Question: Required: On October 1 , 2 0 2 3 , the Voluntary Action Agency ( which has a December 3 1 fiscal year - end

Required:

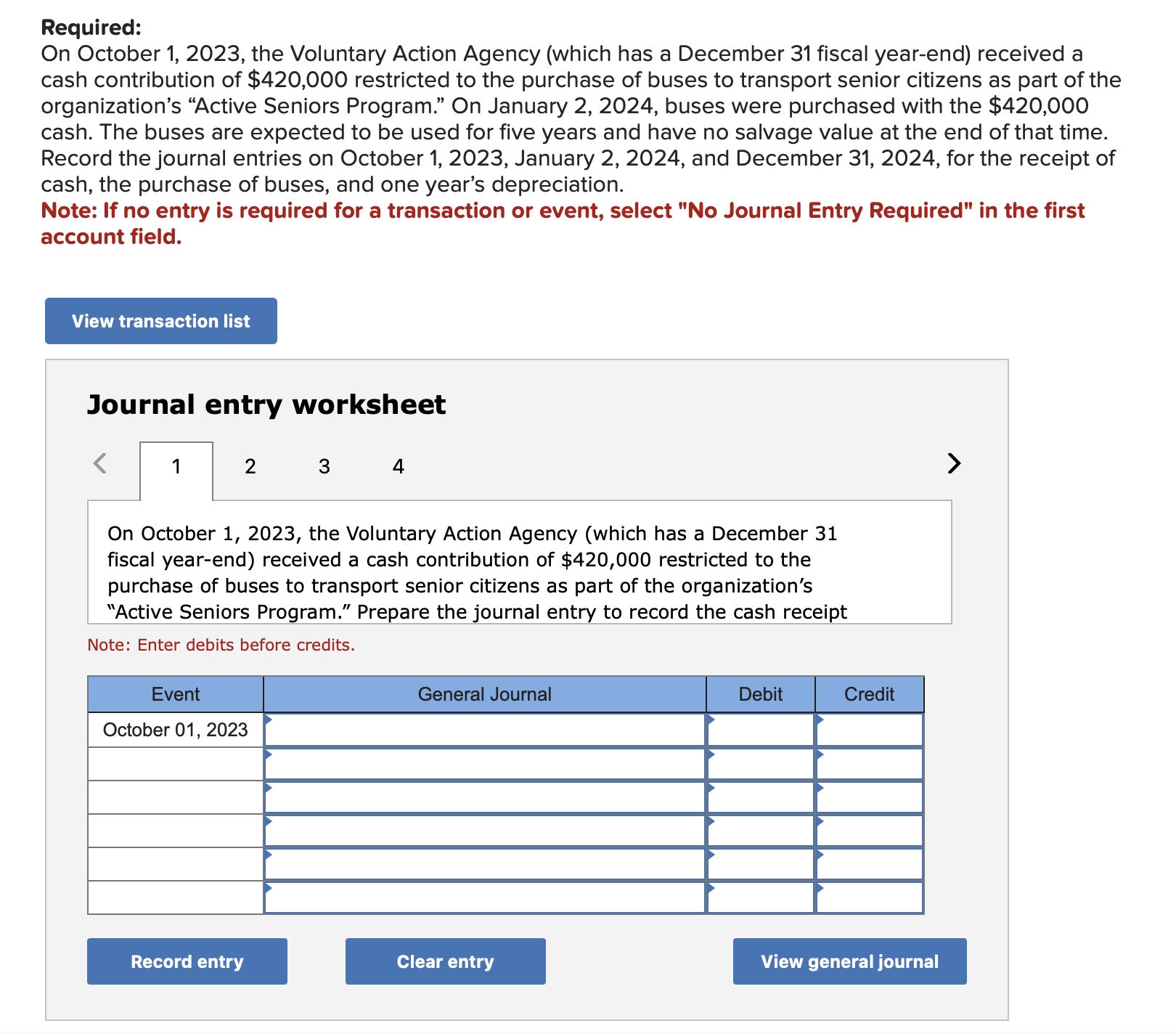

On October the Voluntary Action Agency which has a December fiscal yearend received a cash contribution of $ restricted to the purchase of buses to transport senior citizens as part of the organization's "Active Seniors Program." On January buses were purchased with the $ cash. The buses are expected to be used for five years and have no salvage value at the end of that time. Record the journal entries on October January and December for the receipt of cash, the purchase of buses, and one year's depreciation.

Note: If no entry is required for a transaction or event, select No Journal Entry Required" in the first account field.

Journal entry worksheet

On October the Voluntary Action Agency which has a December fiscal yearend received a cash contribution of $ restricted to the purchase of buses to transport senior citizens as part of the organization's "Active Seniors Program." Prepare the journal entry to record the cash receipt

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock