Question: Required Spreadsheet tab identifies six key matters noted during the audit of Penfolds Mining Group Ltd in each of these matters, required to: Critically assess

Required

Spreadsheet tab identifies six key matters noted during the audit of Penfolds Mining Group Ltd in each of these matters, required to:

- Critically assess the implications of the audit matter raised as it affects the financial statements of Penfolds Mining Group Ltd (referencing the requirements of Australian Accounting Standards where appropriate);

- Provide a recommendation to management as to adjustments that need to be made to the financial statements (if any) in relation to the audit matter.

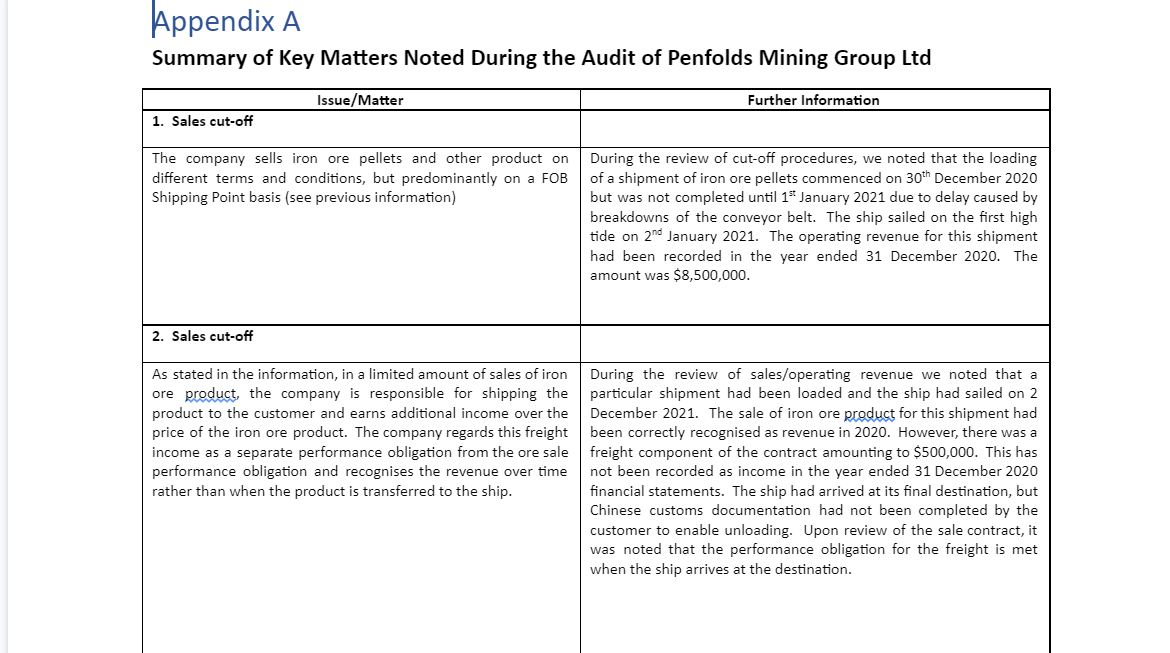

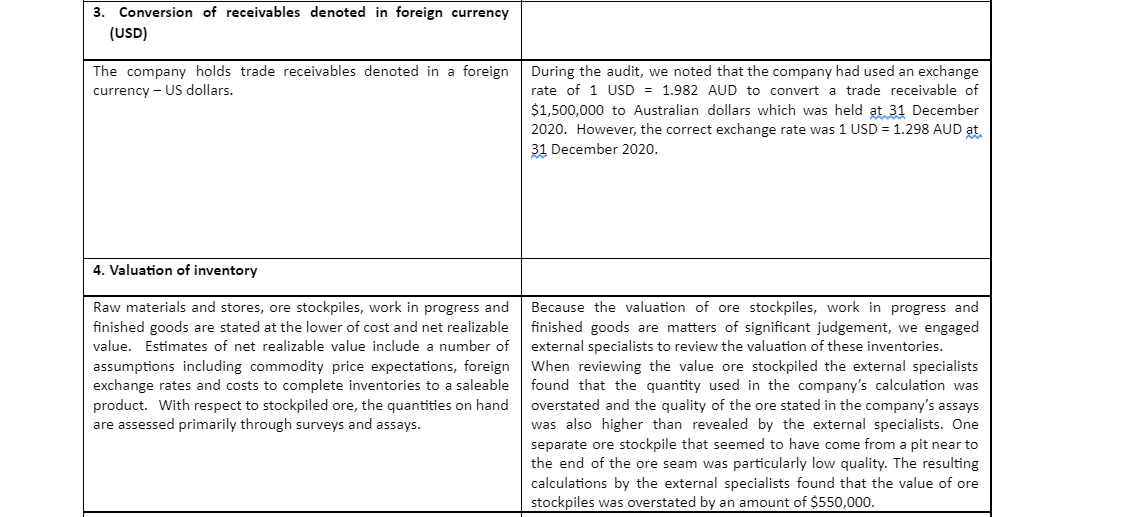

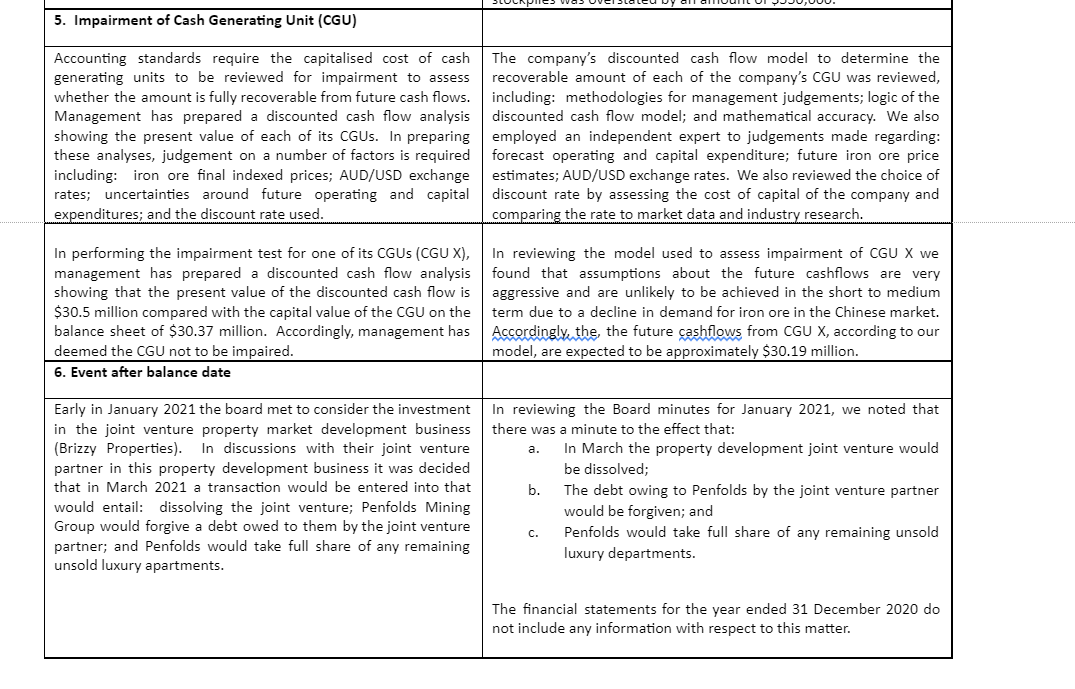

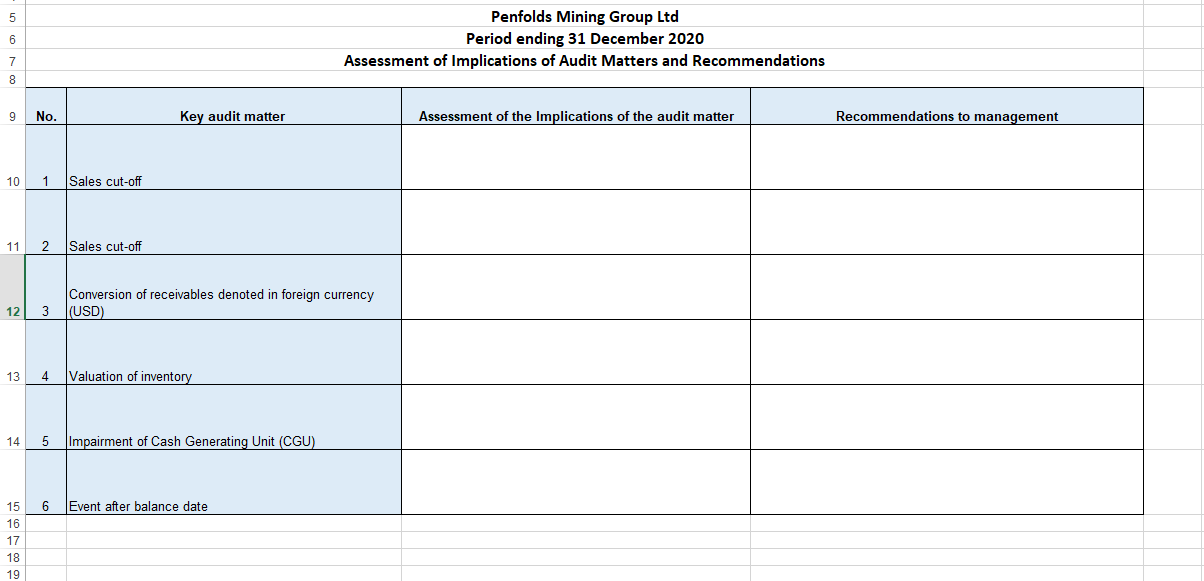

lAppendix A Summary of Key Matters Noted During the Audit of Penfolds Mining Group Ltd IssuefMather 1. Sales cut-off Further Information The company sells iron ore pellets and other product on different terms and conditions, but predominantly on a FOB Shipping Point basis [see previous information} 2. Sales cut-off During the review of cutoff procedures, we noted that the loading of a shipment of iron ore pellets commenced on 30th December 2020 but was not completed until 1St January 2021 due to delay caused by breakdowns of the conveyor belt. The ship sailed on the first high tide on 2'\"1 January 2021. The operating revenue for this shipment had been recorded in the year ended 31 December 2020. The amount was $8,500,000. As stated in the information. in a limited amount of sales of iron ore W the company is responsible for shipping the product to the customer and earns additional income over the price of the iron ore product. The company regards this freight income as a separate performance obligation from the ore sale performance obligation and recognises the revenue over time rather than when the product is transferred to the ship. During the review of sales/operating revenue we noted that a particular shipment had been loaded and the ship had sailed on 2 December 2021. The sale of iron oregggdmfor this shipment had been correctly recognised as revenue in 2020. However, there was a freight component of the contract amounting to $500,000. This has not been recorded as income in the year ended 31 December 2020 financial statements. The ship had arrived at its nal destination. but Chinese customs documentation had not been completed by the customer to enable unloading. Upon review of the sale contract, it was noted that the performance obligation for the freight is met when the ship arrives atthe destination. 3. Conversion of receivables denoted in foreign currency {usn} The company holds trade receivables denoted in a foreign currency US dollars. During the audit, we noted that the company had used an exchange rate of 1 USD = 1.982 AUD to convert a trade receivable of $1,500,000 to Australian dollars which was held M December 2020. However, the correct exchange rate was 1 USD = 1.293 AUD a; ; December 2020. 4. Valuation of inventory Raw materials and stores, ore stockpiles, work in progress and finished goods are stated atthe lower of cost and net realizable value. Estimates of net realizable value include a number of assumptions including commodity price expectations, foreign exchange rates and costs to complete inventories to a saleable product. With respect to stockpiled ore, the quantities on hand are assessed primarily through surveys and assays. Because the valuation of ore stockpiles, work in progress and finished goods are matters of signicant judgement, we engaged external specialists to review the valuation of these inventories. When reviewing the value ore stockpiled the external specialists found that the quantity used in the company's calculation was overstated and the quality of the ore stated in the company's assays was also higher than revealed by the external specialists. One separate ore stockpile that seemed to have come from a pit near to the end of the ore seam was particularly low quality. The resulting calculations by the external specialists found that the value of ore stockpiles was overstated by an amount of $550,000. 5. Impairment of Cash Generating Unit {CGUj JIJJLRPIIIZJ "a: uvchLuLcu U, ml arrruuln LII ngujuuu. Accounting standards require the capitalised oost of cash generating units to be reviewed for impairment to assess whether the amount is fully recoverable from future cash flows. Management has prepared a discounted cash flow analysis showing the present value of each of its CGUs. In preparing these analyses, judgement on a number of factors is required including: iron ore nal indexed prices; AUDIUSD exchange rates; uncertainties around future operating and capital exenditures; and the discount rate used. In performing the impairment test for one of its CGUs {CGU X], management has prepared a discounted cash flow analysis showing that the present value of the discounted cash ow is $30.5 million compared with the capital value ofthe CGU on the balance sheet of $30.3? million. Accordingly, management has deemed the CGU not to be impaired. 6. Event after balance date The company's discounted cash flow model to determine the recoverable amount of each of the oompany's CGU was reviewed. including: methodologies for management judgements; logic of the discounted cash flow model; and mathematical accuracy. We also employed an independent expert to judgements made regarding: forecast operating and capital expenditure; future iron ore price estimates; AUDIUSD exchange rates. We also reviewed the choice of discount rate by assessing the cost of capital of the company and corn arin- the rate to market data and indust research. In reviewing the model used to assess impairment of CGU X we found that assumptions about the future cashflows are very aggressive and are unlikely to be achieved in the short to medium term due to a decline in demand for iron ore in the Chinese market. Accordingly. ther the future cashows from CGU X, according to our model. are expected to be approximately $30.19 million. Early in January 2021 the board met to consider the investment in the joint venture property market development business [Brizzy Properties}. In discussions with their joint venture partner in this property development business it was decided that in March 2021 a transaction would be entered into that would entail: dissolving the joint venture; Penfolds Mining Group would forgive a debt owed to them by the joint venture partner; and Penfolds would taloe full share of any remaining unsold luxury apartments. In reviewing the Board minutes for January 2021; we noted that there was a minute to the effect that: a. In March the property development joint venture would be dissolved: b. The debt owing to Penfolds by the joint venture partner would be forgiven; and c. Penfolds would take full share of any remaining unsold luxury departments. The financial statements for the year ended 31 December 2020 do not include any information with respect to this matter. Penfolds Mining Group Ltd Period ending 31 December 2020 Assessment of Implications of Audit Matters and Recommendations 9 No. Key audit matter Assessment of the Implications of the audit matter Recommendations to management 10 1 Sales cut-off 11 2 Sales cut-off Conversion of receivables denoted in foreign currency 12 3 (USD) 13 4 Valuation of inventory 14 5 Impairment of Cash Generating Unit (CGU) 15 6 Event after balance date 16 17 18 10