Question: Required: Using the plantwide allocation method, calculate the total cost for each product. (Hint: Product costs for this company include overhead and direct labor.) Using

Required:

- Using the plantwide allocation method, calculate the total cost for each product. (Hint: Product costs for this company include overhead and direct labor.)

- Using the plantwide approach, calculate the profit for each product. Also calculate profit as a percent of sales revenue for each product (round to the nearest tenth of a percent).

- Using activity-based costing, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity-based costing process have already been done for you; this is step 4.) Round results to the nearest cent.

- Using activity-based costing, calculate the amount of overhead assigned to each product. (Hint: This is step 5 in the activity-based costing process.)

- Using activity-based costing, calculate the profit for each product. Also calculate profit as a percent of sales revenue for each product (round to the nearest tenth of a percent).

- What caused the shift of overhead costs to the residential product using activity-based costing? How might management use this information to make improvements within the company?

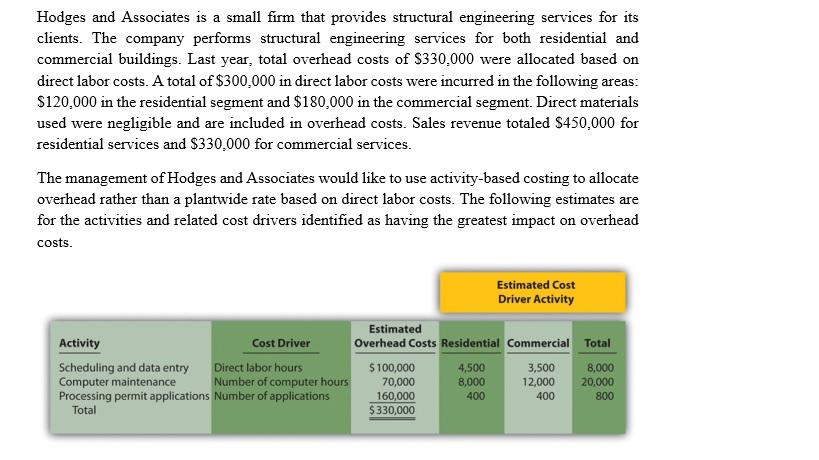

Hodges and Associates is a small firm that provides structural engineering services for its clients. The company performs structural engineering services for both residential and commercial buildings. Last year, total overhead costs of $330.000 were allocated based on direct labor costs. A total of $300,000 in direct labor costs were incurred in the following areas: $120,000 in the residential segment and $180,000 in the commercial segment. Direct materials used were negligible and are included in overhead costs. Sales revenue totaled $450,000 for residential services and $330,000 for commercial services. The management of Hodges and Associates would like to use activity-based costing to allocate overhead rather than a plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs. Estimated Cost Driver Activity Estimated Activity Cost Driver Overhead Costs Residential Commercial Total Scheduling and data entry Direct labor hours $100,000 4,500 3,500 8,000 Computer maintenance Number of computer hours 70,000 8,000 12,000 20,000 Processing permit applications Number of applications 160,000 400 400 800 Total $330,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts