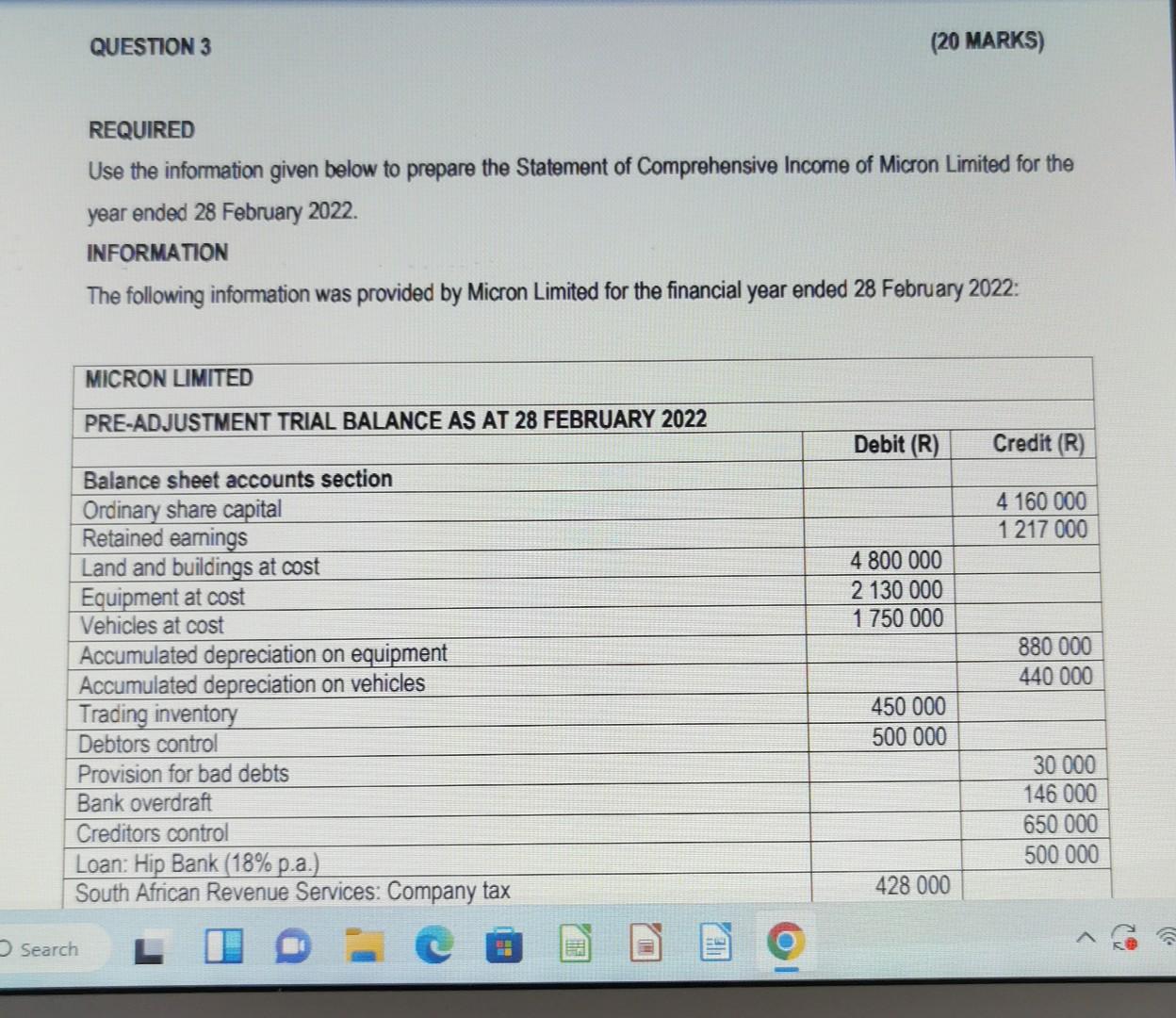

Question: REQUIRED Use the information given below to prepare the Statement of Comprehensive Income of Micron Limited for the year ended 28 February 2022. INFORMATION The

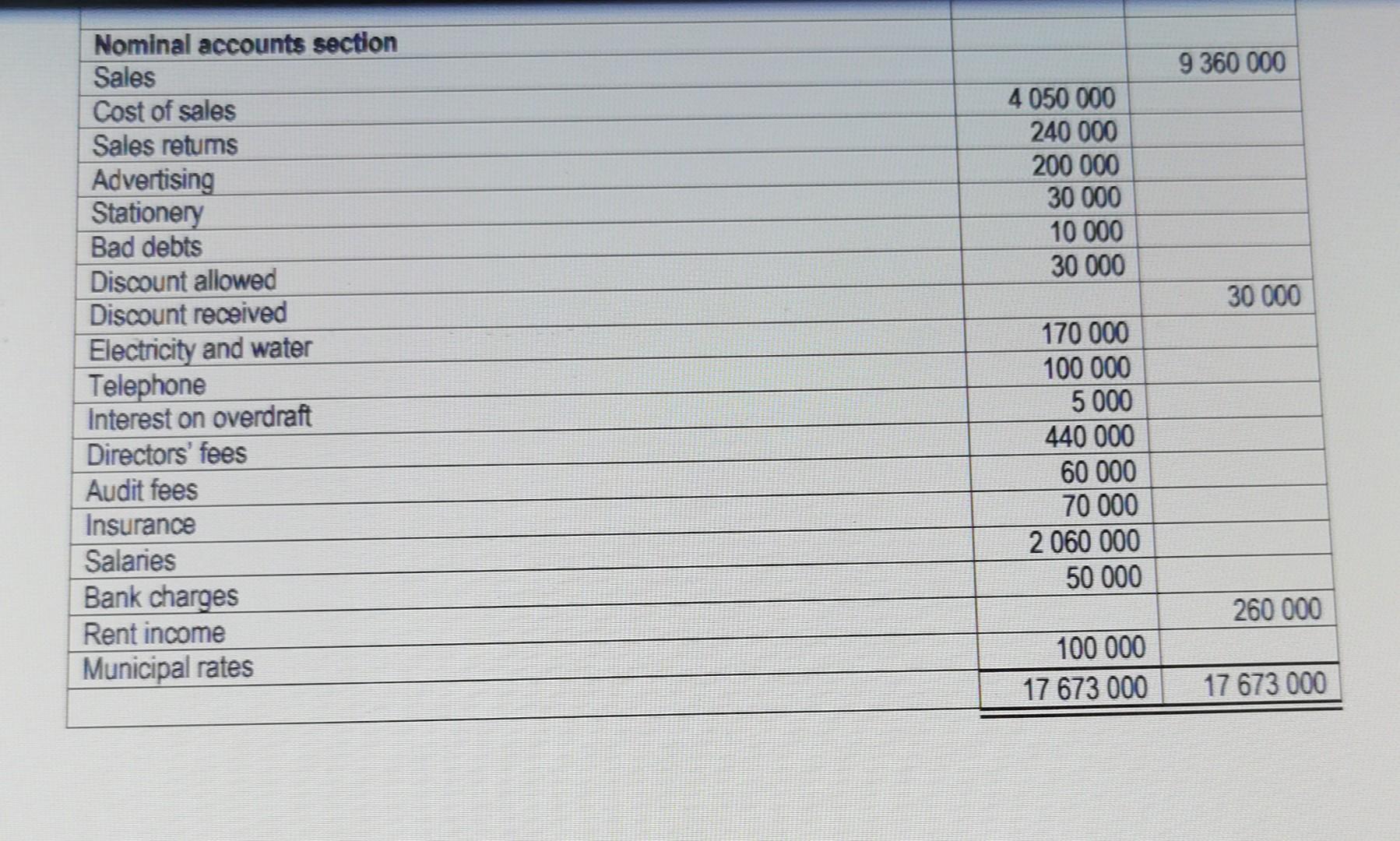

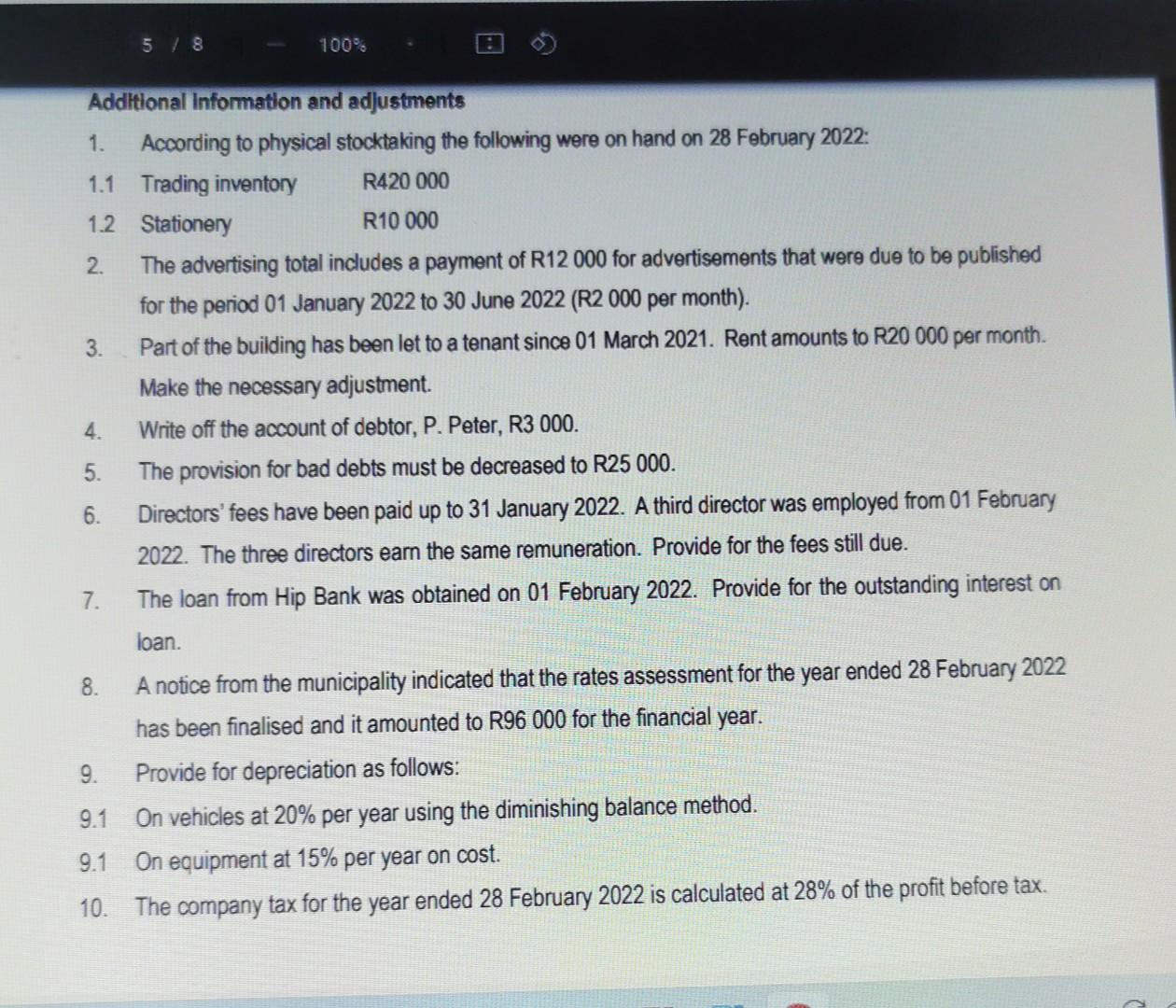

REQUIRED Use the information given below to prepare the Statement of Comprehensive Income of Micron Limited for the year ended 28 February 2022. INFORMATION The following information was provided by Micron Limited for the financial year ended 28 February 2022 : \begin{tabular}{|lrr|} \hline Nominal accounts section & & 9360000 \\ \hline Sales & 4050000 \\ \hline Cost of sales & 240000 \\ \hline Sales retums & 200000 \\ \hline Advertising & 30000 \\ \hline Stationery & 10000 \\ \hline Bad debts & 30000 \\ \hline Discount allowed & 170000 \\ \hline Discount received & 100000 \\ \hline Electricity and water & 5000 \\ \hline Telephone & 440000 \\ \hline Interest on overdraft & 60000 \\ \hline Directors' fees & 70000 \\ \hline Audit fees & 2060000 \\ \hline Insurance & 50000 \\ \hline Salaries & 100000 \\ \hline Bank charges & 17673000 \\ \hline Rent income & 17673000 \\ \hline Municipal rates & 8000 \\ \hline \end{tabular} 1. Accoording to physical stocktaking the following were on hand on 28 February 2022 : 1.1 Trading inventory R420 000 1.2 Stationery R10000 2. The advertising total includes a payment of R12000 for advertisements that were due to be published for the period 01 January 2022 to 30 June 2022 (R2 000 per month). 3. Part of the building has been let to a tenant since 01 March 2021. Rent amounts to R20 000 per month. Make the necessary adjustment. 4. Write off the account of debtor, P. Peter, R3 000. 5. The provision for bad debts must be decreased to R25000. 6. Directors' fees have been paid up to 31 January 2022. A third director was employed from 01 February 2022. The three directors earn the same remuneration. Provide for the fees still due. 7. The loan from Hip Bank was obtained on 01 February 2022. Provide for the outstanding interest on loan. 8. A notice from the municipality indicated that the rates assessment for the year ended 28 February 2022 has been finalised and it amounted to R96000 for the financial year. 9. Provide for depreciation as follows: 9.1 On vehicles at 20% per year using the diminishing balance method. 9.1 On equipment at 15% per year on cost. 10. The company tax for the year ended 28 February 2022 is calculated at 28% of the profit before tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts