accounts receivable Allowance for doubtful accounts Problem 7-2A Part 3 3. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2018, balance sheet assuming that an aging analysis estimates that 6% of year-end accounts receivable are uncollectible Current assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts