Question: Required Write the company's accounting equation and label each element as a debit amount or a credit amount. If you use $ 2 8 ,

Required

Write the company's accounting equation and label each element as a debit amount or a

credit amount. If you use $ for the owner's equity, why is the accounting equation out

of balance?

Write the equation to compute Wawa Cottage Management Service's net income or net loss

for March Indicate which element is a debit amount and which element is a credit

amount. Does net income represent a net debit or a net credit? Does net loss represent a net

debit or a net credit?

How much did the owner, Lenni Champlain, withdraw during March Did the

withdrawal represent a debit amount or a credit amount?

Considering both the net income or net loss and withdrawal for March by how much

did the company's owner's equity increase or decrease? Was the change in owner's equity a

debit amount or a credit amount?

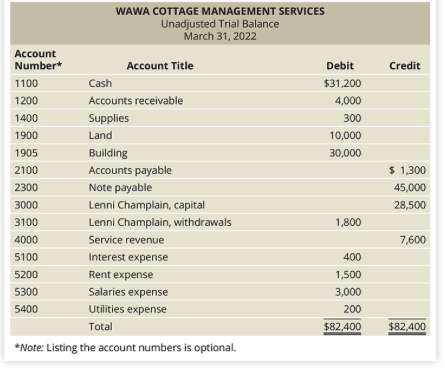

The unadjusted trial balance of Wawa Cottage Management Services on March

lists the company's assets, liabilities, and owner's equity on that date.

During March the business engaged in the following transactions:

Mar. Borrowed $ from the bank and signed a note payable in the name of the

business.

Paid cash of $ to a real estate company to acquire land worth $

and a building worth $ just north of the town of Wawa. Use a compound

journal entry to record this transaction.

Performed services for a customer and received cash of $

Purchased supplies on account, $

Performed services for a customer and earned revenue on account, $

Paid $ of the Accounts Payable balance shown on the March unadjusted trial balance.

Paid the following cash expenses: salaries, $; rent, $; and interest, $

Received $ of the Accounts Receivable balance shown on the March trial balance.

Received a $ utility bill that will be paid next week.

Lenni Champlain withdrew $ for personal use.

begintabularcccc

hline multicolumncbegintabularl

WAWA COTTAGE MANAGEMENT SERVICES

Unadjusted Trial Balance March

endtabular

hline begintabularl

Account

Number

endtabular & Account Title & Debit & Credit

hline & Cash & $ &

hline & Accounts receivable & &

hline & Supplies & &

hline & Land & &

hline & Building & &

hline & Accounts payable & & $

hline & Note payable & &

hline & Lenni Champlain, capital & &

hline & Lenni Champlain, withdrawals & &

hline & Service revenue & &

hline & Interest expense & &

hline & Rent expense & &

hline & Salaries expense & &

hline & Utilities expense & &

hline & Total & $ & $

hline

endtabular

Note: Listing the account numbers is optional.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock