Question: Research the history of the company and write (250-500) words about the companys background. Dice manufacturing company: the acquisition decision Aliaa Bassiouny, Enjy Toma, Farida

- Research the history of the company and write (250-500) words about the companys background.

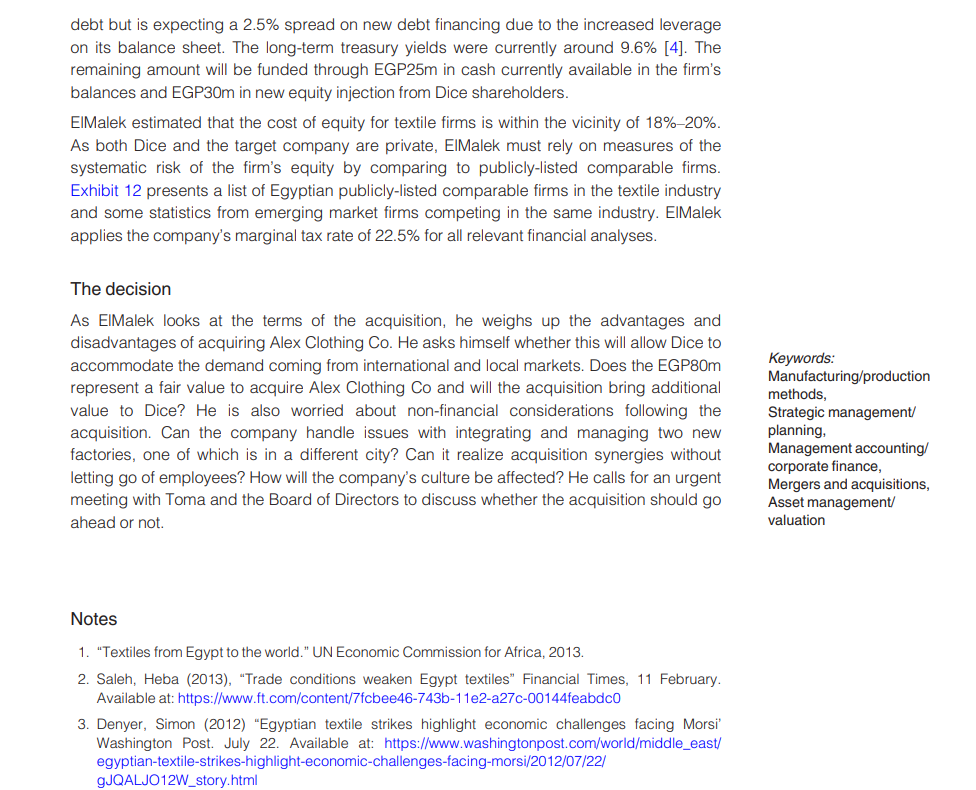

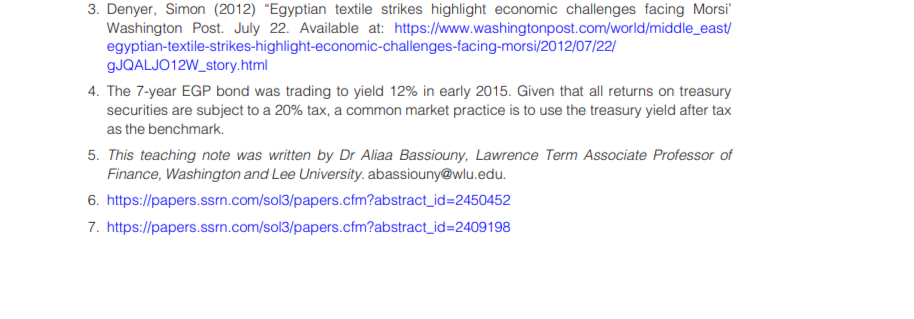

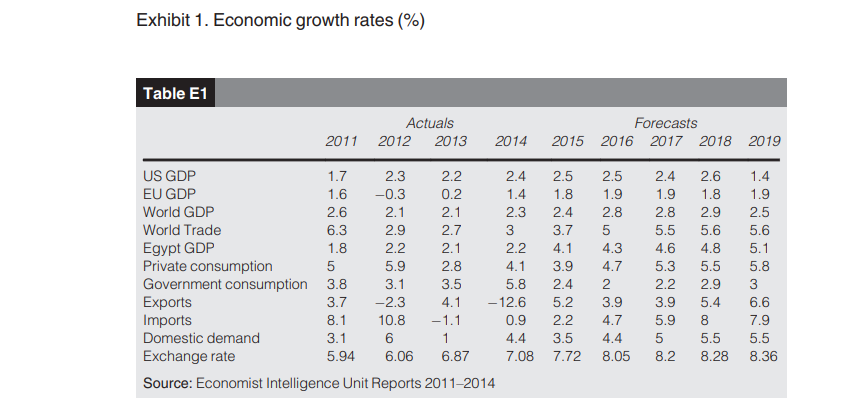

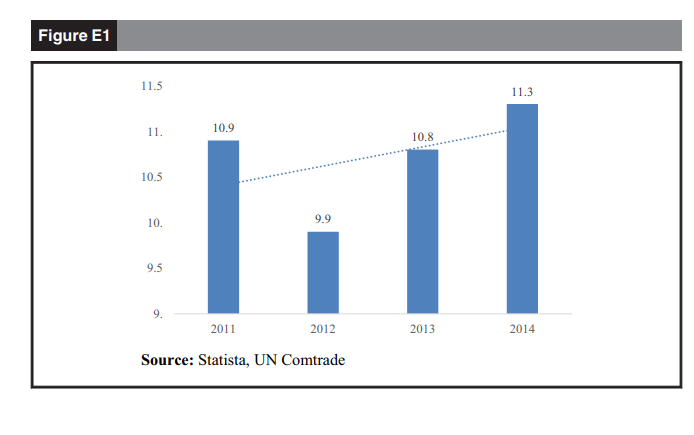

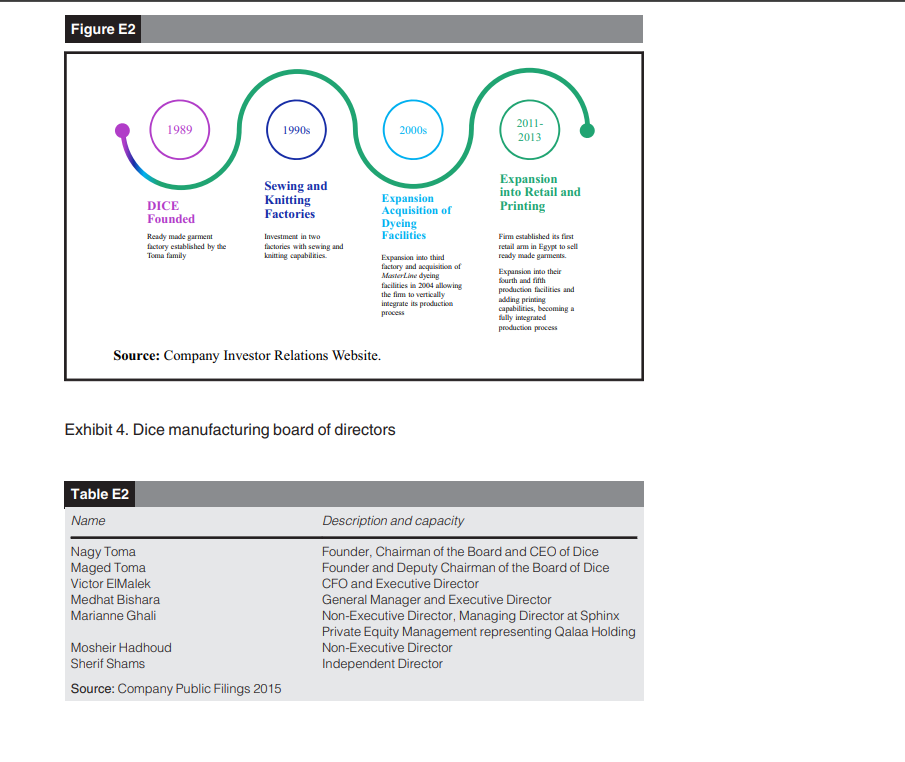

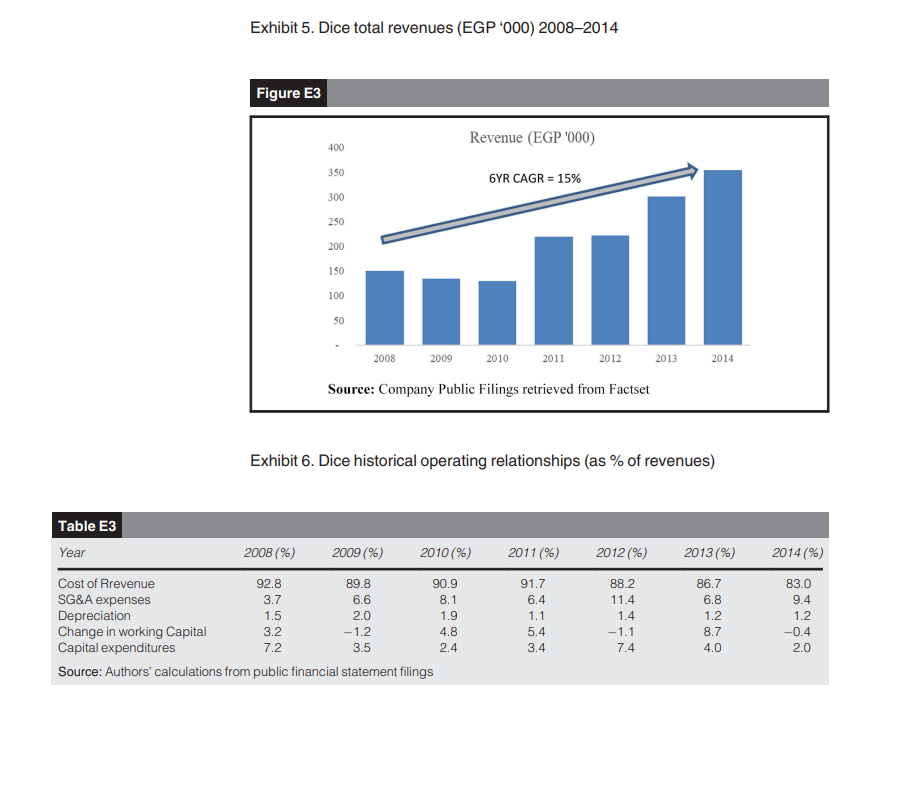

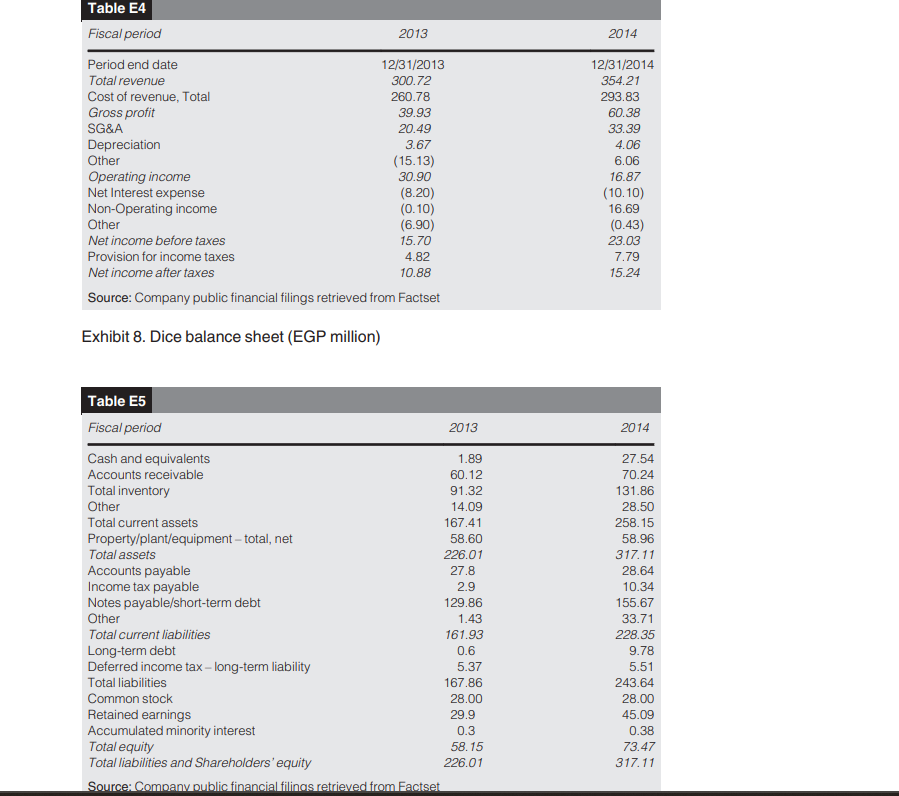

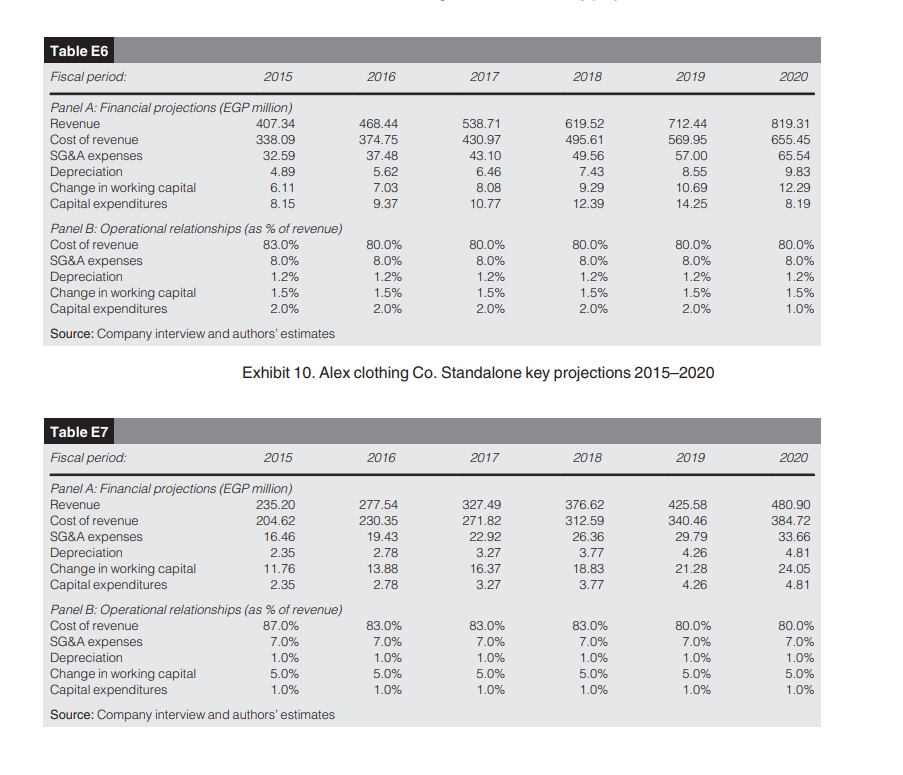

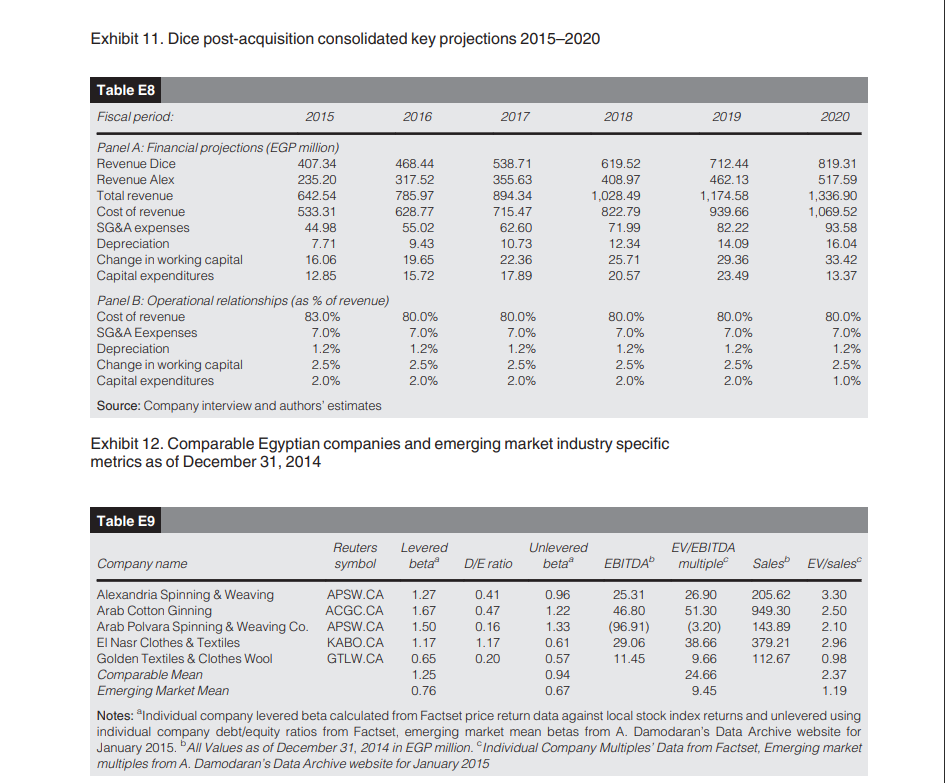

Dice manufacturing company: the acquisition decision Aliaa Bassiouny, Enjy Toma, Farida Dawood, Haneen Aljammali, Salim Seif El Nasr and Youssef Mohy El Din n early January 2015, Mr Nagy Toma, CEO of Dice Manufacturing Company, was sitting in his office in a quiet neighborhood of the vibrant Egyptian capital of Cairo, thinking about the future of the textile company he started with his family a little over 25 years ago. Toma was proud of the milestones that the firm achieved and their agile business model but worried about the best way to grow the company in the future. Prior to 2011, Dice followed an exclusively export-oriented model that relied on fulfilling order contracts from international clothing brands, growing organically to become among the largest garment exporters in the Egyptian market. The January 2011 Egyptian revolution suddenly threatened the company's successful business model. Factory closures from the political unrest and an inability to secure much needed imported raw material inputs due to currency shortages resulted in supply chain interruptions that ultimately lead to the loss of most of their international contracts. While several well-established medium-sized businesses were forced to close, Dice was quick to adjust its model by shifting to locally sourced raw materials and using this as an opportunity to re-channel their production to successfully tap into the local market. The stabilization of the Egyptian economy in recent months, however, saw the return of the international demand for the company's products alongside the strong local demand that the firm established over the past period. Dice is now facing an interesting growth dilemma unlike many of their peers. At a time when various businesses are wary of the future of the Egyptian economy and hesitant to invest, Toma thinks that this is the right time to quickly expand to capture local and international Aliaa Bassiouny, Enjy Toma, Farida Dawood, Haneen aljammali, Salim Seif El Nasr and Youssef Mohy El Din are all based at The American University in Cairo, Cairo, Egypt. Prior to 2011, Dice followed an exclusively export-oriented model that relied on fulfilling order contracts from international clothing brands, growing organically to become among the largest garment exporters in the Egyptian market. The January 2011 Egyptian revolution suddenly threatened the company's successful business model. Factory closures from the political unrest and an inability to secure much needed imported raw material inputs due to currency shortages resulted in supply chain interruptions that ultimately lead to the loss of most of their international contracts. While several well-established medium-sized businesses were forced to close, Dice was quick to adjust its model by shifting to locally sourced raw materials and using this as an opportunity to re-channel their production to successfully tap into the local market. The stabilization of the Egyptian economy in recent months, however, saw the return of the international demand for the company's products alongside the strong local demand that the firm established over the past period. Dice is now facing an interesting growth dilemma unlike many of their peers. At a time when various businesses are wary of the future of the Egyptian economy and hesitant to invest, Toma thinks that this is the right time to quickly expand to capture local and international market share. Given that timing is key, this can only be achieved through acquisitions. Toma calls on Victor ElMalek, Dice's chief financial officer (CFO), to propose the acquisition of Alex Clothing Co., and its subsidiary United Dyers. Toma believes the firm is at a crossroads. He hopes that EIMalek will be able to advise him on a fair value for the acquisition and evaluate whether this acquisition will be a good strategic fit to Dice. Egyptian economic and textile industry overview The Egyptian economy grew at a meager 2\% annually between 2011 and 2014. Exports of Egyptian goods and services were negatively affected not only by disruptions to manufacturing from the political unrest following the January 2011 revolution but also slow global economic activity. This was augmented by loss of tourism income and declining Suez Canal revenues which put a strain on domestic foreign reserves and lead to an economic crisis and severe currency shortages. The election of President Sisi in 2013, combined with aid from the Gulf, contributed to increased confidence and was reflected in higher private and government consumption in 2014. Exhibit 1 summarizes actual and forecast economic growth indicators. University in Cairo, Cairo, Egypt. Disclaimer. This case is written solely for educational purposes and is not intended to represent successful or unsuccessful managerial decision-making. The authors may have disguised names; financial and other recognizable information to protect confidentiality. The textile industry is considered one of the oldest and most important economic sectors, employing over 1 million Egyptians. During the period 2005-2010, the textile industry represented around 3% of gross domestic product (GDP) and a major generator of export revenue, contributing to about 10% of total export revenue. Prior to the 2011 uprising, Egyptian textile firms exported close to $1bn worth of goods to the USA, benefiting from the qualifying industrial zone system and to the European Union following the 2005 euro Mediterranean Partnership Agreement that provided Egyptian textile products duty- and quota-free entry. Although the sector is predominantly state-owned, private-sector companies have a strong presence and cater to licensing contracts to produce top international brands [1]. The deterioration of the overall business environment in Egypt after the 2011 revolution deeply impacted the textile industry, which within a year of the political upheaval lost around 10% of their export revenue as a result of the political and economic crisis. Exhibit 2 summarizes the value of exports of Egyptian textile between 2011 and 2014. Although the depreciation of the Egyptian pound between 2012 and 2013 slightly benefited the industry by increasing the competitiveness of Egyptian textile exports, the reliance on import components dampened this effect [2]. Several of the large Egyptian textile manufacturers had to scale back on their expansions in a couple of years directly following the revolution, but forecasts for overall economic activity for 2015 and beyond, including the textile industry, show improvements with recovery in domestic and global demand. Further depreciation of the Egyptian pound and reduced reliance on imported inputs by textile producers is expected to benefit the industry by boosting textile exports which is forecasted to grow between 15%20% in 2015 . Dice manufacturing company: an overview Background Dice Sports and Casual Wear Manufacturing Societe Anonyme Egyptienne (French: Egyptian Joint Stock Company) commonly referred to as Dice Manufacturing Company is an Egyptian family-run business that was established by brothers Maged and Nagy Toma in 1989 with a core business of producing readymade garments for men, women and children. The company positioned itself in a unique niche in the Egyptian textile market by distinguishing itself for top-quality production, workmanship and management. This was possible as most of the company's competitors were nationalized companies focusing on core non-value-adding operations and targeting the local market. This allowed Dice to focus Dice manufacturing company: an overview Background Dice Sports and Casual Wear Manufacturing Societe Anonyme Egyptienne (French: Egyptian Joint Stock Company) commonly referred to as Dice Manufacturing Company is an Egyptian family-run business that was established by brothers Maged and Nagy Toma in 1989 with a core business of producing readymade garments for men, women and children. The company positioned itself in a unique niche in the Egyptian textile market by distinguishing itself for top-quality production, workmanship and management. This was possible as most of the company's competitors were nationalized companies focusing on core non-value-adding operations and targeting the local market. This allowed Dice to focus exclusively on export-oriented production to international and worldwide brands such as Benetton, Nautica, Calvin Klein, Otto, Bon Prix and Auchon, among other top brands. To cater to this growing international demand, the company expanded over the years to own four manufacturing plants located in the northern border of Cairo, with the management and administrative offices located in the largest plant facility. The company also expanded vertically and currently relies on a fully vertically integrated business model, with operations including knitting, dyeing, printing, cutting, embroidery, sewing, ironing and packaging, giving the firm full control over the value chain. Exhibit 3 provides a timeline of the company's history. Ownership and governance Dice is majority-owned by the Toma family, who by early 2015 , held a 70% ownership stake of the company and its subsidiaries with the remaining 30% owned by Qalaa Holdings, one of the largest investment companies in Africa and the Middle East. Qalaa, which invests in core high-growth businesses in the region, saw potential in Dice's business model and purchased an equity stake from Tomas in 2008, which is indirectly held through Sphinx Private Equity Management. Nagy Toma is the CEO of the company and the Chairman of its Board having been one of the founders and involved in the establishment and day-to-day operations of the business since 1989, with his brother and co-founder Maged Toma as deputy chairman of the board. Victor EIMalek who has been the company's CFO since July 2008 is also an executive board member. ElMalek, a certified public accountant with extensive financial management experience in the manufacturing industry, has been key in facilitating and negotiating to finance for its expansions over the years. Other members of the board of directors, outlined in Exhibit 4, include independent board members and other non-executive business and finance professionals representing Qalaa's stake in the business. Milestones following the 2011 Egyptian revolution The January 2011 revolution, which was accompanied by an extended period of economic and political instability, affected the company's operations and necessitated a change in its overall export-oriented strategy. International companies were afraid to deal with Egyptian companies because of the risk of interrupted order deliveries due to political disruptions and factory closures instigated by labor unrest and strikes that started after the 2011 revolution and continued into 2012, especially in the textile industry [3]. Another important aspect of the operational risk also stemmed from the fact that Dice relied on importing some raw materials from countries such as India and Turkey, which involved the risk of being unable to receive raw material on time to keep up with international orders. This was further aggravated due to a severe currency crisis with a reduction in foreign reserves and currency restrictions on withdrawals, which made it very difficult for local companies to secure foreign currencies to fund their purchase orders for imported raw materials. This led to a loss in export contracts that had been the core of Dice's business activity. Dice's management team was quick to adjust the business model to replace the lost international sales by channeling production locally. They created a local brand, Dice Underwear, to diversify its production and sell its products to Egyptian Consumers, therefore hedging its revenues against any future operational disruptions due to political or economic instability. The brand, which was locally designed and produced, was distributed in 80 shops around Egypt throughout 2011 and marked as 100\% Egyptian made and designed for the whole Egyptian family. The brand was successful in attracting Egyptian consumers, who have been hit by shortages in imports and have shifted their purchases to locally produced brands. Dice manufacturing company: expansion strategy Dice's agility to direct production capacity that was aimed at international clients to local consumers resulted in making up the loss of export contracts and achieve revenue growth of over 70% in 2011 (Exhibit 5). The firm generated a consistent revenue stream in 2012, not because of waning demand on their products, but rather due to production capacity limits. Throughout 2012, the firm took various measures to grow their business. The firm invested in an organic expansion of their existing production capacity by increasing their capital expenditures to 7% of revenue (Exhibit 6). Concurrently, the firm managed to capitalize on the creation and aggressive marketing of their own brand name to move across the value chain and sell their products locally at higher price points to generic products in the market. These measures combined with a reduction of production costs by shifting to more locally sourced raw materials, resulted in drastic improvements in the company's gross margins and reducing their cost of revenue from as high as 92% in 2008 to 83% in 2014. The firm has also taken measures to improve their overall operational cash cycle and working capital management systems which they expect to be beneficial in optimizing investments in working capital in the future. Such efforts were timely, and the firm managed to increase revenue by around 36% in 2013 . Between 2013 and 2014, not only did the Egyptian economy start to slowly rebound but also VOL.11NO.12021EMERALDEMERGINGMARKETSCASESTUDIESPAGE3 the company started to regain the international demand for its products. In addition to serving the local demand through its own new brand, Dice Underwear, the firm had to fulfill international orders. During 2014, the company's factories were used beyond full capacity. While the firm managed to increase revenue by 18% between 2013 and 2014 , the revenue growth potential was much higher. Exhibits 7 and 8 provide Dice's income statement and balance sheet for 2013 and 2014 The firm realized that organic expansion of production capacity can only sustain limited growth. ElMalek has prepared some operational forecasts for Dice for the next six years, Exhibit 9 , based on the firm's ability to grow similar to the historical compound annual growth rate. While the forecasts look promising, Toma believes it overlooks a significant growth potential. As a result, Dice must ensure that it follows an aggressive but costefficient expansion strategy to compete globally by reclaiming its export income while growing its local business. To do this, Toma and ElMalek are discussing the merits of an inorganic growth strategy through acquisitions. While organic growth might have worked for the firm in the past, the timeliness of the expansion is key to a successful growth strategy. Dice is not new to the growth through acquisition strategy. In 2004 , the firm acquired 76% of a company called Master Line, allowing the company to expand vertically into the dyeing process and to control more of its value chain. This allowed it to have more efficient operations and to reduce its production costs and expand its business. Alex Clothing Co.: an acquisition target Deal description Dice now is evaluating acquiring Alex Clothing Co., a clothing company located in the city of Alexandria, along with its subsidiary United Dyers, an automated dyeing house located in Sadat City in Cairo, for a combined cash acquisition value of EGP80m. The acquisition of Alex Clothing Co. would not only allow Dice to integrate horizontally by acquiring a similar firm but also has strategic benefits. Alex Co. is in Egypt's second-biggest city, where Dice's second-largest customer base is located. It also gives Dice the chance to accommodate demand in Alexandria and surrounding cities by easily distributing goods to nearby shops. Alexandria has the additional geographic advantage of bringing Egypt's main port, making exporting easier and less time-consuming. Although Alex Co. is currently generating revenues of around EGP210m, its production facilities are not fully used and therefore the acquisition would not only allow Dice to quickly access a higher production capacity to grow revenue and fulfill demand but also gain increased market share by taking over a company with an established revenues stream from customers in another major city. Moreover, Alex Co.'s subsidiary, United Dyers, would allow the firm to efficiently vertically integrate the dying processes instead of outsourcing. The firm has a net debt balance of around EGP10mn on its balance sheet and will therefore have a minimal effect on Dice's overall capital structure post-acquisition. Deal description Dice now is evaluating acquiring Alex Clothing Co., a clothing company located in the city of Alexandria, along with its subsidiary United Dyers, an automated dyeing house located in Sadat City in Cairo, for a combined cash acquisition value of EGP80m. The acquisition of Alex Clothing Co. would not only allow Dice to integrate horizontally by acquiring a similar firm but also has strategic benefits. Alex Co. is in Egypt's second-biggest city, where Dice's second-largest customer base is located. It also gives Dice the chance to accommodate demand in Alexandria and surrounding cities by easily distributing goods to nearby shops. Alexandria has the additional geographic advantage of bringing Egypt's main port, making exporting easier and less time-consuming. Although Alex Co. is currently generating revenues of around EGP210m, its production facilities are not fully used and therefore the acquisition would not only allow Dice to quickly access a higher production capacity to grow revenue and fulfill demand but also gain increased market share by taking over a company with an established revenues stream from customers in another major city. Moreover, Alex Co.'s subsidiary, United Dyers, would allow the firm to efficiently vertically integrate the dying processes instead of outsourcing. The firm has a net debt balance of around EGP10mn on its balance sheet and will therefore have a minimal effect on Dice's overall capital structure post-acquisition. EIMalek has projected the main operational financial forecasts from the target's standalone business for the next six years in Exhibit 10 assuming the company operates under a business as usual model. ElMalek additionally ran a combined analysis that consolidates the company within Dice (Exhibit 11). The projections reflect solid revenue growth for Alex Co. starting the second year after integration as Dice passes along the strong international order pipeline and uses the firm's excess capacity. Deal financing EIMalek plans to source the funds to finance the EGP80m acquisition as follows. Dice will secure an EGP25m long-term loan from commercial banks to be repaid over 5 years. Dice was currently paying between 0.75%1% spread over the long-term treasury on its existing debt but is expecting a 2.5% spread on new debt financing due to the increased leverage on its balance sheet. The long-term treasury yields were currently around 9.6\% [4]. The remaining amount will be funded through EGP25m in cash currently available in the firm's balances and EGP30m in new equity injection from Dice shareholders. EIMalek estimated that the cost of equity for textile firms is within the vicinity of 18%20%. As both Dice and the target company are private, ElMalek must rely on measures of the systematic risk of the firm's equity by comparing to publicly-listed comparable firms. Exhibit 12 presents a list of Egyptian publicly-listed comparable firms in the textile industry and some statistics from emerging market firms competing in the same industry. ElMalek applies the company's marginal tax rate of 22.5% for all relevant financial analyses. The decision As EIMalek looks at the terms of the acquisition, he weighs up the advantages and disadvantages of acquiring Alex Clothing Co. He asks himself whether this will allow Dice to accommodate the demand coming from international and local markets. Does the EGP80m represent a fair value to acquire Alex Clothing Co and will the acquisition bring additional value to Dice? He is also worried about non-financial considerations following the acquisition. Can the company handle issues with integrating and managing two new factories, one of which is in a different city? Can it realize acquisition synergies without letting go of employees? How will the company's culture be affected? He calls for an urgent meeting with Toma and the Board of Directors to discuss whether the acquisition should go ahead or not. Keywords: Manufacturing/production methods, Strategic management/ planning, Management accounting/ corporate finance, Mergers and acquisitions, Asset management/ valuation Notes 1. "Textiles from Egypt to the world." UN Economic Commission for Africa, 2013. 2. Saleh, Heba (2013), "Trade conditions weaken Egypt textiles" Financial Times, 11 February. Available at: https://www.ft.com/content/7fcbee46-743b-11e2-a27c-00144feabdc0 3. Denyer, Simon (2012) "Egyptian textile strikes highlight economic challenges facing Morsi' Washington Post. July 22. Available at: https://www.washingtonpost.com/world/middle_east/ egyptian-textile-strikes-highlight-economic-challenges-facing-morsi/2012/07/22/ gJQALJO12W_story.html 3. Denyer, Simon (2012) "Egyptian textile strikes highlight economic challenges facing Morsi' Washington Post. July 22. Available at: https://www.washingtonpost.com/world/middle_east/ egyptian-textile-strikes-highlight-economic-challenges-facing-morsi/2012/07/22/ gJQALJO12W_story.html 4. The 7-year EGP bond was trading to yield 12% in early 2015 . Given that all returns on treasury securities are subject to a 20% tax, a common market practice is to use the treasury yield after tax as the benchmark. 5. This teaching note was written by Dr Aliaa Bassiouny, Lawrence Term Associate Professor of Finance, Washington and Lee University. abassiouny@wlu.edu. 6. https://papers.ssrn.com/sol3/papers.cfm?abstract_id =2450452 7. https://papers.ssrn.com/sol3/papers.cfm?abstract_id =2409198 Exhibit 1. Economic growth rates (\%) Exhibit 4. Dice manufacturing board of directors Exhibit 5. Dice total revenues (EGP 000) 2008-2014 Exhibit 6 . Dice historical operating relationships (as % of revenues) Exhibit 8. Dice balance sheet (EGP million) Exhibit 10. Alex clothing Co. Standalone key projections 2015-2020 Exhibit 11. Dice post-acquisition consolidated key projections 2015-2020 Exhibit 12. Comparable Egyptian companies and emerging market industry specific metrics as of December 31,2014 Notes: 'Individual company levered beta calculated from Factset price return data against local stock index returns and unlevered using individual company debt/equity ratios from Factset, emerging market mean betas from A. Damodaran's Data Archive website for January 2015. 'All Values as of December 31, 2014 in EGP million. 'Individual Company Multiples' Data from Factset, Emerging market multiples from A. Damodaran's Data Archive website for January 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts