Question: Requirement For each scenario, indicate the amount that must be included in the taxpayer's gross income. a. Larry was given a $1,500 tuition scholarship to

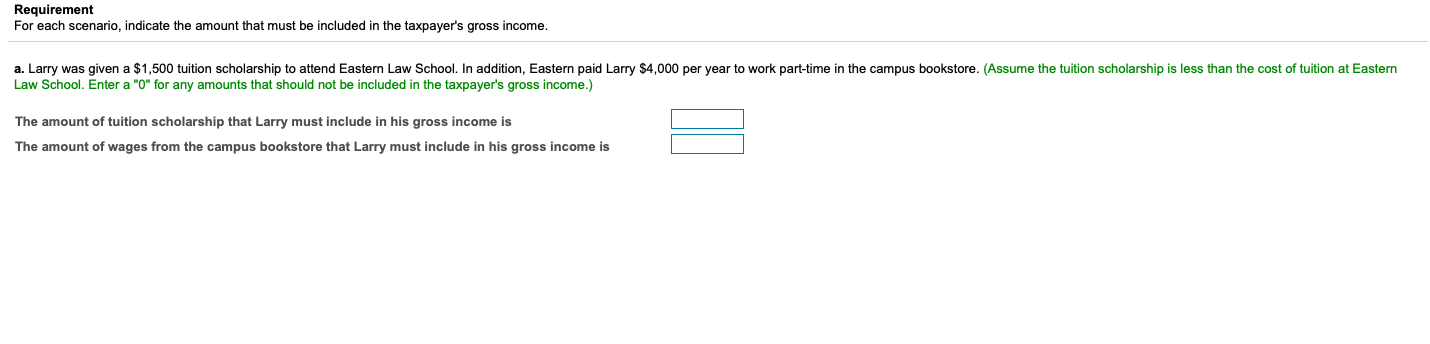

Requirement For each scenario, indicate the amount that must be included in the taxpayer's gross income. a. Larry was given a $1,500 tuition scholarship to attend Eastern Law School. In addition, Eastern paid Larry $4,000 per year to work part-time in the campus bookstore.(Assume the tuition scholarship is less than the cost of tuition at Eastern Law School. Enter a "0" for any amounts that should not be included in the taxpayer's gross income.) The amount of tuition scholarship that Larry must include in his gross income is The amount of wages from the campus bookstore that Larry must include in his gross income is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock