Question: REQUIRED Study the information provided below and answer the following questions independently: 3.1.1 Calculate the margin of safety (in units). (4 marks) 3.1.2 Use the

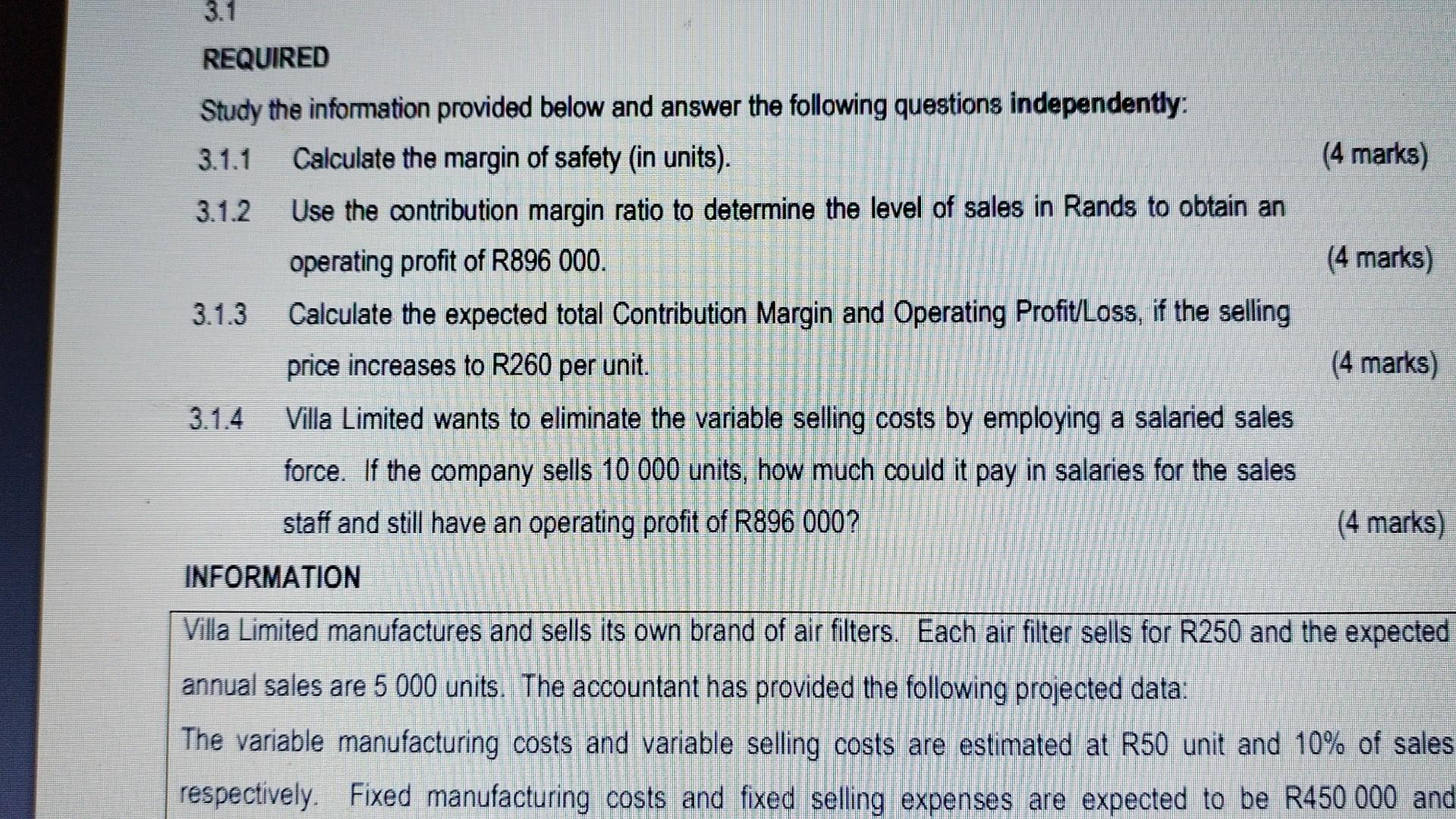

REQUIRED Study the information provided below and answer the following questions independently: 3.1.1 Calculate the margin of safety (in units). (4 marks) 3.1.2 Use the contribution margin ratio to determine the level of sales in Rands to obtain an operating profit of R896000. (4 marks) 3.1.3 Calculate the expected total Contribution Margin and Operating ProfitLoss, if the selling price increases to R260 per unit. (4 marks) 3.1.4 Villa Limited wants to eliminate the variable selling costs by employing a salaried sales force. If the company sells 10000 units, how much could it pay in salaries for the sales staff and still have an operating profit of R896000 ? (4 marks) INFORMATION Villa Limited manufactures and sells its own brand of air filters. Each air filter sells for R250 and the expectec annual sales are 5000 units. The accountant has provided the following projected data: The variable manufacturing costs and variable selling costs are estimated at R50 unit and 10% of sale respectively. Fixed manufacturing costs and fixed selling expenses are expected to be R450000 an REQUIRED Study the information provided below and answer the following questions independently: 3.1.1 Calculate the margin of safety (in units). (4 marks) 3.1.2 Use the contribution margin ratio to determine the level of sales in Rands to obtain an operating profit of R896000. (4 marks) 3.1.3 Calculate the expected total Contribution Margin and Operating ProfitLoss, if the selling price increases to R260 per unit. (4 marks) 3.1.4 Villa Limited wants to eliminate the variable selling costs by employing a salaried sales force. If the company sells 10000 units, how much could it pay in salaries for the sales staff and still have an operating profit of R896000 ? (4 marks) INFORMATION Villa Limited manufactures and sells its own brand of air filters. Each air filter sells for R250 and the expectec annual sales are 5000 units. The accountant has provided the following projected data: The variable manufacturing costs and variable selling costs are estimated at R50 unit and 10% of sale respectively. Fixed manufacturing costs and fixed selling expenses are expected to be R450000 an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts