Question: Required: Journalize the transactions for Sid. When calculating interest, do not round intermediate amounts, but do round the final amount to the nearest dollar.

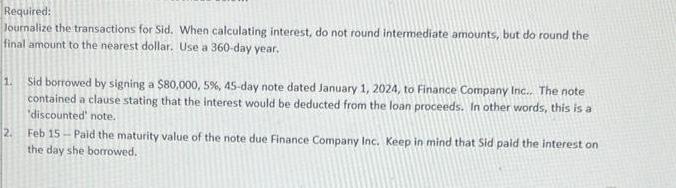

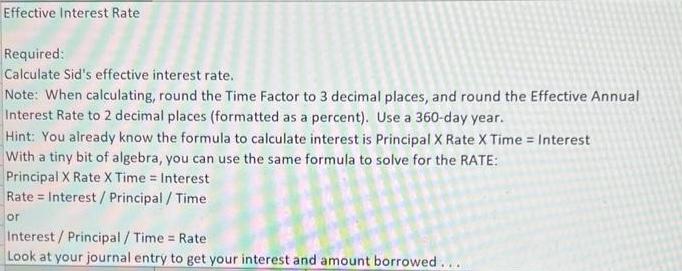

Required: Journalize the transactions for Sid. When calculating interest, do not round intermediate amounts, but do round the final amount to the nearest dollar. Use a 360-day year. 1. Sid borrowed by signing a $80,000, 5 %, 45-day note dated January 1, 2024, to Finance Company Inc... The note contained a clause stating that the interest would be deducted from the loan proceeds. In other words, this is a 'discounted' note. 2. Feb 15-Paid the maturity value of the note due Finance Company Inc. Keep in mind that Sid paid the interest on the day she borrowed. Effective Interest Rate Required: Calculate Sid's effective interest rate. Note: When calculating, round the Time Factor to 3 decimal places, and round the Effective Annual Interest Rate to 2 decimal places (formatted as a percent). Use a 360-day year. Hint: You already know the formula to calculate interest is Principal X Rate X Time = Interest With a tiny bit of algebra, you can use the same formula to solve for the RATE: Principal X Rate X Time = Interest Rate Interest / Principal / Time or Interest / Principal / Time = Rate Look at your journal entry to get your interest and amount borrowed...

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step 11 WN1 Calculation of the Interest Expense on the ... View full answer

Get step-by-step solutions from verified subject matter experts