Question: Required: The time from acceptance to maturity on a $ 1 , 0 0 2 , 0 0 0 banker's acceptance is 1 2 0

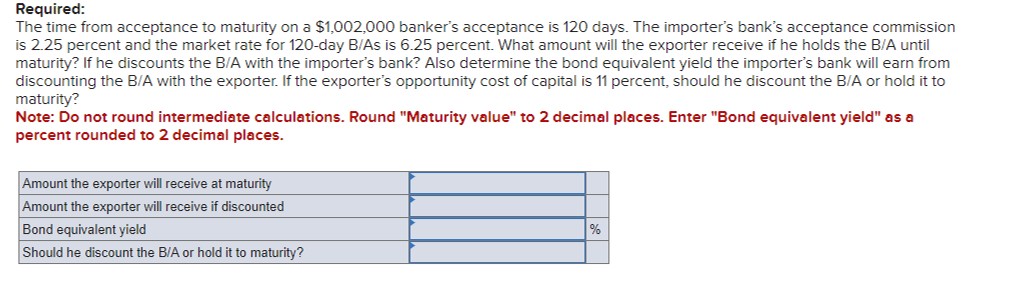

Required:

The time from acceptance to maturity on a $ banker's acceptance is days. The importer's bank's acceptance commission

is percent and the market rate for day BAs is percent. What amount will the exporter receive if he holds the BA until

maturity? If he discounts the BA with the importer's bank? Also determine the bond equivalent yield the importer's bank will earn from

discounting the BA with the exporter. If the exporter's opportunity cost of capital is percent, should he discount the BA or hold it to

maturity?

Note: Do not round intermediate calculations. Round "Maturity value" to decimal places. Enter "Bond equivalent yield" as a

percent rounded to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock