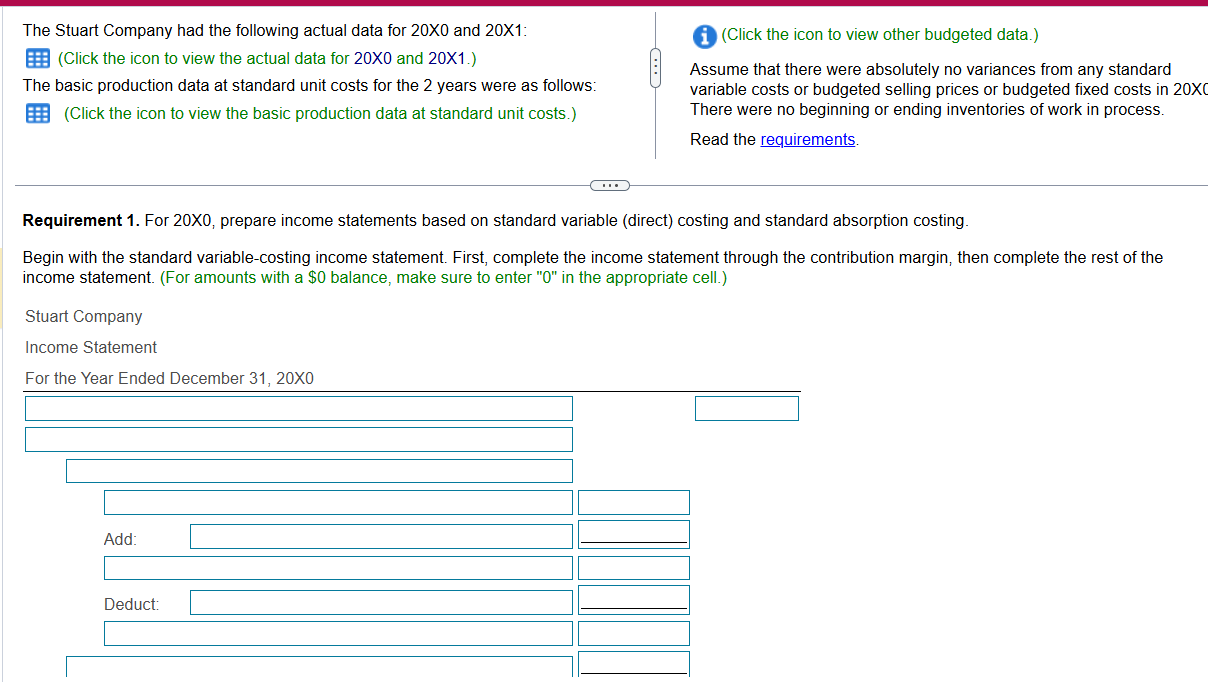

Question: Requirement 1 . For 2 0 X 0 , prepare income statements based on standard variable ( direct ) costing and standard absorption costing. Begin

Requirement For X prepare income statements based on standard variable direct costing and standard absorption costing.

Begin with the standard variablecosting income statement. First, complete the income statement through the contribution margin, then complete the rest of the income statement. For amounts with a $ balance, make sure to enter in the appropriate cell.

Stuart Company

Income Statement

For the Year Ended December X

Add:

Deduct: Operating income

Now prepare the standard absorptioncosting income statement. First, complete the income statement through the gross profit, at standard, then complete the rest of the income statement. For amounts with a $ balance, make sure to enter in the appropriate cell.

Stuart Company

Income Statement

For the Year Ended December X

Add:

Deduct:

Requirement Explain why operating income differs between variable costing and absorption costing. Be specific.

When inventories increase, operating income will be higher under

If inventories decrease, operating income will be higher under

Determine the formula, then compute the difference.

x Difference

x

Data table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock