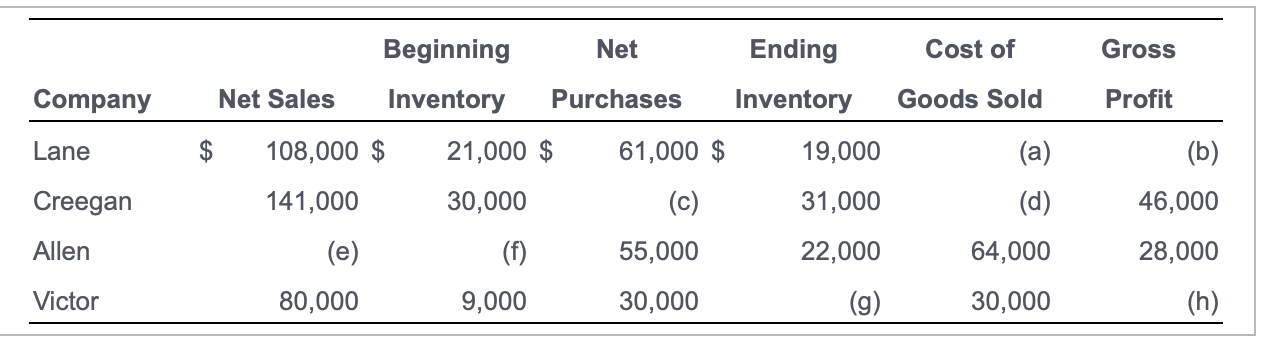

Question: Requirement 1. Supply the missing income statement amounts for each of the companies. Requirement 2. Prepare the income statement for Lane Company for the year

Requirement 1. Supply the missing income statement amounts for each of the companies.

Requirement 2. Prepare the income statement for Lane Company for the year ended Dec 31, 2018. Use the cost of goods sold model to compute cost of goods sold. Lanes operating and other expenses and other expenses for the year were $40,000. Ignore income tax

| 1. |

|

Beginning Net Ending Cost of Gross Company Net Sales Inventory Purchases Inventory Goods Sold Profit Lane $ 108,000 $ 21,000 $ 61,000 $ 19,000 (a) (b) Creegan 141,000 30,000 (c) 31,000 (d) 46,000 Allen 55,000 22,000 64,000 28,000 (e) 80,000 (f) 9,000 Victor 30,000 (g) 30,000 (h)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts