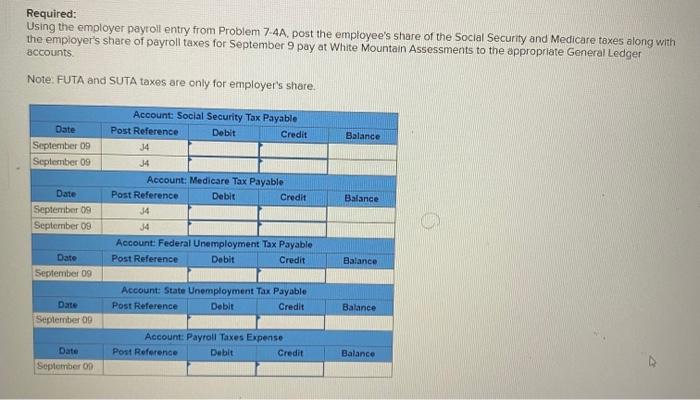

Question: Required: Using the employer payroll entry from Problem 7-4A, post the employee's share of the Social Security and Medicare taxes along with the employer's

Required: Using the employer payroll entry from Problem 7-4A, post the employee's share of the Social Security and Medicare taxes along with the employer's share of payroll taxes for September 9 pay at White Mountain Assessments to the appropriate General Ledger accounts. Note: FUTA and SUTA taxes are only for employer's share. Account: Social Security Tax Payable Date Post Reference September 09 34 September 09 34 Date September 09 Post Reference 34 September 09 34 Date September 09 Debit Account: Medicare Tax Payable Debit Credit Balance Credit Balance Account: Federal Unemployment Tax Payable Post Reference Debit Credit Balance Date September 09 Account: State Unemployment Tax Payable Post Reference Debit Credit Balance Account: Payroll Taxes Expense Date September 09 Post Reference Debit Credit Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts