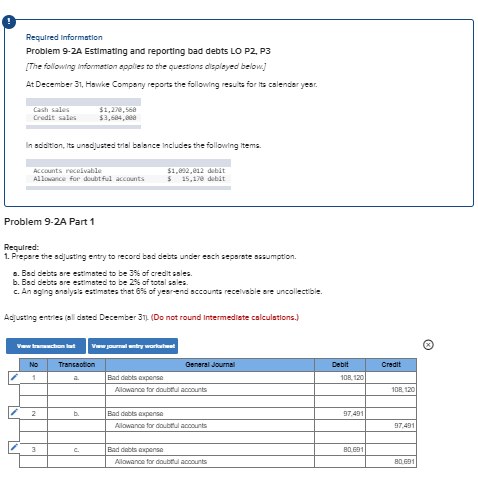

Question: Required information Problem 9-2A Estimating and reporting bad debts LO P2, P3 The following information applies to the questions displayed below.) At December 31, Hawke

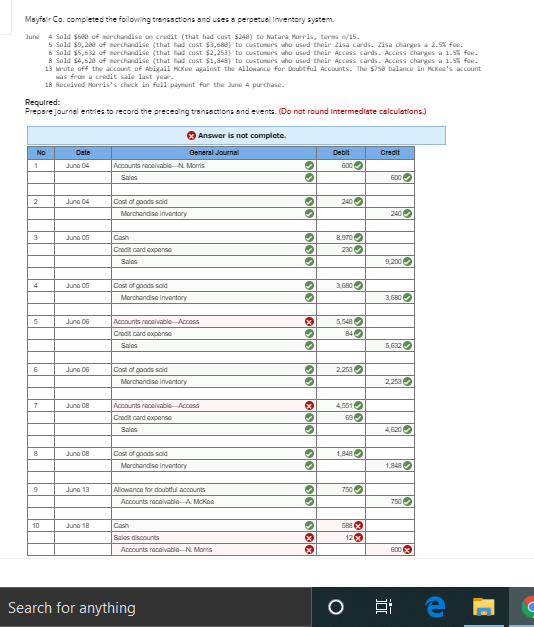

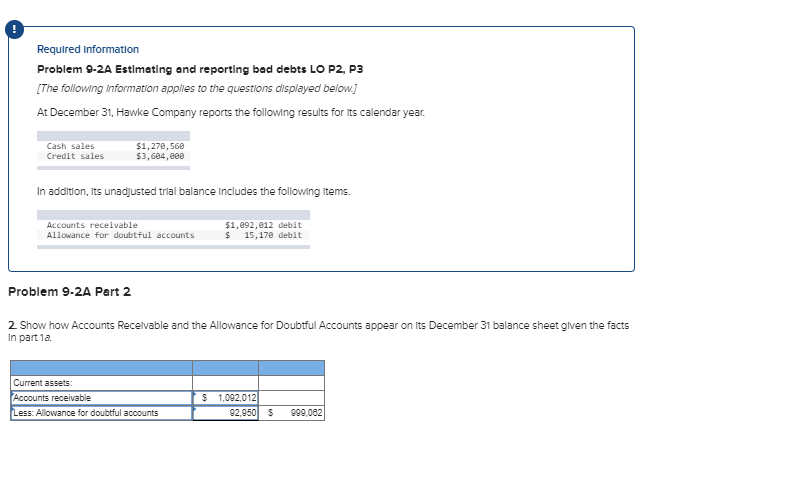

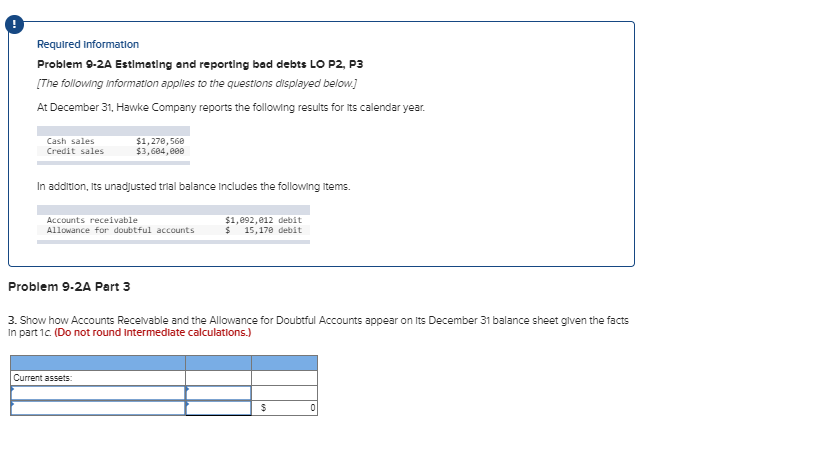

Required information Problem 9-2A Estimating and reporting bad debts LO P2, P3 The following information applies to the questions displayed below.) At December 31, Hawke Company reports the following results for its calendar year. Credit sales $1,270, $3,684,80 In addition, its un djusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $1,432,612 debit $ 15,178 debit Problem 9-2A Part 1 Required: 1. Prepare the adjusting entry to record bad debts under esch separate assumption. .. Bad debts are estimated to be 3% of credit sales. b. Bad debts are estimated to be 2% of total sales. c. An aging analysis estimates that 6% of year-end accounts receivable are uncollectible Adjusting entries (all dated December 311. (Do not round Intermediate calculations.) Vw ramach View journal entry workwet No Trancation Debit Credit 1 General Journal Bad debts expense Allowance for doubtful Accounts 101L 120 108. 120 2 b. 97,491 Bad debts expense Allowance for doubtul accounts 97.491 80.601 Baddats expense Allowance for doubtul accounts 80.691 June Mayfair Co.completed the following transactions and uses a perpetual Inventory system 4 Sold See of merchandise on credit that had cost $24) to Natara Morris, ters w/15. 5 Sold $9,28 of merchandise (that had cost $3,680) to customers who used their Zisa cards. Zisa charges a 2.5x foe. 6 Sold $5,532 of merchandise (that had cost $2,253) to customers who used their access cards. Access charges a 1.5% fue. 8 Sold $4,52e of merchandise that had cost $1.848) to customers who used their access cards. Access charges a 1.5% fue. 13 wrote off the account of Abigail Mckee against the Allowance for Doubtful Accounts. The $75 balance in McKee's account was from a credit sale last year. 18 Received Morris's check in full payment for the Dune purchase. Required: Prepare journal entries to record the preceding transactions and events. (Do not round Intermediate calculations.) x Answer not complete No Date Credit Debit 600 1 General Journal Accounts receivable. Morris Sales June 04 600 OOOO 2 June 04 240 Cost of goods sold Merchandise inventory 240 Jung OG 8.970 230 Credit card expo Sales 9.200 4 June 05 3.680 Cost of goods sold Merchandise inventory 3.60 OOO OOOO OO 5 June 06 Accounts receivable Access Credit card expanse Sales 84 5.632 6 June 06 2.263 Cost of goods sold Merchandise inventory 2.253 7 Jun 08 4561 Accounts receivable Access Crack card expense Sales colo 4.62 8 June 1.848 Cost of goods sold Merchandise inventory 1,848 OOOO 9 June 13 750 Allowance for doubtful counts Accounts receivable A. McKee 750 10 June 18 Cash 5889 12% x Sales discounts Accounts receivabo N. Morris 600 x Search for anything e Required Information Problem 9-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,270,560 $3,684,6ee In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $1, e92, e12 debit $ 15,17 debit Problem 9-2A Part 2 2 Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet given the facts In part 1a. Current assets: Accounts receivable Less: Allowance for doubtful accounts $ 1.092,012 92,950 $ 999,062 Required information Problem 9-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,270,560 $3,604, In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $1,292,012 debit $ 15,17 debit Problem 9-2A Part 3 3. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet given the facts In part 10 (Do not round Intermediate calculations.) Current assets: $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts