Question: Requirement For each scenario, indicate the amount that must be included in the taxpayer's gross income. a . Larry was given a $ 1 ,

Requirement

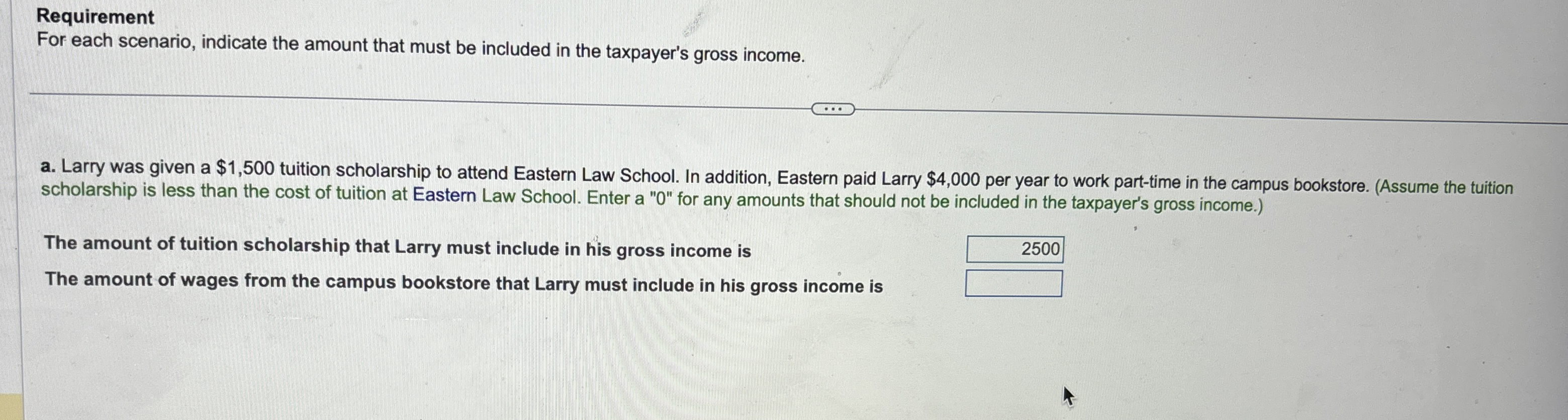

For each scenario, indicate the amount that must be included in the taxpayer's gross income.

a Larry was given a $ tuition scholarship to attend Eastern Law School. In addition, Eastern paid Larry $ per year to work parttime in the campus bookstore. Assume the tuition

scholarship is less than the cost of tuition at Eastern Law School. Enter a for any amounts that should not be included in the taxpayer's gross income.

The amount of tuition scholarship that Larry must include in his gross income is

The amount of wages from the campus bookstore that Larry must include in his gross income is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock