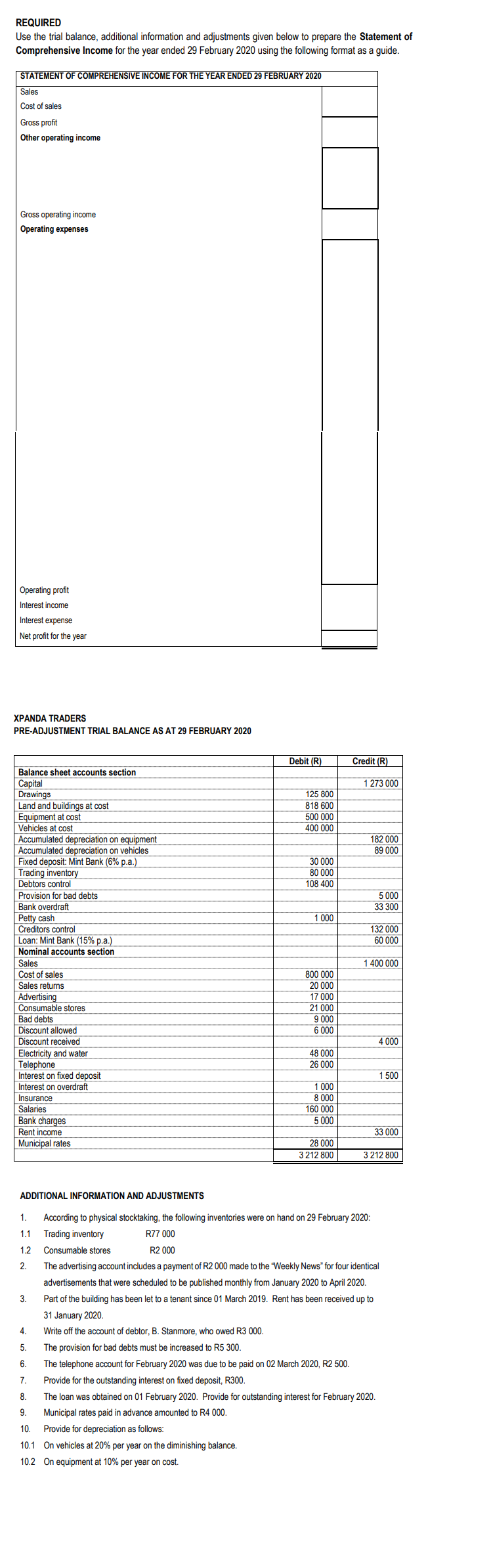

Question: REQUIRED Use the trial balance, additional information and adjustments given below to prepare the Statement of Comprehensive Income for the year ended 29 February 2020

REQUIRED Use the trial balance, additional information and adjustments given below to prepare the Statement of Comprehensive Income for the year ended 29 February 2020 using the following format as a guide. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 29 FEBRUARY 2020 Sales Cost of sales Gross profit Other operating income Gross operating income Operating expenses Operating profit Interest income Interest expense Net profit for the year XPANDA TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 29 FEBRUARY 2020 Debit (R) Credit (R) 1 273 000 125 800 818 600 500 000 400 000 182 000 89 000 30 000 80 000 108 400 5 000 33 300 1 000 132 000 60 000 Balance sheet accounts section Capital Drawings Land and buildings at cost Equipment at cost Vehicles at cost Accumulated depreciation on equipment Accumulated depreciation on vehicles Fixed deposit: Mint Bank (6% p.a.) Trading inventory Debtors control Provision for bad debts Bank overdraft Petty cash Creditors control Loan: Mint Bank (15% p.a.) Nominal accounts section Sales Cost of sales Sales returns Advertising Consumable stores Bad debts Discount allowed Discount received Electricity and water Telephone Interest on fixed deposit Interest on overdraft Insurance Salaries Bank charges Rent income Municipal rates 1 400 000 800 000 20 000 17 000 21 000 9 000 6 000 4000 48 000 26 000 1 500 1 000 8 000 160 000 5 000 33 000 28 000 3 212 800 3212 800 ADDITIONAL INFORMATION AND ADJUSTMENTS 1. According to physical stocktaking, the following inventories were on hand on 29 February 2020: 1.1 Trading inventory R77 000 1.2 Consumable stores R2 000 2. The advertising account includes a payment of R2 000 made to the Weekly News for four identical advertisements that were scheduled to be published monthly from January 2020 to April 2020. 3. Part of the building has been letto a tenant since 01 March 2019. Rent has been received up to 31 January 2020. 4. Write off the account of debtor, B. Stanmore, who owed R3 000 5. The provision for bad debts must be increased to R5 300. 6. The telephone account for February 2020 was due to be paid on 02 March 2020, R2 500. 7. Provide for the outstanding interest on fixed deposit, R300. 8. The loan was obtained on 01 February 2020. Provide for outstanding interest for February 2020. 9. Municipal rates paid in advance amounted to R4 000 10 Provide for depreciation as follows: 10.1 On vehicles at 20% per year on the diminishing balance. 10.2 On equipment at 10% per year on cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts