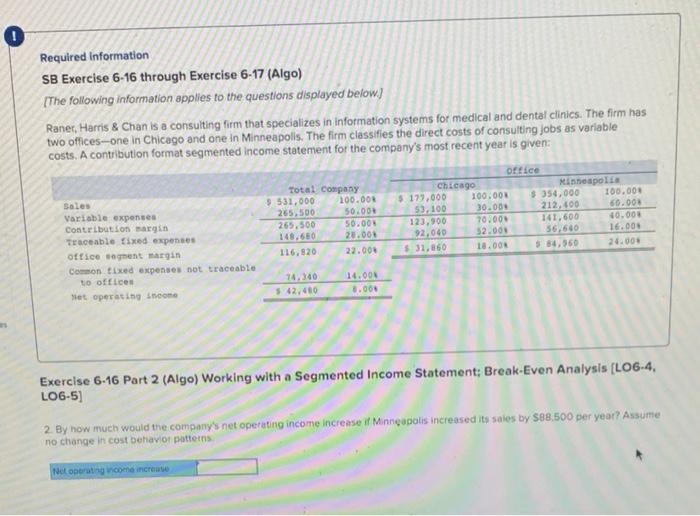

Question: Required information SB Exercise 6-16 through Exercise 6-17 (Algo) [The following information applies to the questions displayed below) Raner, Harris & Chan is a consulting

Required information SB Exercise 6-16 through Exercise 6-17 (Algo) [The following information applies to the questions displayed below) Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices--one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting Jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given Sales Variable expenses Contribution margin Traceable fixed expenses office agent margin Common tixed expenses not traceable to offices het operating Soon Total Company 5 531.000 100.000 265,500 50.000 265.500 50.000 148.660 28.000 116,820 22.000 office Chicago Minneapoli $ 179.000 100.000 $ 354,000 100.000 5), 100 30.000 212,400 60.000 123.900 10.000 141.600 10.000 92,040 52.000 56,640 16.000 $31.860 18.000 5 34,960 24.000 14.340 542,40 16.000 8.000 Exercise 6-16 Part 2 (Algo) Working with a Segmented Income Statement: Break-Even Analysis (L06-4, LO65) 2. By how much would the company's net operating income increase il Minneapolis increased its sales by 588,500 per year? Assume no change in cost behavior patterns Neobrang come increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts