Question: Requirements (Use a financial calculator for any present value computations and round your final answers to the nearest dollar. Record debits first, then credits. Explanations

Requirements (Use a financial calculator for any present value computations and round your final answers to the nearest dollar. Record debits first, then credits. Explanations are not required.)

| a. | Prepare journal entries to record: | |

| i. | the sale and retirement of the bonds in scenario 1; | |

| ii. | the sale of the bonds in scenario 2 and payment of interest on December 31, 2018; and | |

| iii. | the sale of the bonds in scenario 3. | |

| b. | Prepare a schedule of interest expense and bond amortization during the life of the bond in scenario 3. | |

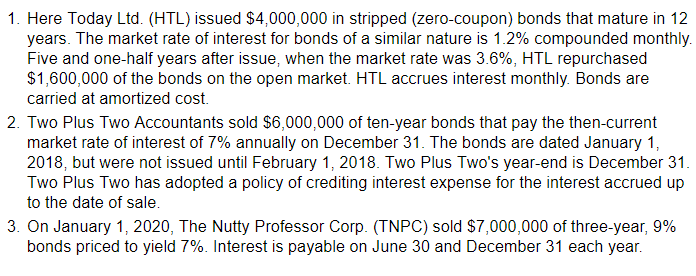

1. Here Today Ltd. (HTL) issued $4,000,000 in stripped (zero-coupon) bonds that mature in 12 years. The market rate of interest for bonds of a similar nature is 1.2% compounded monthly. Five and one-half years after issue, when the market rate was 3.6%, HTL repurchased $1,600,000 of the bonds on the open market. HTL accrues interest monthly. Bonds are carried at amortized cost. 2. Two Plus Two Accountants sold $6,000,000 of ten-year bonds that pay the then-current market rate of interest of 7% annually on December 31. The bonds are dated January 1, 2018, but were not issued until February 1, 2018. Two Plus Two's year-end is December 31. Two Plus Two has adopted a policy of crediting interest expense for the interest accrued up to the date of sale. 3. On January 1, 2020, The Nutty Professor Corp. (TNPC) sold $7,000,000 of three-year, 9% bonds priced to yield 7%. Interest is payable on June 30 and December 31 each year. 1. Here Today Ltd. (HTL) issued $4,000,000 in stripped (zero-coupon) bonds that mature in 12 years. The market rate of interest for bonds of a similar nature is 1.2% compounded monthly. Five and one-half years after issue, when the market rate was 3.6%, HTL repurchased $1,600,000 of the bonds on the open market. HTL accrues interest monthly. Bonds are carried at amortized cost. 2. Two Plus Two Accountants sold $6,000,000 of ten-year bonds that pay the then-current market rate of interest of 7% annually on December 31. The bonds are dated January 1, 2018, but were not issued until February 1, 2018. Two Plus Two's year-end is December 31. Two Plus Two has adopted a policy of crediting interest expense for the interest accrued up to the date of sale. 3. On January 1, 2020, The Nutty Professor Corp. (TNPC) sold $7,000,000 of three-year, 9% bonds priced to yield 7%. Interest is payable on June 30 and December 31 each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts