Question: Required Why is the beta calculated in problem 3(d) different than the betas you calculated in problems 1(f) and 2 (d)? ( 1 mark) Beta

Required

- Why is the beta calculated in problem 3(d) different than the betas you calculated in problems 1(f) and 2 (d)? (1 mark)

Beta 1 f = 1.096 beta 2 d = 1.1

b. What is the market value of the firm if the firm issues $7,000,000 in debt? (5 marks)

c. What would be the PV of financial distress costs if the firm issues $7,000,000 in debt? (2 marks)

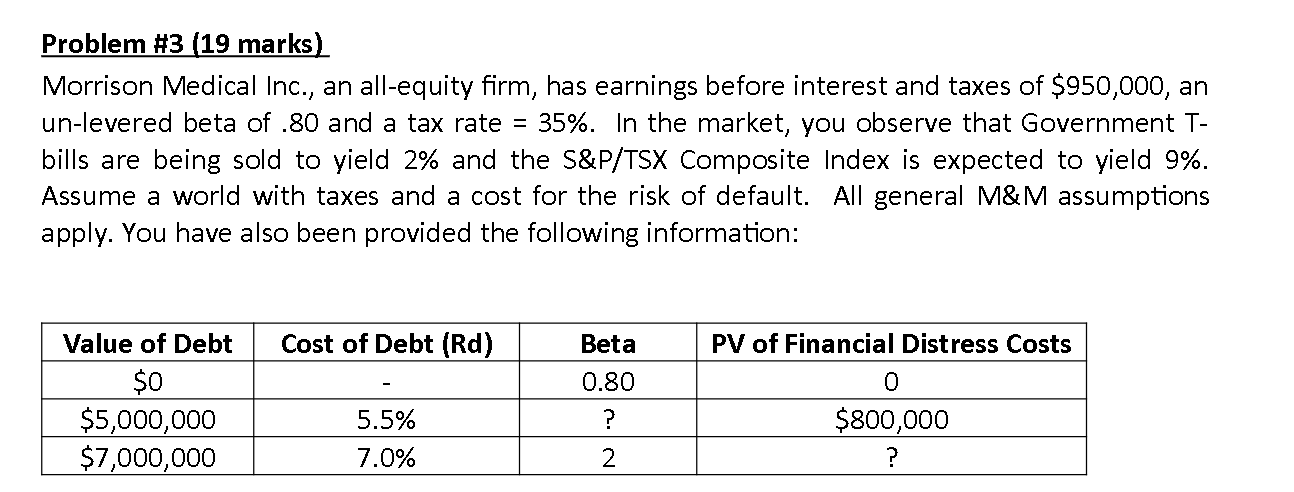

Problem #3 (19 marks) Morrison Medical Inc., an all-equity firm, has earnings before interest and taxes of $950,000, an un-levered beta of .80 and a tax rate = 35%. In the market, you observe that Government T- bills are being sold to yield 2% and the S&P/TSX Composite Index is expected to yield 9%. Assume a world with taxes and a cost for the risk of default. All general M&M assumptions apply. You have also been provided the following information: Cost of Debt (Rd) Beta 0.80 Value of Debt $0 $5,000,000 $7,000,000 PV of Financial Distress Costs 0 $800,000 ? ? 5.5% 7.0% 2 Problem #3 (19 marks) Morrison Medical Inc., an all-equity firm, has earnings before interest and taxes of $950,000, an un-levered beta of .80 and a tax rate = 35%. In the market, you observe that Government T- bills are being sold to yield 2% and the S&P/TSX Composite Index is expected to yield 9%. Assume a world with taxes and a cost for the risk of default. All general M&M assumptions apply. You have also been provided the following information: Cost of Debt (Rd) Beta 0.80 Value of Debt $0 $5,000,000 $7,000,000 PV of Financial Distress Costs 0 $800,000 ? ? 5.5% 7.0% 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts