Question: brightspace.cuny.edu Intermediate Accounting Final - Spring 2 . . . 0 : 0 4 : 3 9 remaining Question 2 8 ( ? ? ?

brightspace.cuny.edu

Intermediate Accounting Final Spring

:: remaining

Question points

Saved

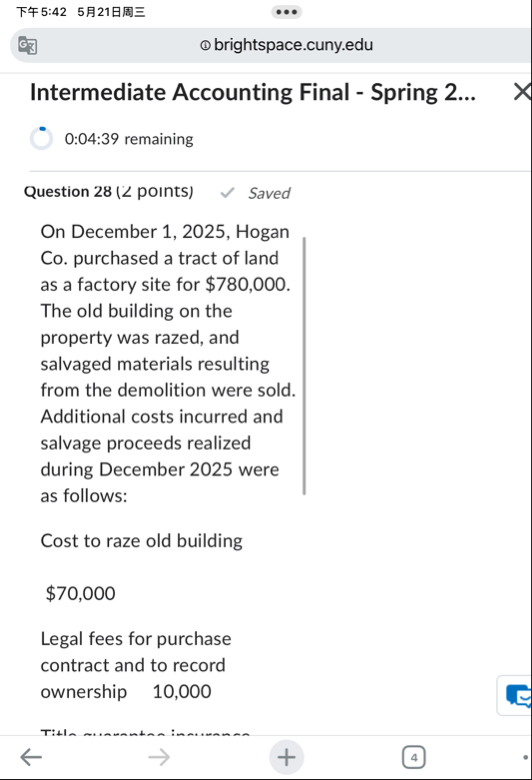

On December Hogan Co purchased a tract of land as a factory site for $ The old building on the property was razed, and salvaged materials resulting from the demolition were sold. Additional costs incurred and salvage proceeds realized during December were as follows:

Cost to raze old building

$

Legal fees for purchase contract and to record ownership

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock