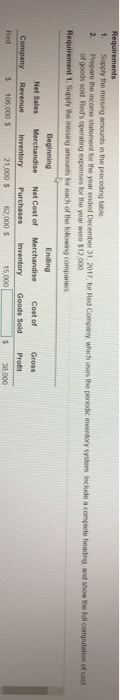

Question: Requirements 1. Supply the missing amounts in the preceding table 2. Prepare the income statement for the year onded December 31, 2017 for Red Company

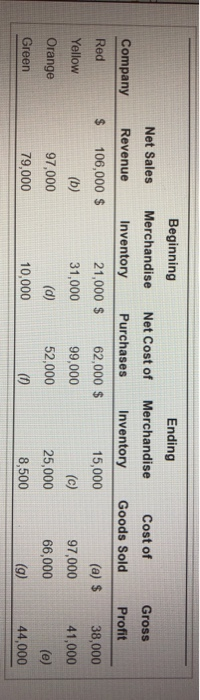

Requirements 1. Supply the missing amounts in the preceding table 2. Prepare the income statement for the year onded December 31, 2017 for Red Company which uses the periodic inventory system include a complete heading and show the full computation of cost of goods so Rod's operating expenses for the year were $12.000 Requirement 1. Supply the missing amounts for each of the following companies Beginning Ending Net Sales Merchandise Net Cost of Merchandise Cost of Revenue Inventory Purchases Inventory Goods Sold $ 100,000 $ 21.000 $ 62,000 $ 15.000 L Company Red Gross Profit 38,000 $ Cost of Goods Sold Gross Profit Company Red Beginning Ending Net Sales Merchandise Net Cost of Merchandise Revenue Inventory Purchases Inventory $ 106,000 $ 21,000 $ 62,000 $ 15,000 (b) 31,000 99,000 97,000 52,000 25,000 79,000 10,000 8,500 38,000 41,000 Yellow (a) $ 97,000 66,000 (c) Orange (e) Green (g) 44,000 Requirements 1. Supply the missing amounts in the preceding table 2. Prepare the income statement for the year onded December 31, 2017 for Red Company which uses the periodic inventory system include a complete heading and show the full computation of cost of goods so Rod's operating expenses for the year were $12.000 Requirement 1. Supply the missing amounts for each of the following companies Beginning Ending Net Sales Merchandise Net Cost of Merchandise Cost of Revenue Inventory Purchases Inventory Goods Sold $ 100,000 $ 21.000 $ 62,000 $ 15.000 L Company Red Gross Profit 38,000 $ Cost of Goods Sold Gross Profit Company Red Beginning Ending Net Sales Merchandise Net Cost of Merchandise Revenue Inventory Purchases Inventory $ 106,000 $ 21,000 $ 62,000 $ 15,000 (b) 31,000 99,000 97,000 52,000 25,000 79,000 10,000 8,500 38,000 41,000 Yellow (a) $ 97,000 66,000 (c) Orange (e) Green (g) 44,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts