Answered step by step

Verified Expert Solution

Question

1 Approved Answer

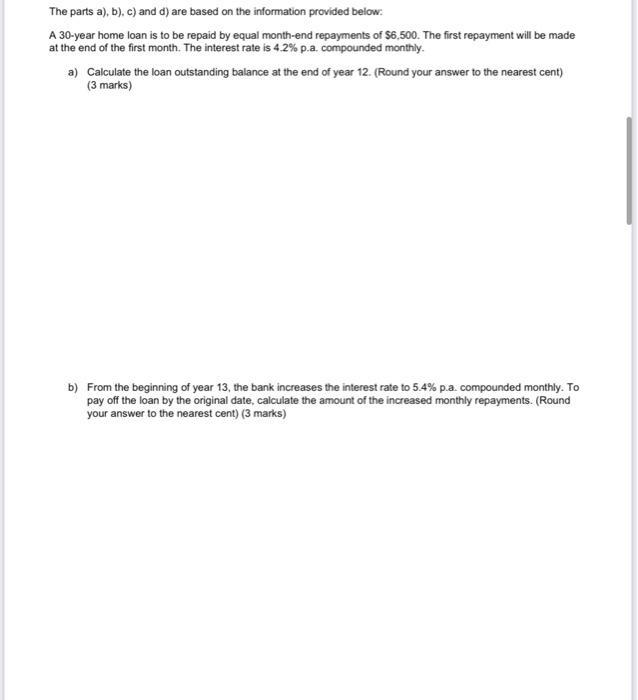

The parts a), b), c) and d) are based on the information provided below: A 30-year home loan is to be repaid by equal

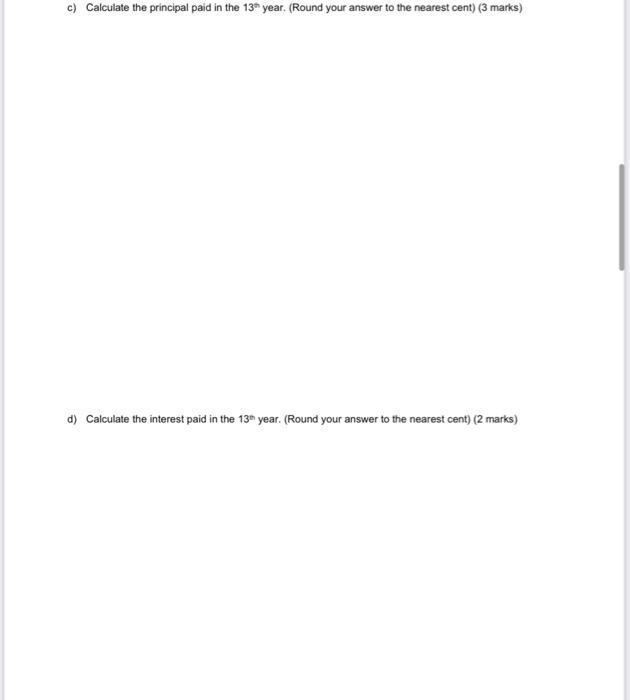

The parts a), b), c) and d) are based on the information provided below: A 30-year home loan is to be repaid by equal month-end repayments of $6,500. The first repayment will be made at the end of the first month. The interest rate is 4.2% p.a. compounded monthly. a) Calculate the loan outstanding balance at the end of year 12. (Round your answer to the nearest cent) (3 marks) b) From the beginning of year 13, the bank increases the interest rate to 5.4% p.a. compounded monthly. To pay off the loan by the original date, calculate the amount of the increased monthly repayments. (Round your answer to the nearest cent) (3 marks) c) Calculate the principal paid in the 13th year. (Round your answer to the nearest cent) (3 marks) d) Calculate the interest paid in the 13th year. (Round your answer to the nearest cent) (2 marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Interest rate per month 4212 00035 Outstanding Loan Balance at the end of year 12 Present value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started