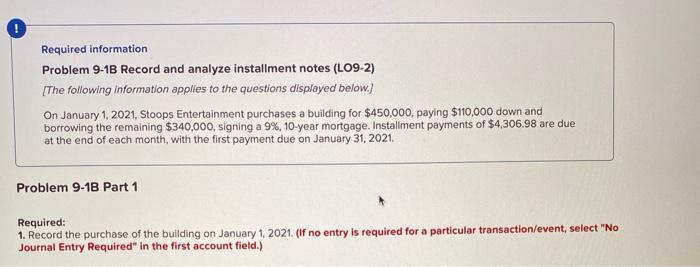

Question: Required information Problem 9-1B Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.) On January 1, 2021, Stoops Entertainment

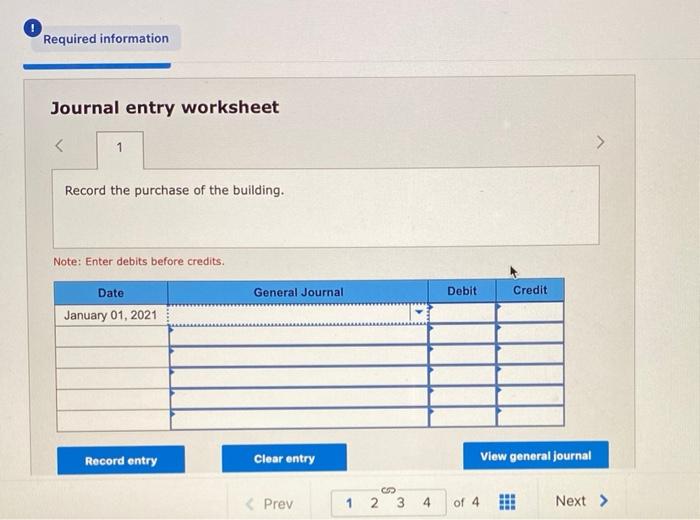

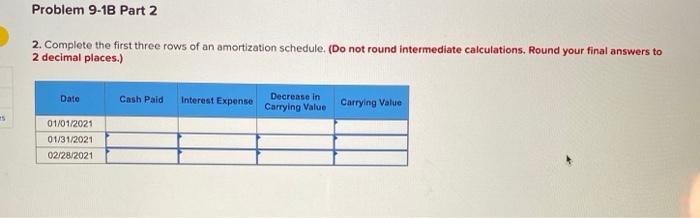

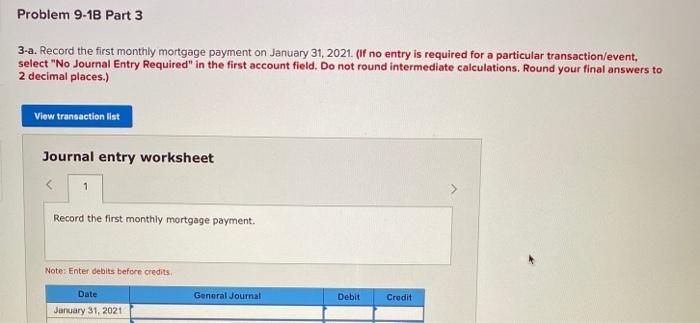

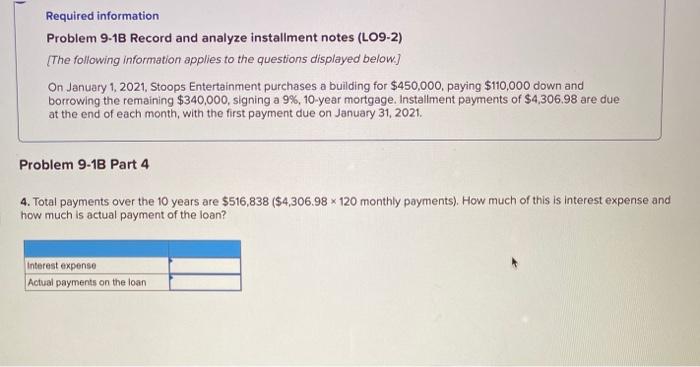

Required information Problem 9-1B Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.) On January 1, 2021, Stoops Entertainment purchases a building for $450,000, paying $110,000 down and borrowing the remaining $340,000, signing a 9%, 10-year mortgage. Installment payments of $4,306.98 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-1B Part 1 Required: 1. Record the purchase of the building on January 1, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Required information Journal entry worksheet 1 > Record the purchase of the building. Note: Enter debits before credits. General Journal Debit Credit Date January 01, 2021 Record entry Clear entry View general journal Problem 9-1B Part 2 2. Complete the first three rows of an amortization schedule. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Dato Cash Paid Interest Expense Decrease in Carrying Value Carrying Value es 01/01/2021 01/31/2021 02/28/2021 Problem 9-18 Part 3 3-a. Record the first monthly mortgage payment on January 31, 2021. (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 decimal places.) View transaction list Journal entry worksheet 1 Record the first monthly mortgage payment. Note: Enter debits before credits General Journal Debit Credit Date January 31, 2021 Required information Problem 9-1B Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.) On January 1, 2021, Stoops Entertainment purchases a building for $450,000, paying $110,000 down and borrowing the remaining $340,000, signing a 9%, 10-year mortgage. Installment payments of $4,306.98 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-18 Part 4 4. Total payments over the 10 years are $516,838 ($4,306,98 * 120 monthly payments). How much of this is interest expense and how much is actual payment of the loan? Interest expense Actual payments on the loan