Question: REQUIRED Use the relevant information provided below to prepare the following: 4 . 1 Double entries for the second provisional company tax payment of R

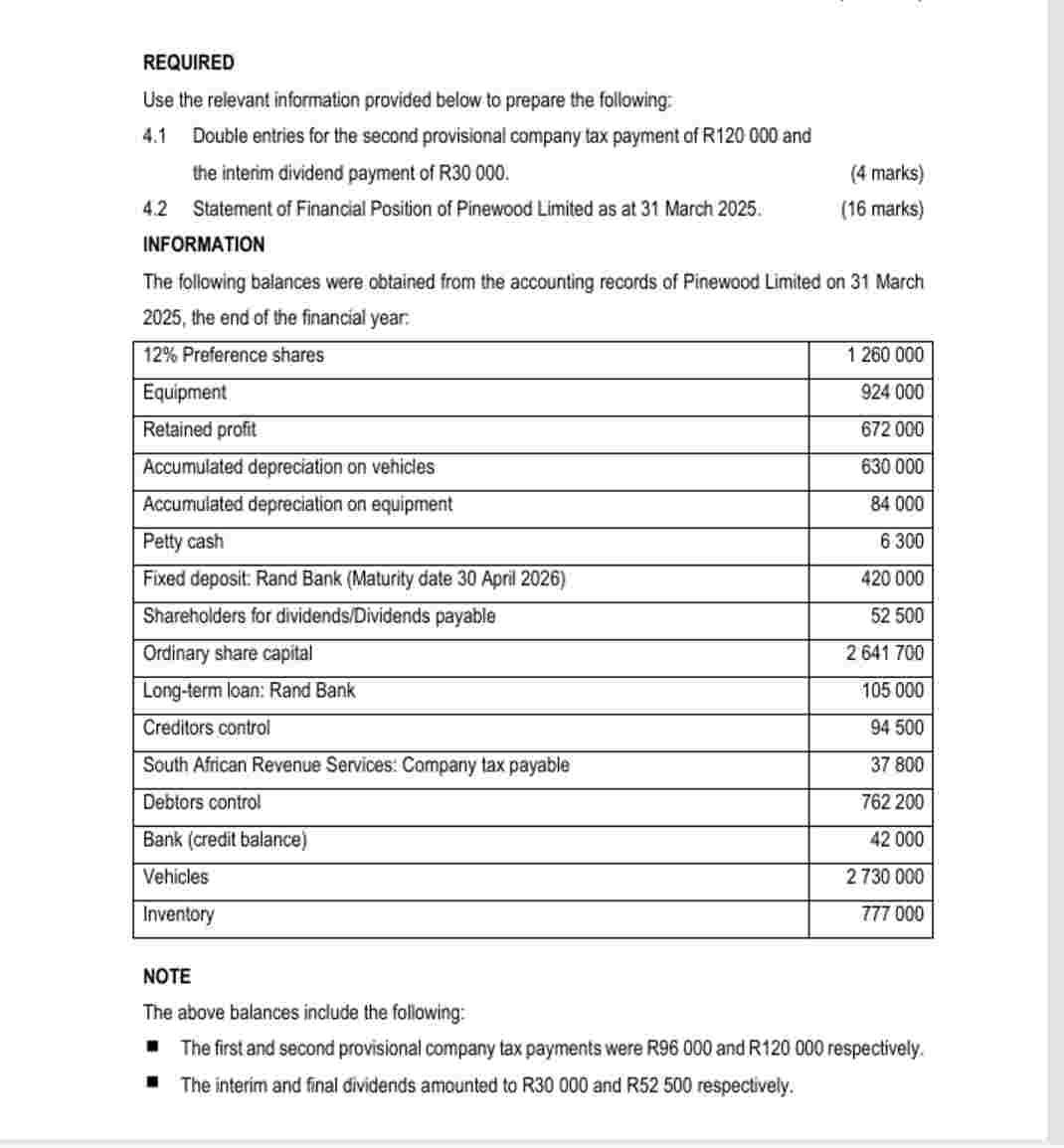

REQUIRED Use the relevant information provided below to prepare the following: Double entries for the second provisional company tax payment of R and the interim dividend payment of R marks Statement of Financial Position of Pinewood Limited as at March marks INFORMATION The following balances were obtained from the accounting records of Pinewood Limited on March the end of the financial year: Preference shares Equipment Retained profit Accumulated depreciation on vehicles Accumulated depreciation on equipment Petty cash Fixed deposit: Rand Bank Maturity date April Shareholders for dividendsDividends payable Ordinary share capital Longterm loan: Rand Bank Creditors control South African Revenue Services: Company tax payable Debtors control Bank credit balance Vehicles Inventory NOTE The above balances include the following: The first and second provisional company tax payments were R and R respectively. The interim and final dividends amounted to R and R respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock