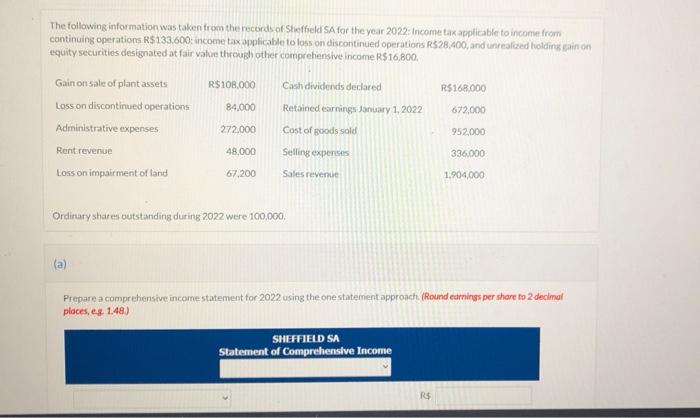

Question: requirments: a: Prepare a comprehensive income statment for 2022 using the one statement approach b: Prepare a retained earnings statement for 2022 The following information

The following information was taken from the records of Sheffield SA for the year 2022: Income tax applicable to income from continuing operations R$133.600 income tax applicable to loss on discontinued operations R$28.400, and unrealized holding in on equity securities designated at fair value through other comprehensive income R$ 16,800. Gain on sale of plant assets R$ 100.000 Cash dividends declared R$168,000 Loss on discontinued operations 84,000 Retained earnings January 1, 2022 672,000 Administrative expenses 272,000 Cost of goods sold 952.000 Rent revenue 48,000 Selling expenses 336.000 Loss on impairment of land 67,200 Sales revenue 1,904,000 Ordinary shares outstanding during 2022 were 100,000, (a) Prepare a comprehensive income statement for 2022 using the one statement approach (Round earnings per share to 2 decimal places, es 1.48) SHEFFIELD SA Statement of Comprehensive Income R$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts