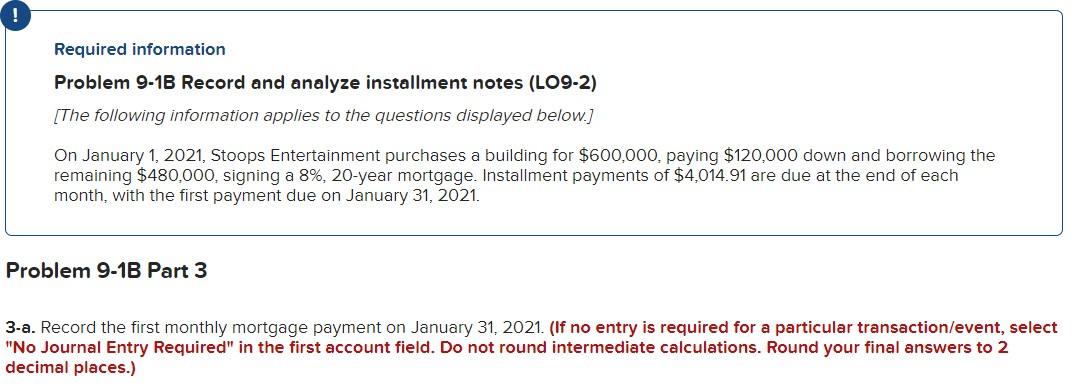

Question: Required information Problem 9-1B Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment

![following information applies to the questions displayed below.] On January 1, 2021,](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6661d4327d700_3466661d43218c48.jpg)

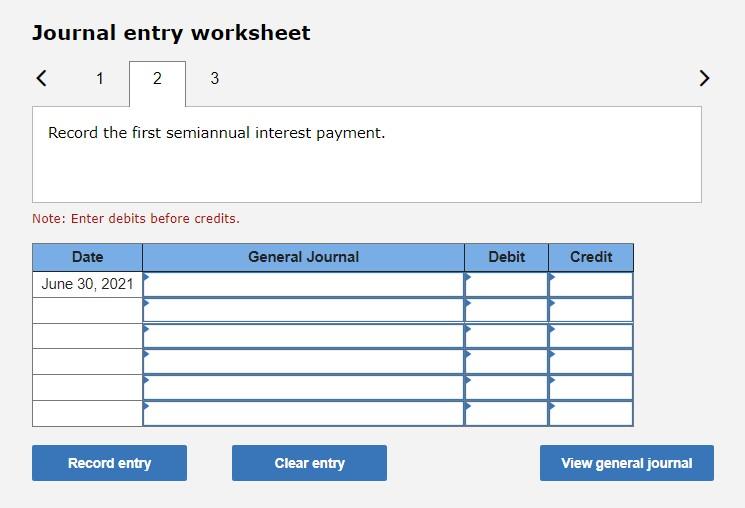

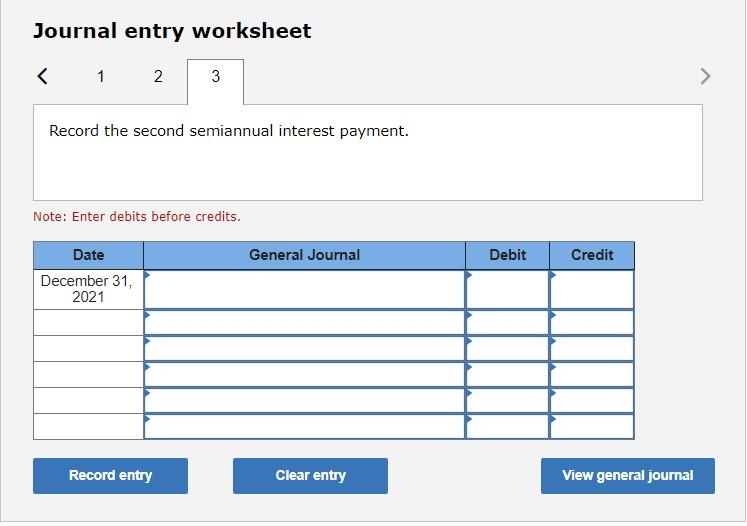

Required information Problem 9-1B Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $600,000, paying $120,000 down and borrowing the remaining $480,000, signing a 8%, 20-year mortgage. Installment payments of $4,014.91 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-1B Part 3 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 decimal places.) Record the first monthly mortgage payment. Note: Enter debits before credits. Date General Journal Debit Credit 3,200.00 January 31, 2021 Interest Expense Notes Payable Cash Record entry Clear entry View general journal 3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? (Round your answers to 2 decimal places.) Interest Expense Reducing the Carrying Value First payment Journal entry worksheet Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts